Arkansas Affidavit of Both Domestic Partners to Employer in Order to Receive Benefits

Description

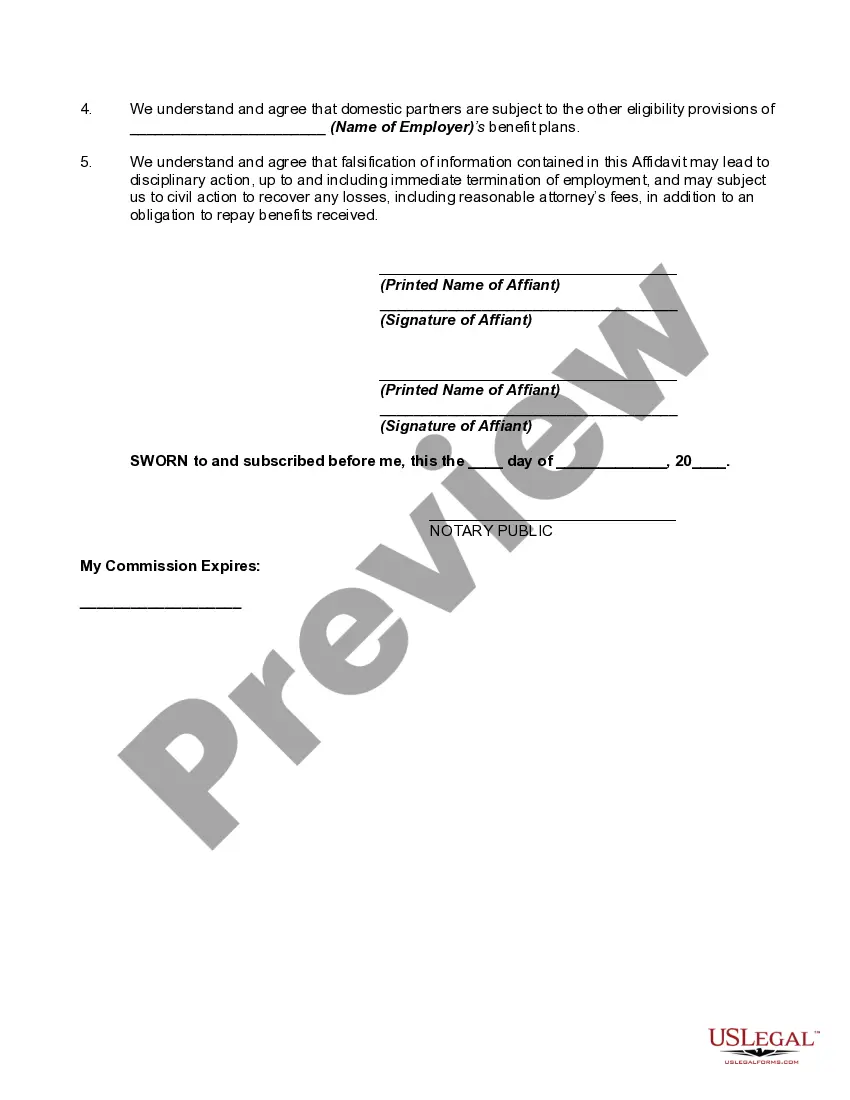

How to fill out Affidavit Of Both Domestic Partners To Employer In Order To Receive Benefits?

Are you currently in the situation where you require documents for either business or personal purposes almost every day.

There are numerous legal document templates accessible online, but finding reliable versions can be challenging.

US Legal Forms offers thousands of form templates, such as the Arkansas Affidavit of Both Domestic Partners to Employer in Order to Receive Benefits, which are designed to meet federal and state standards.

Once you locate the appropriate form, click Purchase now.

Select the pricing plan you want, fill out the required information to create your account, and process the payment using your PayPal or credit card.

- If you are already familiar with the US Legal Forms website and have an account, simply Log In.

- After that, you can download the Arkansas Affidavit of Both Domestic Partners to Employer in Order to Receive Benefits template.

- If you do not have an account and wish to start utilizing US Legal Forms, follow these steps.

- Acquire the form you need and make sure it is for the correct city/county.

- Use the Review button to examine the form.

- Check the description to ensure you have selected the correct form.

- If the form is not what you are seeking, use the Lookup field to find the form that suits your needs.

Form popularity

FAQ

The time it takes to be recognized as a domestic partner differs by state and employer policies. Generally, you should have lived together for a certain period and maintain a committed relationship. To facilitate your recognition, consider submitting an Arkansas Affidavit of Both Domestic Partners to Employer in Order to Receive Benefits, which formalizes your status. Keep in mind that meeting specific criteria is essential for acknowledgment in most cases.

A domestic partner in the US typically refers to an adult in a committed relationship with another adult, sharing a domestic life together. There are commonly accepted criteria that include living together, mutual financial support, and a committed emotional connection. Depending on your state, filing an Arkansas Affidavit of Both Domestic Partners to Employer in Order to Receive Benefits may officially recognize your partnership for benefits. States vary in their definition, so be sure to consult local regulations.

Imputed income refers to the value of benefits provided to domestic partners that are not subject to federal tax withholding. If your employer extends benefits to your domestic partner, the value of those benefits may be considered imputed income. By submitting the Arkansas Affidavit of Both Domestic Partners to Employer in Order to Receive Benefits, you can clarify dependency and benefit eligibility, potentially reducing tax implications. Understanding these nuances can help optimize your tax situation.

Yes, your husband may claim you as a dependent if you do not work, provided you meet IRS criteria. Generally, this includes having no income or income below a certain threshold, and other supporting conditions. Filing the Arkansas Affidavit of Both Domestic Partners to Employer in Order to Receive Benefits may also help clarify your status regarding health and other benefits. Always consult a tax professional for personalized advice.

Claiming your girlfriend as a domestic partner is possible if you meet certain criteria. Typically, you must demonstrate financial interdependence and mutual commitment, along with living together for a specified period. To formalize this relationship, many people file an Arkansas Affidavit of Both Domestic Partners to Employer in Order to Receive Benefits, helping to access employee benefits. It's advisable to check your employer's specific policies to ensure compliance.

To prove your domestic partnership for health insurance purposes, you typically need to submit a domestic partner affidavit signed by both partners. This affidavit confirms your relationship and is a critical part of the documentation. By completing the Arkansas Affidavit of Both Domestic Partners to Employer in Order to Receive Benefits, you can effectively demonstrate your partnership and gain access to necessary benefits.

A domestic partner affidavit is a legal document that states two individuals are domestic partners, providing formal recognition of their relationship. This affidavit is often used for benefits eligibility in the workplace, including health insurance. Submitting the Arkansas Affidavit of Both Domestic Partners to Employer in Order to Receive Benefits is crucial for accessing employer-provided rights and benefits.

In Arkansas, a domestic partner is an individual with whom you share an emotional and domestic commitment, without being legally married. This includes partners who live together and have a shared household. For employers and benefits, the Arkansas Affidavit of Both Domestic Partners to Employer in Order to Receive Benefits serves as an essential document to validate this relationship.

Domestic partner relationship status refers to a committed relationship between two individuals who live together and share a domestic life but are not legally married. In Arkansas, this status can impact health benefits and tax implications. To clarify your partnership for benefits, you can submit the Arkansas Affidavit of Both Domestic Partners to Employer in Order to Receive Benefits.

To claim your domestic partner on your taxes, you typically cannot do so as you would a spouse since Arkansas does not allow joint filings for domestic partners. Instead, each partner must file individually. However, you can use the Arkansas Affidavit of Both Domestic Partners to Employer in Order to Receive Benefits to ensure you both receive proper employer benefits related to your partnership.