This form is a generic example that may be referred to when preparing such a form for your particular state. It is for illustrative purposes only. Local laws should be consulted to determine any specific requirements for such a form in a particular jurisdiction.

Arkansas Contract with Consultant as Self-Employed Independent Contractor with Confidentiality Agreement and Covenant not to Compete

Description

How to fill out Contract With Consultant As Self-Employed Independent Contractor With Confidentiality Agreement And Covenant Not To Compete?

US Legal Forms - one of the largest collections of legal templates in the United States - offers a range of legal document formats that you can download or print.

By using the website, you can access thousands of forms for corporate and personal use, organized by categories, requests, or keywords. You can find the latest editions of forms such as the Arkansas Agreement with Consultant as Freelance Independent Contractor with Non-Disclosure Agreement and Non-Compete Clause in just a few minutes.

If you already possess a subscription, Log In and download the Arkansas Agreement with Consultant as Freelance Independent Contractor with Non-Disclosure Agreement and Non-Compete Clause through the US Legal Forms library. The Download button will show up on every form you view. You have access to all previously retrieved electronic forms in the My documents section of your account.

Select the format and download the document onto your device.

Make changes. Fill out, modify, and print and sign the downloaded Arkansas Agreement with Consultant as Freelance Independent Contractor with Non-Disclosure Agreement and Non-Compete Clause. Each template you add to your account has no expiration date, meaning it is yours indefinitely. So, if you want to download or print another version, just go to the My documents section and click on the template you need.

- If you want to use US Legal Forms for the first time, here are simple steps to begin.

- Make sure to have selected the correct form for your city/county.

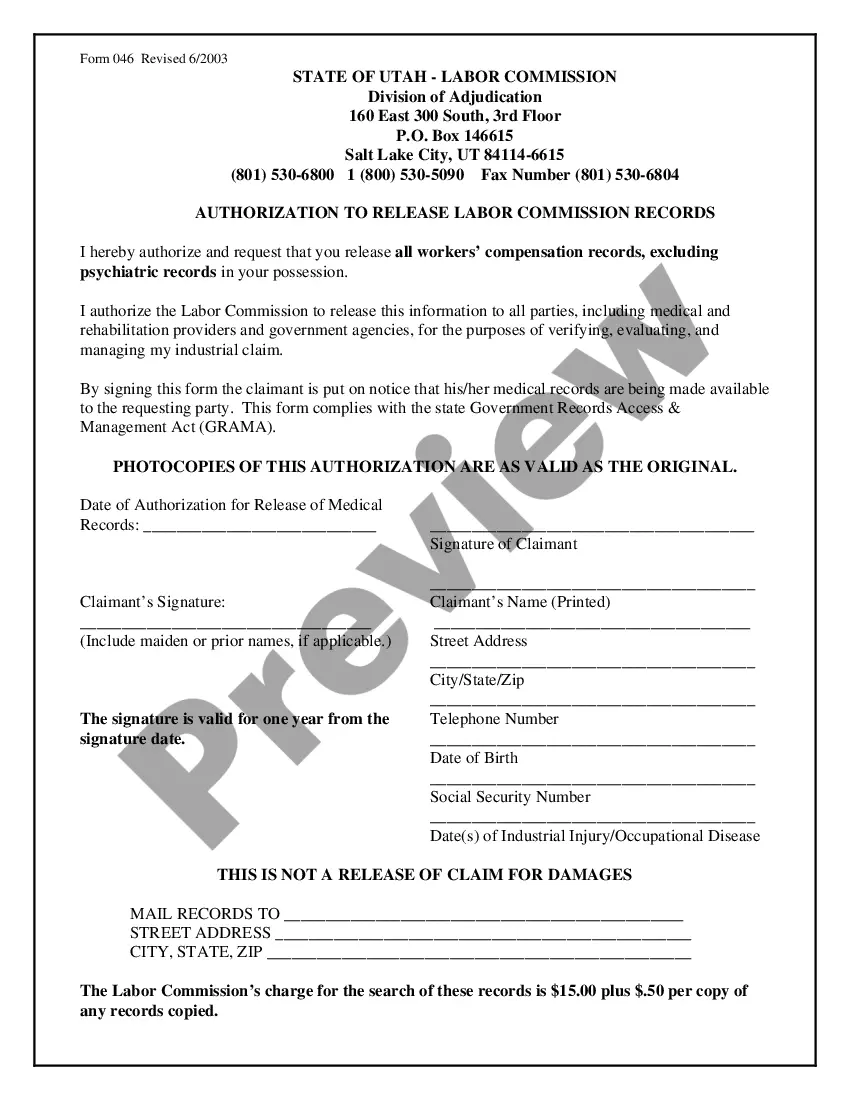

- Click the Preview button to examine the document's content.

- Check the form summary to confirm that you have chosen the correct template.

- If the form does not meet your requirements, use the Search field at the top of the page to find the one that does.

- If you are satisfied with the form, verify your choice by clicking the Get now button. Then, choose your payment plan and provide your details to register for an account.

- Complete the transaction. Use your credit card or PayPal account to finalize the payment.

Form popularity

FAQ

Having a non-compete can complicate job opportunities, as some companies may view it as a liability. However, many employers understand that non-compete agreements can be excessive or unenforceable. It’s vital to communicate openly about your contract and its implications. With US Legal Forms, you can learn more about structuring an Arkansas Contract with Consultant as Self-Employed Independent Contractor with Confidentiality Agreement and Covenant not to Compete that attracts potential employers instead.

Working for a competitor may violate your non-compete agreement, especially if it contains clear restrictions against doing so. The enforceability of such agreements can vary significantly based on state laws, including those in Arkansas. To ensure compliance and protect yourself, it's wise to review your contract carefully. You can also explore options on platforms like US Legal Forms that may provide guidance on creating strong agreements, including Arkansas Contracts with Consultants.

Yes, you can work for a client, but it depends on the specific terms of your non-compete agreement. If the agreement explicitly prohibits working with certain clients, then you're bound by those terms. However, if it’s vague or does not identify any specific clients, you may have more flexibility. It's advisable to consult an attorney to fully understand your rights under an Arkansas Contract with Consultant as Self-Employed Independent Contractor with Confidentiality Agreement and Covenant not to Compete.

Yes, a covenant not to compete can be enforceable in an employment contract if it adheres to legal standards. Courts usually examine whether the agreement is reasonable in its restrictions and if it serves a legitimate business interest. For those drafting an Arkansas Contract with Consultant as Self-Employed Independent Contractor with Confidentiality Agreement and Covenant not to Compete, using a reputable platform like US Legal Forms can ensure your contract is more likely to be upheld.

If you want to get out of a non-compete in Arkansas, consider a few strategies. First, you may negotiate a release from your employer or client, which can sometimes lead to a mutual agreement. Alternatively, demonstrating that the non-compete is overly broad or unreasonable may help you challenge it in court. Utilizing resources like US Legal Forms can guide you in drafting an Arkansas Contract with Consultant as Self-Employed Independent Contractor with Confidentiality Agreement and Covenant not to Compete that protects your interests.

Yes, non-compete agreements can be enforceable in Arkansas. However, enforceability often depends on how reasonable and specific the terms are. Factors such as the duration of the restriction and the geographic area impacted are key. If you need a solid Arkansas Contract with Consultant as Self-Employed Independent Contractor with Confidentiality Agreement and Covenant not to Compete, consider using a platform like US Legal Forms to ensure compliance with state laws.

In many cases, a non-compete agreement can hold up in court, provided it meets certain criteria. Courts typically review these contracts to ensure they are reasonable in duration, geographic scope, and line of work. If you're considering an Arkansas Contract with Consultant as Self-Employed Independent Contractor with Confidentiality Agreement and Covenant not to Compete, make sure it aligns with these standards. Legal guidance can help strengthen your position.

Whether you can work for a competitor after signing a non-compete agreement largely depends on the terms of that agreement. If the agreement restricts your ability to work in certain areas for a defined period, you may not be able to proceed without potential legal repercussions. Therefore, it's wise to review your Arkansas Contract with Consultant as Self-Employed Independent Contractor with Confidentiality Agreement and Covenant not to Compete closely. Consulting with a legal professional can offer clarity on your specific situation.

The noncompete bans can indeed apply to contractors, depending on the agreement's wording and scope. If the agreement specifies restrictions that are too broad or limit a contractor's ability to work, it might be challenged in court. Therefore, understanding the specific language and limits of an Arkansas Contract with Consultant as Self-Employed Independent Contractor with Confidentiality Agreement and Covenant not to Compete is essential for compliance. Legal guidance can clarify these issues.

Non-compete agreements can be enforceable on independent contractors in Arkansas. However, these agreements need to adhere to legal standards that ensure they are fair and clear. It's crucial to define the terms explicitly in the Arkansas Contract with Consultant as Self-Employed Independent Contractor with Confidentiality Agreement and Covenant not to Compete to minimize disputes. Consulting legal expertise can help independent contractors navigate these complexities.