Arkansas Demand for Payment of an Open Account by Creditor

Description

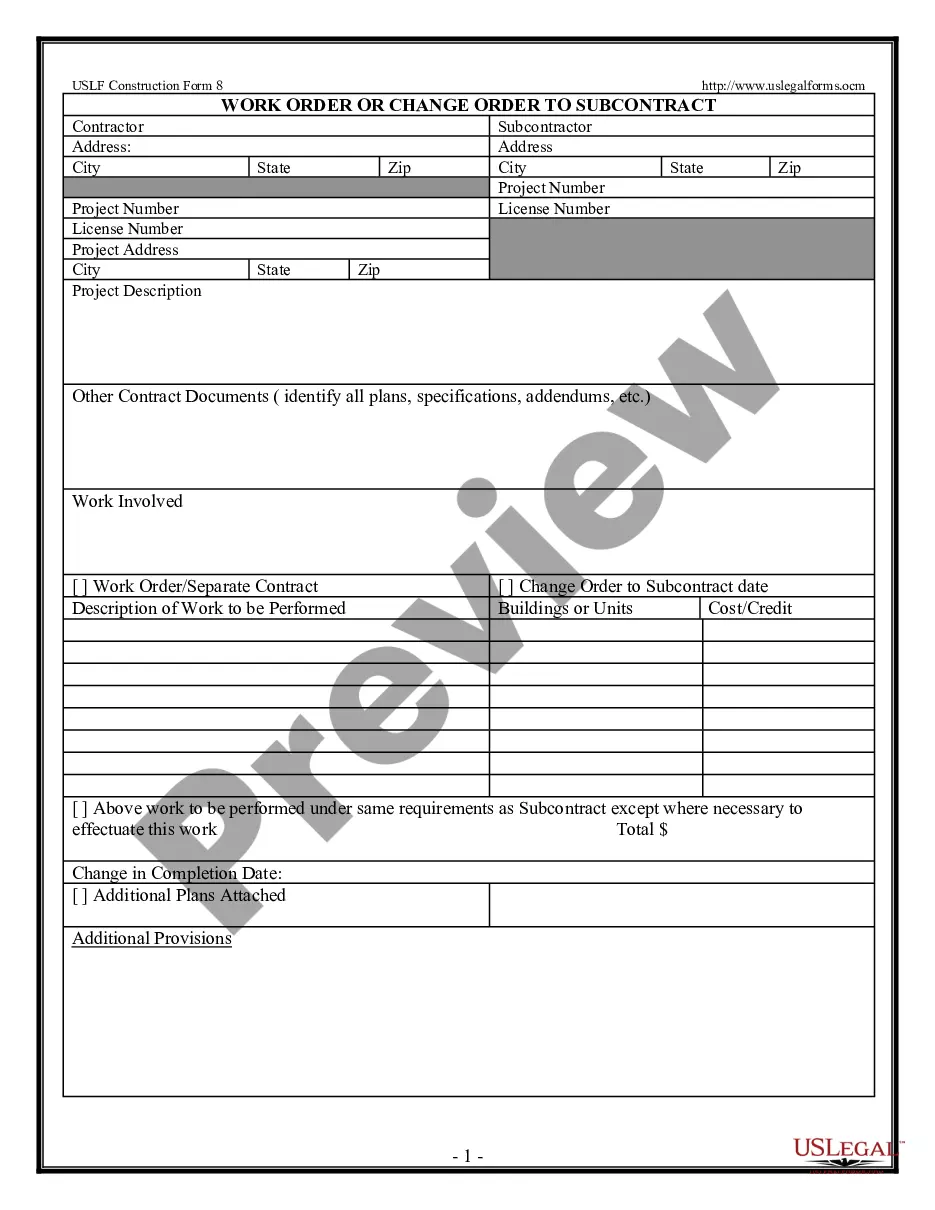

How to fill out Demand For Payment Of An Open Account By Creditor?

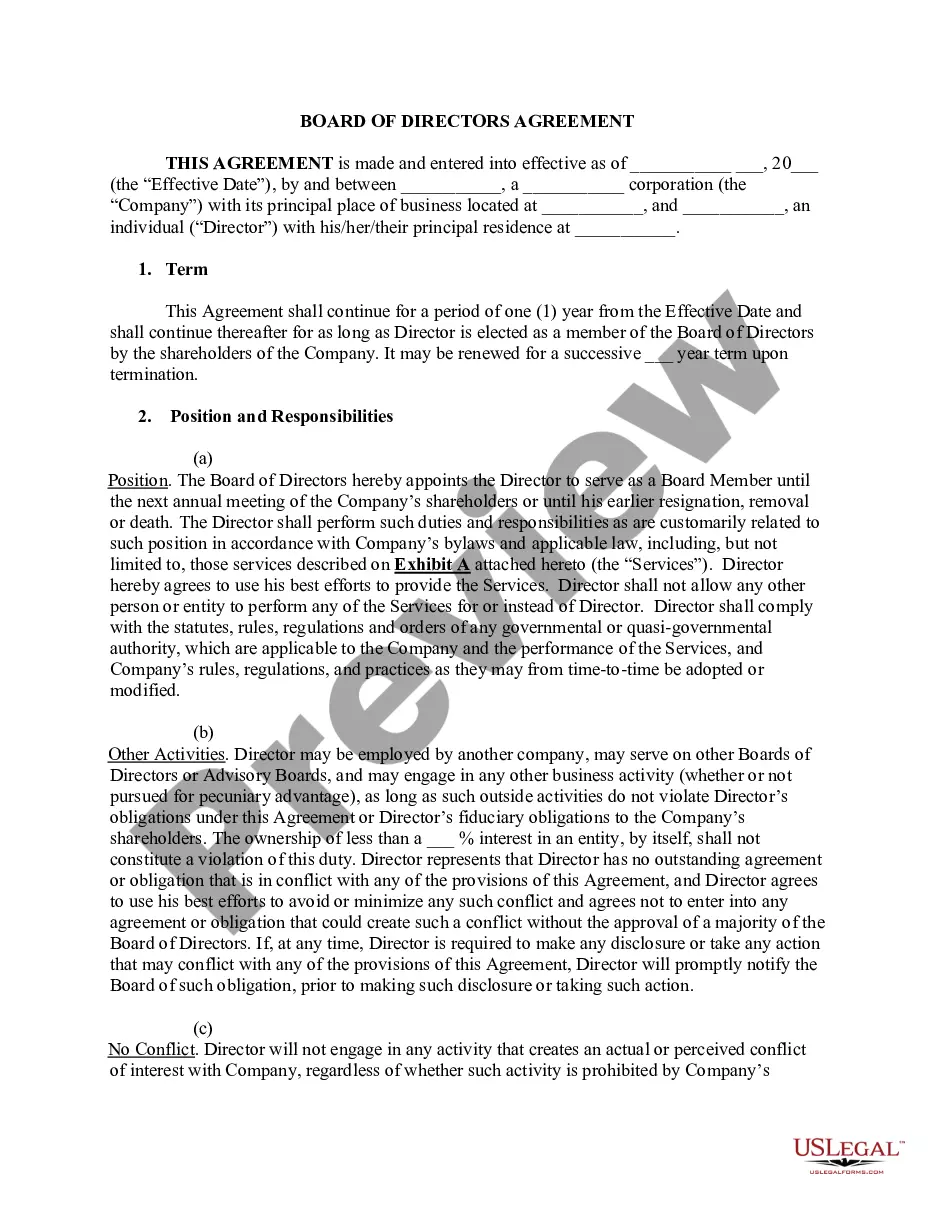

Choosing the best legal papers design might be a have a problem. Obviously, there are plenty of themes available on the Internet, but how can you obtain the legal develop you require? Make use of the US Legal Forms internet site. The assistance gives thousands of themes, such as the Arkansas Demand for Payment of an Open Account by Creditor, which you can use for organization and personal needs. All of the varieties are checked out by professionals and meet state and federal needs.

If you are presently authorized, log in to the profile and then click the Download option to have the Arkansas Demand for Payment of an Open Account by Creditor. Make use of your profile to look with the legal varieties you might have bought earlier. Visit the My Forms tab of your profile and have an additional duplicate in the papers you require.

If you are a new consumer of US Legal Forms, listed below are simple directions so that you can follow:

- Initial, make certain you have chosen the right develop for your personal city/region. It is possible to check out the form using the Review option and look at the form description to make sure it is the right one for you.

- In the event the develop is not going to meet your needs, use the Seach discipline to get the correct develop.

- Once you are sure that the form is suitable, select the Buy now option to have the develop.

- Pick the prices strategy you desire and type in the necessary info. Make your profile and purchase an order using your PayPal profile or bank card.

- Opt for the submit formatting and obtain the legal papers design to the system.

- Complete, revise and print and signal the obtained Arkansas Demand for Payment of an Open Account by Creditor.

US Legal Forms is definitely the greatest library of legal varieties in which you can discover numerous papers themes. Make use of the service to obtain expertly-produced files that follow express needs.

Form popularity

FAQ

Summary: The statute of limitations on debt in Arkansas is five years for most types of debt, but it is two years for medical debt and three years for debt resulting from an oral contract.

If you are struggling with debt and debt collectors, Farmer & Morris Law, PLLC can help. As soon as you use the 11-word phrase ?please cease and desist all calls and contact with me immediately? to stop the harassment, call us for a free consultation about what you can do to resolve your debt problems for good.

A creditor is a someone to whom you owe a debt. If someone owes you money, you are a creditor of that person. If you can't pay a debt when it's due, the creditor may try to collect the debt by sending you a demand for payment, or the creditor may assign the debt to a debt collection agency.

Your creditors do not have to accept your offer of payment or freeze interest. If they continue to refuse what you are asking for, carry on making the payments you have offered anyway. Keep trying to persuade your creditors by writing to them again.

A letter of demand is a demand for payment from a debtor or defendant. It is usually the first step in a legal dispute case. A letter of demand will outline the breaches of the law, foreshadow the legal action and consequences of not paying.

The minimum repayment on a credit card must be set at an amount that at least repays the interest, fees and charges applied to your account, plus 1% of the outstanding balance. These rules don't mean credit card providers have to force you to repay more by automatically increasing your monthly credit card repayments.

If a creditor refuses my offer It is a good idea to start making the reduced payments you have offered on a regular basis and point out that you are doing this as a 'gesture of goodwill'. It is also worth telling them if any of your other creditors have accepted your offers.

Debt collectors cannot harass or abuse you. They cannot swear, threaten to illegally harm you or your property, threaten you with illegal actions, or falsely threaten you with actions they do not intend to take. They also cannot make repeated calls over a short period to annoy or harass you.