Arkansas Sample Letter for Checks for Settlement

Description

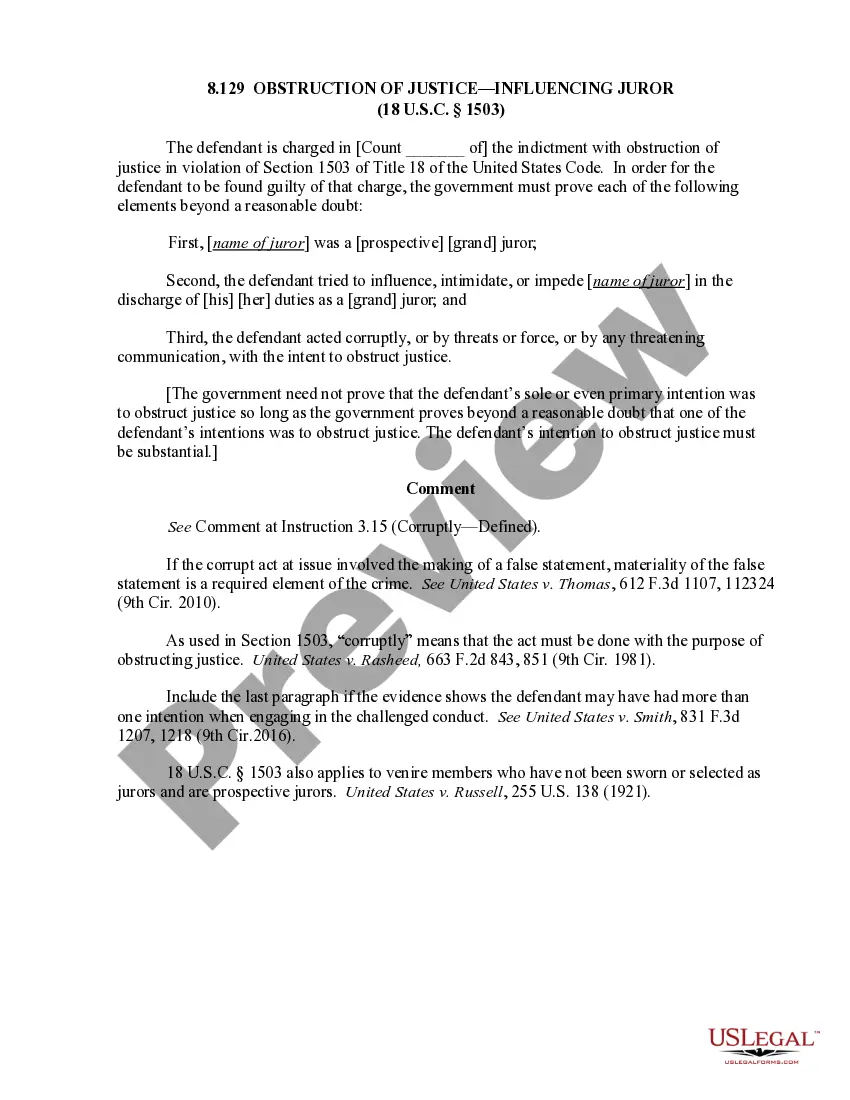

How to fill out Sample Letter For Checks For Settlement?

Finding the appropriate legal document template can be a challenge. Obviously, there are numerous templates accessible online, but how can you locate the legal form you require? Utilize the US Legal Forms website. The service offers thousands of templates, including the Arkansas Sample Letter for Checks for Settlement, which you can utilize for business and personal needs. All of the forms are reviewed by experts and comply with federal and state regulations.

If you are currently registered, Log In to your account and click the Obtain button to get the Arkansas Sample Letter for Checks for Settlement. Use your account to search through the legal forms you have purchased previously. Visit the My documents tab of your account and retrieve another copy of the document you need.

If you are a new user of US Legal Forms, here are straightforward instructions that you should follow: First, ensure you have selected the correct form for your city/region. You can review the form using the Review button and read the form description to confirm it is suitable for you. If the form does not fulfill your requirements, use the Search field to find the appropriate form. Once you are certain that the form is correct, click on the Purchase now button to obtain the form. Choose the pricing plan you prefer and enter the required information. Create your account and complete the transaction using your PayPal account or Visa or Mastercard. Select the document format and download the legal document template to your device. Complete, modify, print, and sign the acquired Arkansas Sample Letter for Checks for Settlement.

Make the most of US Legal Forms for all your legal documentation needs.

- US Legal Forms is the largest collection of legal documents available, where you can find a variety of document templates.

- Utilize the service to obtain professionally designed paperwork that adheres to state regulations.

- The platform offers a wide range of templates for various legal needs.

- All documents are crafted to meet legal standards.

- Access to a vast library of forms makes it easier to find what you need.

- The site assists users in navigating through numerous legal forms.

Form popularity

FAQ

To start a settlement letter, you should first clearly state your intent to settle the matter at hand. Begin with a concise introduction that outlines the purpose of the letter. Next, include the specifics of your claim, such as the amount you seek and the reasons supporting your request. For your convenience, consider using the Arkansas Sample Letter for Checks for Settlement available on the USLegalForms platform, which provides a structured template to guide you through the process.

To write a letter for a final settlement, start by summarizing the terms of the settlement and any agreements made. Clearly state the final amount and request confirmation of acceptance. It is also important to mention the release from any further claims. For a well-crafted approach, consider using the Arkansas Sample Letter for Checks for Settlement available through US Legal Forms, which can help you ensure all necessary details are included.

When writing a letter for a settlement amount, be specific about the amount you are proposing. Include a brief explanation for your request to provide context. Make sure to express your willingness to negotiate if necessary. For more structured guidance, the Arkansas Sample Letter for Checks for Settlement on US Legal Forms can serve as a helpful resource.

A good sentence for settlement might be, 'I propose to settle this matter for the amount of $X in exchange for a release of all claims.' This sentence clearly communicates your intent and the terms you are offering. Crafting effective sentences can be simplified by referring to the Arkansas Sample Letter for Checks for Settlement, which offers examples you can adapt.

Writing a strong settlement letter involves being clear and direct about your demands. Begin with a polite introduction, state the purpose of your letter, and present your case logically. Providing evidence supporting your position can strengthen your request. Utilizing the Arkansas Sample Letter for Checks for Settlement from US Legal Forms can help you format your letter effectively.

To write a letter asking for a full and final settlement, start by clearly stating your intention to settle. Include relevant details such as your case number or account information. It is beneficial to reference any previous discussions or agreements. For guidance, consider using the Arkansas Sample Letter for Checks for Settlement available on US Legal Forms, which provides a structured format.

To write a settlement offer letter, start with a clear introduction, state your offer, and provide a rationale for your proposal. Be concise and maintain a respectful tone to foster positive negotiations. Using the Arkansas Sample Letter for Checks for Settlement can streamline this process, ensuring you include all necessary information.

A demand letter for settlement purposes only is a formal request for compensation, outlining the reasons for the demand and the desired outcome. It serves as a precursor to negotiation and may lead to a settlement. The Arkansas Sample Letter for Checks for Settlement can help you draft a compelling demand letter that sets the right tone for discussions.

A claim settlement letter is a document sent to propose a resolution to a claim, often outlining the details of the incident and the compensation being sought. This letter aims to facilitate dialogue between parties. For a clear example, you can refer to the Arkansas Sample Letter for Checks for Settlement, which illustrates how to present your claim effectively.

To create a settlement letter, start by clearly stating your intentions, including the offer amount and the rationale behind it. Ensure that you maintain a professional tone throughout the letter. The Arkansas Sample Letter for Checks for Settlement can serve as a helpful template, guiding you through the necessary components.