Arkansas Agreement between Unmarried Individuals to Purchase and Hold Residence as Joint Tenants with Right of Survivorship

Description

How to fill out Agreement Between Unmarried Individuals To Purchase And Hold Residence As Joint Tenants With Right Of Survivorship?

US Legal Forms - one of the largest collections of legal forms in the United States - provides a variety of legal document templates that you can acquire or print.

By utilizing the website, you will find a vast selection of forms for business and personal purposes, organized by categories, states, or keywords. You can obtain the latest versions of forms like the Arkansas Agreement between Unmarried Individuals to Purchase and Hold Property as Joint Tenants with Right of Survivorship in mere seconds.

If you have a monthly subscription, Log In and obtain the Arkansas Agreement between Unmarried Individuals to Purchase and Hold Property as Joint Tenants with Right of Survivorship from the US Legal Forms library. The Download button will appear on each form you view. You can access all previously saved forms in the My documents tab in your account.

Process the transaction. Use your credit card or PayPal account to complete the transaction.

Select the file format and download the form to your device. Make changes. Fill out, edit, print, and sign the downloaded Arkansas Agreement between Unmarried Individuals to Purchase and Hold Property as Joint Tenants with Right of Survivorship. Each template you add to your account has no expiration date and belongs to you indefinitely. Therefore, if you want to download or print another copy, simply navigate to the My documents section and click on the template you need. Gain access to the Arkansas Agreement between Unmarried Individuals to Purchase and Hold Property as Joint Tenants with Right of Survivorship using US Legal Forms, the most extensive library of legal document templates. Utilize a wide array of professional and state-specific templates that fulfill your business or personal needs and requirements.

- To start using US Legal Forms for the first time, here are simple instructions to help you get started.

- Make sure you have picked the correct form for your municipality/county.

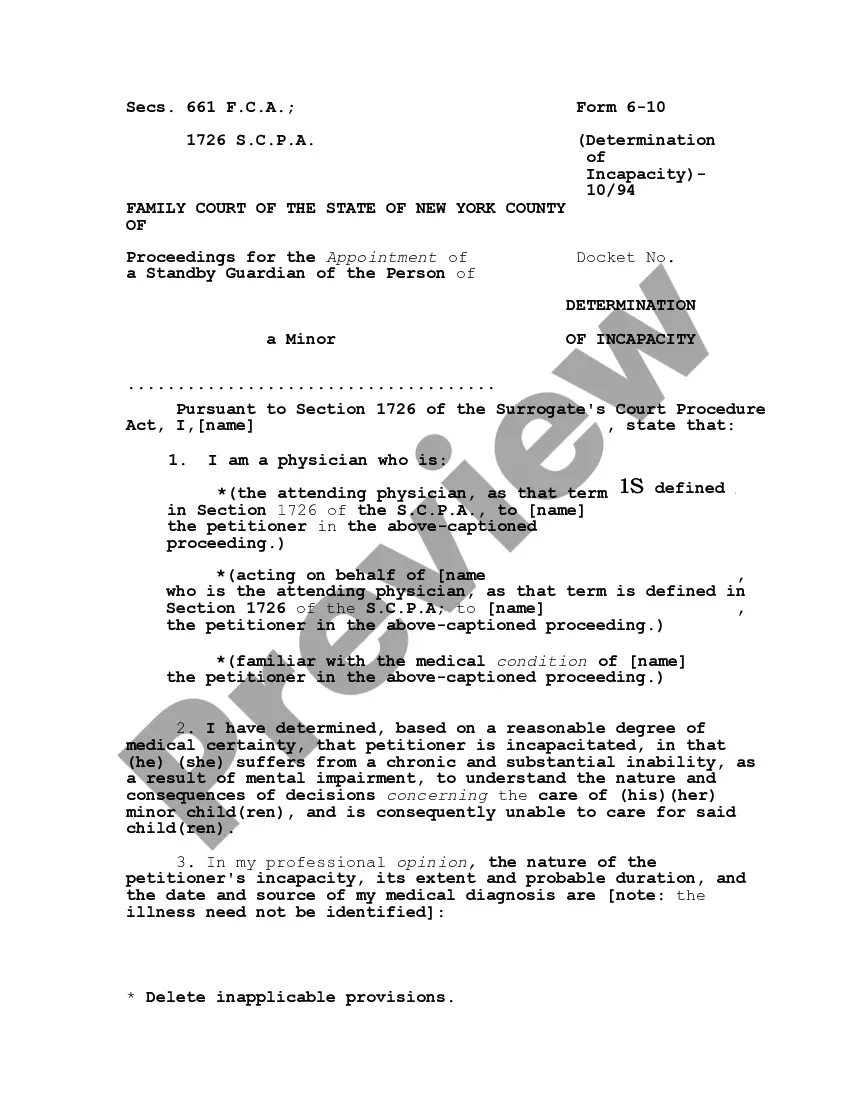

- Click the Preview button to review the content of the form.

- Check the form details to ensure you have chosen the right form.

- If the form doesn't meet your needs, use the Search bar at the top of the screen to find one that does.

- If you are satisfied with the form, confirm your choice by clicking the Purchase now button.

- Then, select your preferred pricing plan and provide your information to register for an account.

Form popularity

FAQ

Yes. You can find a lender that will allow you to apply for a home loan with your partner. However, you'll run into different challenges than married couples based on the current legal framework. Take the time to determine whether you and your partner should apply for a loan together.

Yes. You can find a lender that will allow you to apply for a home loan with your partner. However, you'll run into different challenges than married couples based on the current legal framework. Take the time to determine whether you and your partner should apply for a loan together.

To truly protect yourself legally, you can put together a cohabitation agreement, which is sort of like a prenup. "Cohabitation agreements usually include how property will be divided in the event of a separation," said attorney David Reischer, CEO of LegalAdvice.com.

Assuming both parties are on the deed and there's no property agreement, the home can either be sold or one person can buy out the other.

The term "joint tenancy" refers to a legal arrangement in which two or more people own a property together, each with equal rights and obligations. Joint tenancies can be created by married and non-married couples, friends, relatives, and business associates.

A joint survivorship agreement is one in which spouses may agree between themselves that all or part of their property, then existing or to be acquired, becomes the property of the surviving spouse on the death of a spouse.