Arkansas Credit support agreement

Description

How to fill out Credit Support Agreement?

Discovering the right lawful file format could be a have a problem. Needless to say, there are a variety of web templates accessible on the Internet, but how would you discover the lawful develop you require? Utilize the US Legal Forms site. The service provides 1000s of web templates, including the Arkansas Credit support agreement, that can be used for business and private requires. All the types are checked by professionals and meet state and federal demands.

In case you are already listed, log in to your profile and click on the Down load switch to obtain the Arkansas Credit support agreement. Utilize your profile to appear throughout the lawful types you may have acquired in the past. Go to the My Forms tab of your profile and have one more duplicate in the file you require.

In case you are a whole new consumer of US Legal Forms, allow me to share simple guidelines for you to stick to:

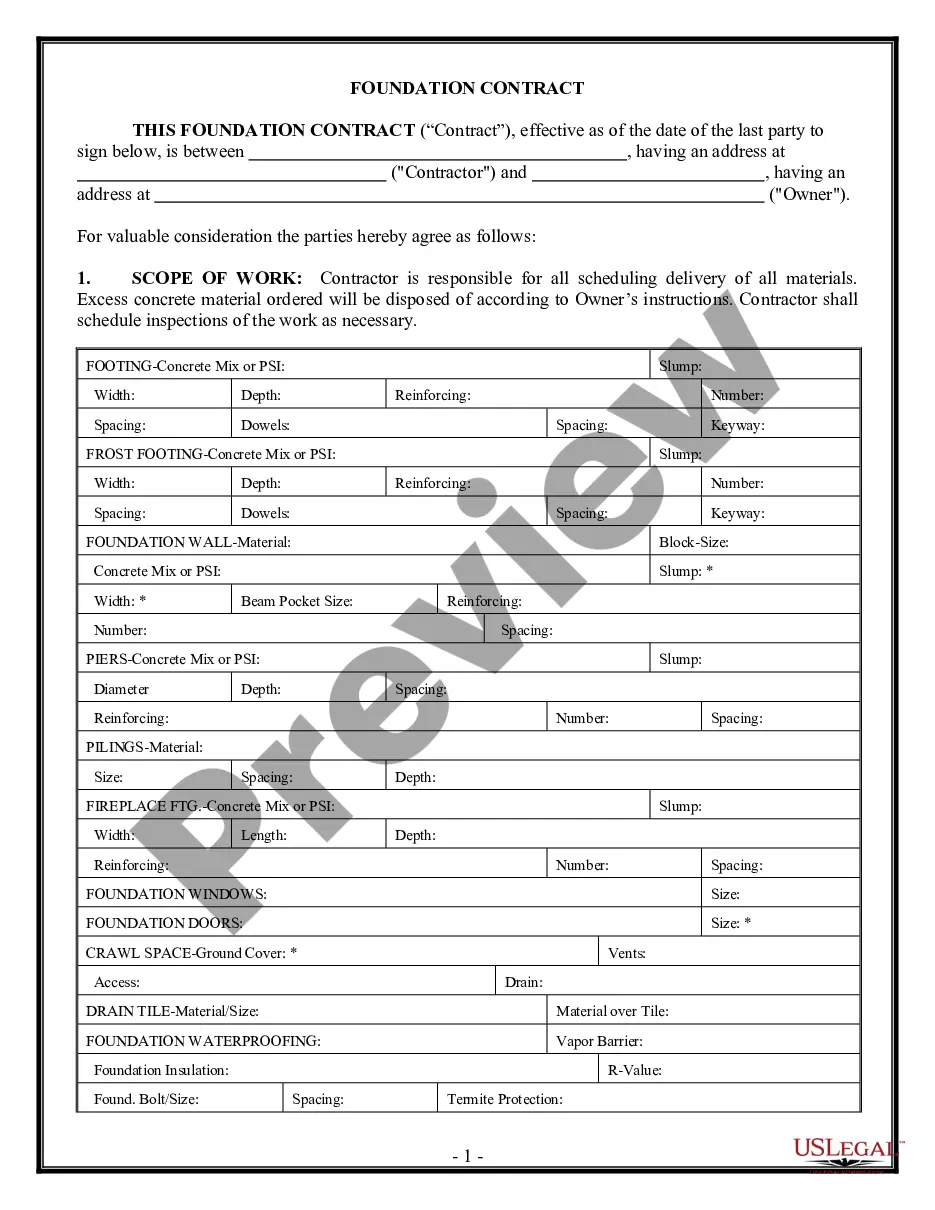

- First, ensure you have selected the appropriate develop to your city/county. You may look through the form while using Review switch and study the form explanation to make certain it is the best for you.

- If the develop does not meet your expectations, use the Seach industry to discover the proper develop.

- When you are positive that the form is acceptable, click on the Get now switch to obtain the develop.

- Opt for the prices strategy you want and enter the required information. Make your profile and buy your order making use of your PayPal profile or Visa or Mastercard.

- Choose the file structure and obtain the lawful file format to your system.

- Full, change and printing and sign the attained Arkansas Credit support agreement.

US Legal Forms will be the greatest library of lawful types for which you can see different file web templates. Utilize the service to obtain expertly-made papers that stick to condition demands.

Form popularity

FAQ

The state of Arkansas requires you to pay taxes if you're a resident or nonresident that receives income from an Arkansas source. The state income tax rates range up to 5.9%, and the sales tax rate is 6.5%.

Statute of Limitations on Arkansas Back Taxes The state of Arkansas has a 10-year statute of limitations on back taxes. This means that the state can pursue collection activities including property liens for up to 10 years after the taxes have been assessed.

Arkansas Tax Payment Options Direct Online Payment via Bank Account. Create an account with Arkansas Taxpayer Access Point. ... Credit or Debit Card Payment. Submit a tax payment through ACI, Payments Inc. ... Check or Money Order with Form AR1000V. ... Estimated Tax Payment Options. ... Online IRS Tax Payment Options.

Arkansas standard deduction for tax year 2021 is $4,400 for married filing jointly and $2,200 for all other filers.

When collecting any state tax due from a taxpayer, the Secretary is authorized to file a Certificate of Indebtedness (state tax lien) with the circuit clerk of any county of this state certifying that the person named therein is indebted to the state for the amount of tax due as established by the Secretary.

Please contact 501-682-5000 or 1-800-292-9829 to inquire about qualifications for a payment plan agreement.

Refund: Arkansas State Income Tax. P.O. Box 1000. Little Rock, AR 72203-1000. Tax Due/No Tax: Arkansas State Income Tax. P.O. Box 2144. Little Rock, AR 72203-2144. State. ZIP.

The Rule provides requirements for the management of cash funds of state agencies including investment activities and the collateralization of cash funds that are on deposit with banks or financial institutions that exceed coverage by the Federal Deposit Insurance Corporation (FDIC).