Arkansas Sample Letter for Selling of Estate

Description

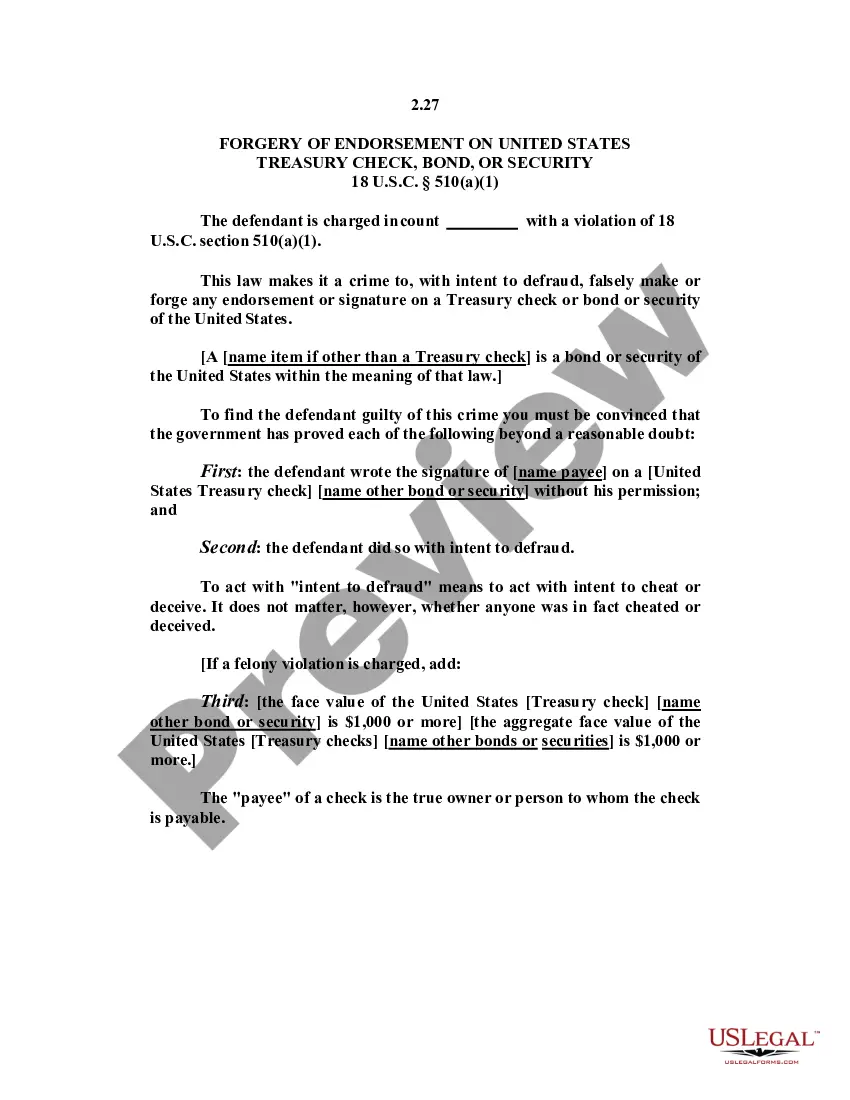

How to fill out Sample Letter For Selling Of Estate?

US Legal Forms - among the largest libraries of lawful types in the States - offers a variety of lawful papers templates you are able to obtain or printing. While using website, you will get thousands of types for enterprise and personal reasons, sorted by groups, says, or search phrases.You will discover the newest models of types much like the Arkansas Sample Letter for Selling of Estate in seconds.

If you already possess a monthly subscription, log in and obtain Arkansas Sample Letter for Selling of Estate through the US Legal Forms catalogue. The Obtain button will show up on every single develop you view. You have accessibility to all earlier delivered electronically types within the My Forms tab of your own bank account.

If you want to use US Legal Forms for the first time, listed here are basic directions to help you get started out:

- Be sure you have picked out the proper develop to your area/county. Click on the Review button to check the form`s content. Look at the develop information to ensure that you have chosen the correct develop.

- When the develop does not fit your specifications, utilize the Lookup discipline near the top of the screen to find the one that does.

- If you are satisfied with the shape, verify your option by simply clicking the Purchase now button. Then, pick the costs program you want and provide your references to sign up for an bank account.

- Procedure the financial transaction. Utilize your bank card or PayPal bank account to accomplish the financial transaction.

- Select the formatting and obtain the shape in your gadget.

- Make changes. Load, edit and printing and indication the delivered electronically Arkansas Sample Letter for Selling of Estate.

Each web template you added to your bank account does not have an expiry date and is the one you have for a long time. So, if you want to obtain or printing an additional version, just go to the My Forms portion and click about the develop you want.

Get access to the Arkansas Sample Letter for Selling of Estate with US Legal Forms, by far the most extensive catalogue of lawful papers templates. Use thousands of professional and state-specific templates that fulfill your company or personal needs and specifications.

Form popularity

FAQ

To use the small estate process: Arrange for any estate debts to be paid. Submit an Affidavit for Collection of Small Estate by Distributee to the court (attach a copy of the death certificate and the will if any) The court will certify your affidavit, which you can then use to obtain possession of estate assets.

Even if there is a valid Last Will and Testament you must go through probate court. Arkansas Code Ann 28-40-104 states, ?No will shall be effectual for the purpose of proving title to or the right to the possession of any real or personal property disposed of by the will until it has been admitted to probate.?

How do I get letters of testamentary in Arkansas? Settling an Estate in Arkansas The will must be filed with the circuit court in the county where the decedent lived. An executor is appointed to oversee the estate, and the court provides letters testamentary to them.

You must file an Affidavit for Collection of Small Estate with the probate clerk of the circuit court in the county where the deceased last lived. The affidavit can be filed by one or more of the people receiving proceeds from the estate (called distributees).

In Arkansas, executor fees are calculated based on a percentage of the estate's worth, with the rate varying depending on the size of the estate. The fees shouldn't be more than 10% of the first $1,000, 5% of the next $4,000, and 3% of the remaining estate balance.

In Arkansas, executors have a fiduciary duty to act in the best interests of the estate and its beneficiaries. This means they must act with care, loyalty, and impartiality while carrying out their responsibilities. Executors may also hire professionals, such as attorneys or accountants, to assist them in their duties.

How to Write an LOI in Commercial Real Estate Structure it like a letter. ... Write the opening paragraph. ... State the parties involved. ... Draft a property description. ... Outline the terms of the offer. ... Include disclaimers. ... Conclude with a closing statement.

How to Settle a Large Estate in Arkansas Step 1: Appoint a Personal Representative. ... Step 2: Petition the Probate Court. ... Step 3: Notify Named Heirs & Creditors. ... Step 4: Inventory & Appraise the Estate's Assets. ... Step 5: Handle the Property Sale. ... Step 6: Final Accounting. ... Step 7: Final Distribution & Estate Closing.