Arkansas Proof of Residency for Mortgage

Description

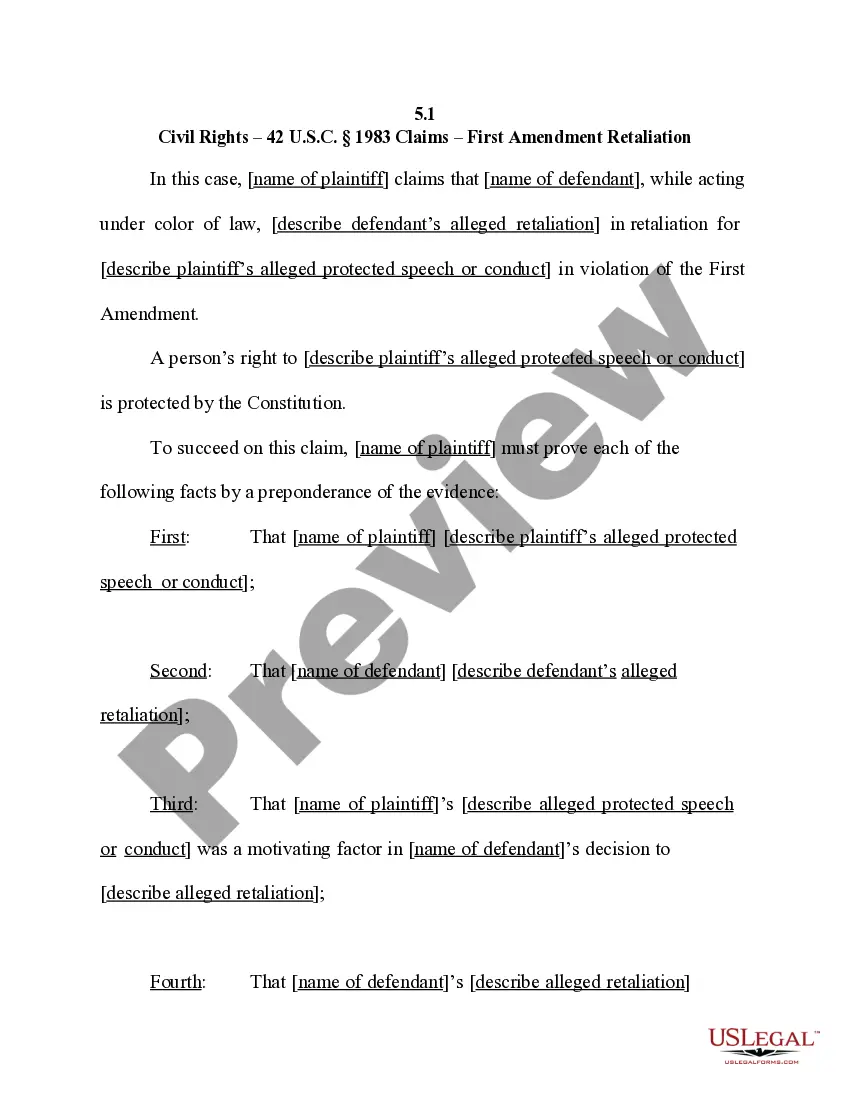

How to fill out Proof Of Residency For Mortgage?

US Legal Forms - one of several largest libraries of lawful varieties in the United States - delivers a wide range of lawful papers web templates you can download or print. While using web site, you may get a huge number of varieties for company and person reasons, categorized by categories, states, or keywords.You will find the most up-to-date models of varieties such as the Arkansas Proof of Residency for Mortgage within minutes.

If you already have a subscription, log in and download Arkansas Proof of Residency for Mortgage from your US Legal Forms local library. The Acquire option will appear on every single type you see. You get access to all previously acquired varieties from the My Forms tab of your own profile.

If you wish to use US Legal Forms initially, here are straightforward recommendations to help you get began:

- Ensure you have picked out the proper type to your town/area. Click the Review option to examine the form`s content. See the type outline to ensure that you have selected the right type.

- If the type does not match your requirements, utilize the Look for discipline towards the top of the monitor to discover the the one that does.

- In case you are pleased with the shape, confirm your selection by clicking the Purchase now option. Then, opt for the costs plan you prefer and offer your references to register for the profile.

- Approach the financial transaction. Utilize your charge card or PayPal profile to finish the financial transaction.

- Pick the file format and download the shape on your device.

- Make adjustments. Load, modify and print and sign the acquired Arkansas Proof of Residency for Mortgage.

Each and every design you included with your money does not have an expiry time and it is the one you have eternally. So, if you wish to download or print one more backup, just visit the My Forms section and then click in the type you will need.

Gain access to the Arkansas Proof of Residency for Mortgage with US Legal Forms, the most extensive local library of lawful papers web templates. Use a huge number of skilled and state-certain web templates that meet up with your company or person needs and requirements.

Form popularity

FAQ

The only acceptable evidence includes one of the following: Copy of U.S. passport (current or expired) Copy of U.S. civil issued birth certificate. Copy of alien registration card. Copy of naturalization/citizenship certificate.

To acquire a legal residence in Arkansas, an individual must have established a legal home of permanent character, resided in Arkansas for six continuous months and have no present intention of changing residence to a location outside Arkansas.

You need to have these proper documents before you go: Proof of Legal Presence: A passport, birth certificate. U.S. Visa with valid foreign passport. photo document from DHS, Certificate of Naturalization. ... One Proof of Social Security Number: Social Security Card. W-2 form. Form 1099. ... Two Proofs of Residency: paycheck. Gas.

Get a Duplicate DL or ID Relax. Request a duplicate online and get it in the mail in 3 days or less.

Consider making a DMV appointment or getting a line waiting concierge. Surrender your current license and submit All proofs of legal presence, identity, and Social Security number. Pass the vision test. Pay for the $40 renewal fee, using cash or a check/money order made payable to the AR DFA.

What are the acceptable forms for proof of residency? Acceptable forms for proof of residency include: current vehicle registration, property tax bill, residential lease agreement, current utility bill, and valid driver's license.

An Arkansas Resident is a person that lived in or maintained a domicile in Arkansas for the entire calendar year. Complete Form AR-1000S or Form AR1000F.