Arkansas Notice of Termination of a UCC Sales Agreement for the sale of Goods or Personal Property

Description

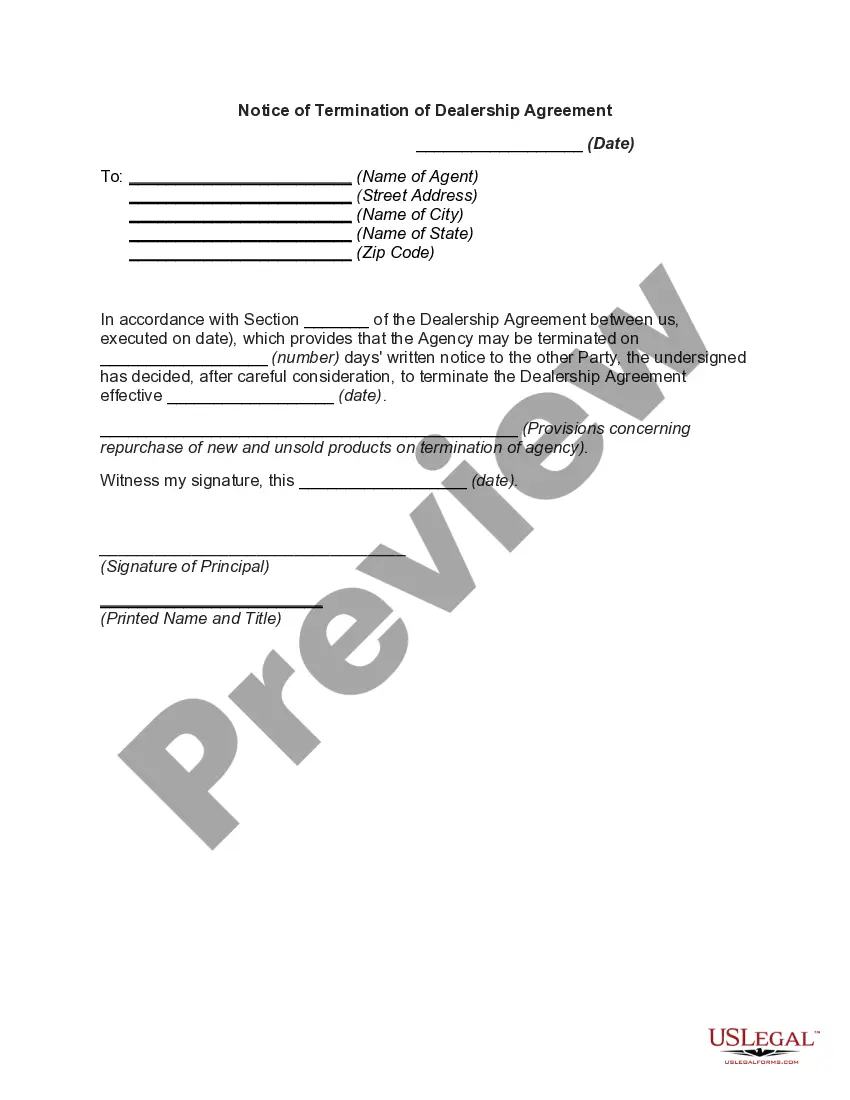

How to fill out Notice Of Termination Of A UCC Sales Agreement For The Sale Of Goods Or Personal Property?

Choosing the best legitimate record template might be a battle. Obviously, there are a lot of templates accessible on the Internet, but how can you get the legitimate form you will need? Take advantage of the US Legal Forms site. The assistance gives a huge number of templates, such as the Arkansas Notice of Termination of a UCC Sales Agreement for the sale of Goods or Personal Property, which you can use for business and personal requires. All the forms are inspected by experts and fulfill federal and state needs.

If you are currently signed up, log in for your profile and then click the Acquire key to have the Arkansas Notice of Termination of a UCC Sales Agreement for the sale of Goods or Personal Property. Use your profile to search throughout the legitimate forms you have bought formerly. Visit the My Forms tab of your respective profile and have an additional version in the record you will need.

If you are a whole new consumer of US Legal Forms, here are straightforward instructions so that you can follow:

- Initial, be sure you have chosen the proper form for your area/state. You may check out the form utilizing the Review key and study the form information to ensure it will be the best for you.

- If the form fails to fulfill your needs, use the Seach discipline to discover the right form.

- Once you are sure that the form would work, click the Buy now key to have the form.

- Opt for the pricing strategy you desire and enter in the necessary information and facts. Make your profile and buy the transaction making use of your PayPal profile or charge card.

- Choose the submit formatting and obtain the legitimate record template for your gadget.

- Comprehensive, edit and print out and indicator the acquired Arkansas Notice of Termination of a UCC Sales Agreement for the sale of Goods or Personal Property.

US Legal Forms is the most significant library of legitimate forms where you will find numerous record templates. Take advantage of the company to obtain skillfully-made documents that follow express needs.

Form popularity

FAQ

A UCC filing is a legal statement that a lender would file when you take out a business loan that requires you to put up some or all of your business assets as collateral. A UCC filing gives the lender the right to claim those assets if you default on your payments.

Ask the lender to terminate the lien upon payoff. When you pay off a loan, a good rule of thumb is to immediately submit a request with the lender to file a UCC-3 form with your secretary of state. The UCC-3 will terminate the lien on your company's asset (or assets) and remove the UCC-1 filing.

Having a UCC-1 filing or lien tied to your name or business isn't necessarily a bad thing. It's simply a public record stating that a lender has the rights to certain assets until that loan is repaid. That record will also show if the loan has been repaid or not.

?UCC? stands for Uniform Commercial Code. The Uniform Commercial Code is a uniform law that governs commercial transactions, including sales of goods, secured transactions and negotiable instruments. The Uniform Commercial Code is a comprehensive set of statutes created to provide consistency among the states.

Methods to Remove a UCC Filing Ask the lender to terminate the lien upon payoff. Visit your secretary of state's office. Dispute inaccurate information on your business credit reports.

If you need to remove a UCC filing form your credit report, ask the lender to file for its removal. In order to do this, they need to file a UCC-3 Financing Statement Amendment. You can also just wait it out. Depending on how long you have been with the lender, the filing may be removed within a few months.

A UCC (Uniform Commercial Code) filing is a legal document that creates a public record of a creditor's security interest in personal property, such as inventory, equipment, or accounts receivable.

Uniform Commercial Code (UCC) filings allow creditors to notify other creditors about a debtor's assets used as collateral for a secured transaction. UCC liens filed with Secretary of State offices act as a public notice by the "creditor" of the creditor's interest in the property.

Request termination. Once the debt is paid off, you should request that the creditor (secured party) file a UCC-3 termination statement with the appropriate filing office (typically the Secretary of State or a similar state agency where the original UCC-1 was filed).

3 termination statement (a ?Termination?) is a required filing that terminates a security interest that has been perfected by a UCC1 filing. 1. A Termination for personal property is accomplished by completing and filing form UCC3 with the Secretary of State's office in the appropriate state.