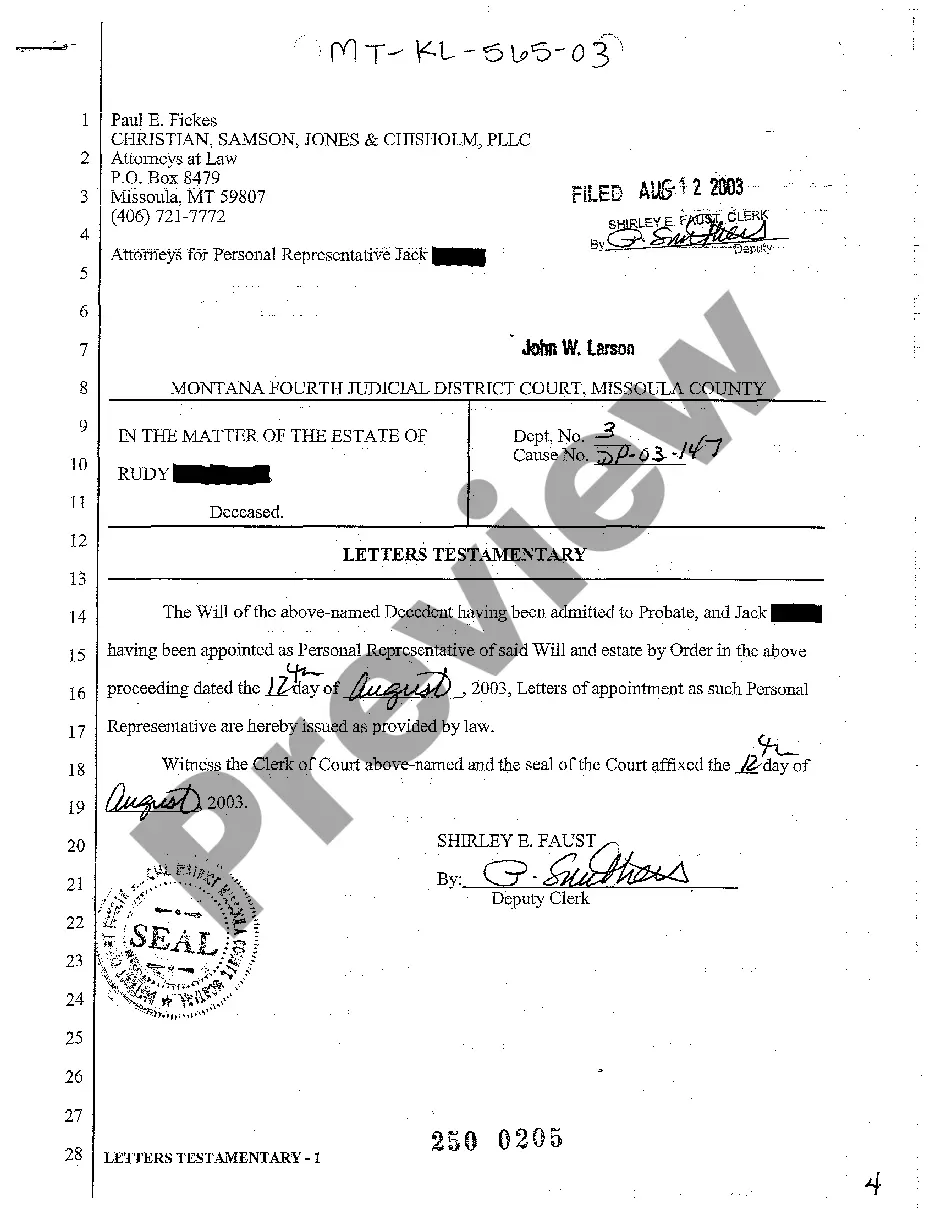

Arkansas Sales Receipt

Description

How to fill out Sales Receipt?

Are you in the situation where you consistently require documents for either business or personal purposes? There is an abundance of legal document templates available online, but finding reliable ones isn't easy.

US Legal Forms offers a vast array of form templates, such as the Arkansas Sales Receipt, that are designed to comply with federal and state regulations.

If you are already familiar with the US Legal Forms website and have an account, just Log In. Afterwards, you can download the Arkansas Sales Receipt template.

You can find all the document templates you have purchased in the My documents section. You can download an additional copy of the Arkansas Sales Receipt at any time, if desired. Simply click on the required form to download or print the document template.

Use US Legal Forms, the most extensive collection of legal templates, to save time and minimize errors. The service provides professionally crafted legal document templates that can be utilized for a variety of purposes. Create your account on US Legal Forms and start simplifying your life.

- Locate the form you need and ensure it is for the correct state/region.

- Utilize the Preview button to review the document.

- Examine the description to confirm that you have selected the correct form.

- If the form isn't what you're looking for, use the Search field to find the form that fulfills your needs and requirements.

- Once you find the appropriate form, click Purchase now.

- Select the payment plan you prefer, enter the necessary information to create your account, and complete the transaction using your PayPal or credit card.

- Choose a suitable document format and download your copy.

Form popularity

FAQ

To avoid Arkansas sales tax on used vehicles, it helps to buy from individuals instead of dealers. Under certain conditions, out-of-state purchases may also be tax-exempt if you meet specific criteria. Make sure you provide proper documentation, including the necessary Arkansas Sales Receipt, to validate your claim for a tax exemption.

Some vehicles in Arkansas qualify for sales tax exemptions. Common exemptions include vehicles given as gifts, certain agricultural vehicles, and some vehicles that are modified for disabled individuals. It is essential to check with the Arkansas Department of Finance and Administration for the specific requirements. Having an Arkansas Sales Receipt can be helpful when claiming these exemptions.

Finding your car registration receipt can be done in a few ways. First, check through your emails if you registered your vehicle online, as digital receipts are often sent. If you can't find it, visiting your local DMV or accessing their online portal can help you locate the necessary paperwork, including your Arkansas sales receipt for any sales transaction.

To obtain a copy of your NY DMV registration, you can request it online through the New York DMV website, or visit your local DMV office. Make sure to have your vehicle information and identification ready to expedite the process. You'll need this documentation to take care of related matters such as obtaining an Arkansas sales receipt if you ever transfer ownership.

To obtain an Arkansas sales tax ID, you need to complete an application with the Arkansas Department of Finance and Administration. You can apply online, by mail, or in person at their office. Make sure to have necessary documentation like your business information ready. This ID will help you facilitate sales transactions and create proper Arkansas sales receipts.

In Arkansas, a bill of sale is not strictly required for all transactions. However, when selling certain items like vehicles, it is highly advisable to create a bill of sale to document the transfer of ownership. This document serves as proof of the sale and can help avoid disputes later. Additionally, an Arkansas sales receipt may be beneficial for tax purposes.

In Arkansas, reporting sales tax requires completing the state’s sales tax forms accurately and timely. You must provide your sales figures and include the total sales tax collected, supported by your records and Arkansas Sales Receipts. Utilizing platforms like US Legal Forms can help simplify this process by providing the necessary templates and guidance.

Reporting sales tax involves documenting all sales tax collected and remitting the appropriate amounts to the tax authorities. You need to have an accurate account of your sales transactions and keep your Arkansas Sales Receipts for reference. This process ensures compliance and maintains transparency in your business operations.

Claiming sales tax can be beneficial as it can reduce your overall tax liability. Though it may seem like a small amount, every dollar counts towards improving your financial position. By keeping organized records and Arkansas Sales Receipts, you can maximize your savings during tax season.

You can typically claim sales tax on items purchased for use in your business. This includes supplies, equipment, and other tangible goods necessary for your operations. Just ensure you keep an Arkansas Sales Receipt to document your claims. It helps in simplifying the process and provides clarity when filing taxes.