The right of an employee to compensation is based on either an express or implied contract. Whether the employment contract is express or implied, it need not be formalized in order for the terms of employment to begin. Once employment has begun, the employment contract represents the right of the employee to be paid the wages agreed upon for services he or she has performed and the right of an employer to receive the services for which the wages have been paid.

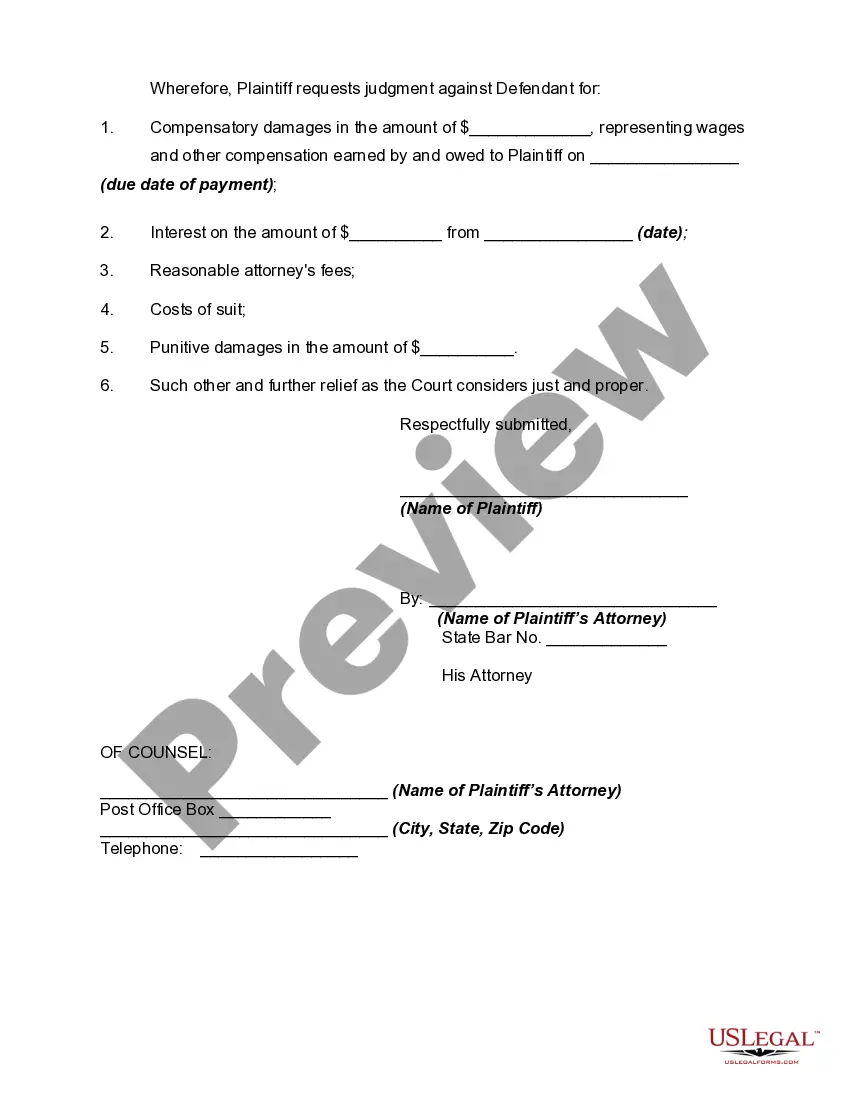

Arkansas Complaint for Recovery of Unpaid Wages

Description

How to fill out Complaint For Recovery Of Unpaid Wages?

Choosing the best authorized record design can be a struggle. Obviously, there are plenty of themes accessible on the Internet, but how will you discover the authorized kind you want? Make use of the US Legal Forms web site. The services offers a huge number of themes, such as the Arkansas Complaint for Recovery of Unpaid Wages, that can be used for business and personal requires. All of the varieties are examined by professionals and satisfy federal and state specifications.

When you are currently authorized, log in to your accounts and click on the Acquire button to get the Arkansas Complaint for Recovery of Unpaid Wages. Utilize your accounts to look with the authorized varieties you might have purchased previously. Proceed to the My Forms tab of the accounts and have yet another copy from the record you want.

When you are a fresh user of US Legal Forms, listed below are easy instructions that you should comply with:

- First, be sure you have chosen the proper kind for your city/area. It is possible to look through the form utilizing the Preview button and look at the form outline to guarantee it is the right one for you.

- When the kind fails to satisfy your needs, use the Seach discipline to find the correct kind.

- When you are certain that the form is proper, click the Purchase now button to get the kind.

- Select the pricing prepare you need and enter in the essential information. Create your accounts and pay for the transaction utilizing your PayPal accounts or Visa or Mastercard.

- Opt for the file file format and acquire the authorized record design to your system.

- Complete, change and produce and indicator the attained Arkansas Complaint for Recovery of Unpaid Wages.

US Legal Forms will be the largest collection of authorized varieties that you can find different record themes. Make use of the company to acquire appropriately-created paperwork that comply with condition specifications.

Form popularity

FAQ

Workers may contact the Arkansas Department of Labor (ADOL) for help at (501) 682-4500. The ADOL must keep the name of anyone who complains confidential until the investigation has been finished or unless a court orders the ADOL to release the name.

Arkansas Labor Laws Guide Arkansas Labor Laws FAQArkansas minimum wage$11Arkansas tipped minimum wage$2.63Arkansas overtime1.5 times the minimum wage for any time worked over 40 hours/week ($16.5 for minimum wage workers)Arkansas breaksBreaks not required by law

Workers who are fired by a corporation must be paid their last paycheck within seven days of being fired. In all other cases, payment must be made at the regularly scheduled payday. If an employer owes an unpaid last paycheck of less than $2,000 to a worker, the worker may file a wage claim with the ADOL.

The Fair Labor Standards Act (FLSA) establishes minimum wage, overtime pay, recordkeeping, and youth employment standards affecting employees in the private sector and in Federal, State, and local governments.

In ance with the Fair Labor Standards Act, Arkansas employee rights include a right to overtime work being paid at a rate not lower than 1.5 times the regular pay rate. In most cases, overtime must be paid for any additional hours worked beyond 40 in a workweek.

The current minimum wage in Arkansas is $11. Arkansas Department of Labor wage and hour law stipulates that employers with fewer than four employees may pay the federal minimum wage. The current minimum wage for tipped employees is $2.63. Arkansas law allows employees to participate in tip pooling arrangements.

Arkansas Supreme Court Limits Statute Of Limitations For State Wage Claims To Three Years. Numerous state wage laws provide for limitations periods longer than the maximum three years provided under federal law (such as six years under the New York Labor Law).

The Labor Standards Division is responsible for investigating wage claims filed by workers who are owed $2000 or less. It does not matter if the worker was an employee or an independent contractor who physically performed the work. Both are covered by the wage claim law.