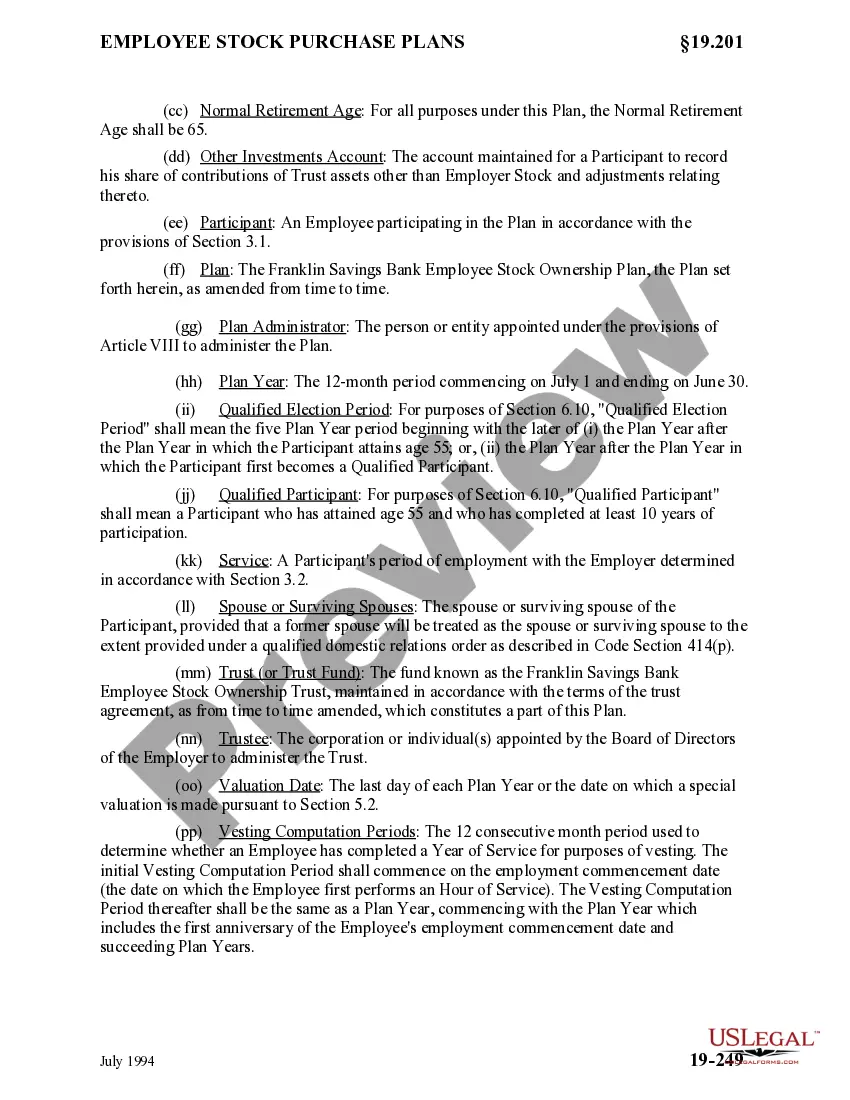

Georgia Employee Stock Ownership Plan of Franklin Savings Bank - Detailed

Description

How to fill out Employee Stock Ownership Plan Of Franklin Savings Bank - Detailed?

It is possible to spend several hours on-line looking for the legal papers design that suits the federal and state requirements you need. US Legal Forms supplies a large number of legal types that are analyzed by pros. You can actually download or printing the Georgia Employee Stock Ownership Plan of Franklin Savings Bank - Detailed from my assistance.

If you currently have a US Legal Forms bank account, you can log in and then click the Obtain option. Following that, you can complete, revise, printing, or indicator the Georgia Employee Stock Ownership Plan of Franklin Savings Bank - Detailed. Every single legal papers design you buy is the one you have permanently. To have another duplicate for any obtained type, proceed to the My Forms tab and then click the corresponding option.

If you work with the US Legal Forms internet site the first time, follow the easy recommendations under:

- Very first, make sure that you have selected the best papers design for the state/town of your choosing. Browse the type description to make sure you have selected the correct type. If readily available, make use of the Review option to check through the papers design as well.

- If you would like discover another edition of the type, make use of the Search discipline to discover the design that suits you and requirements.

- After you have identified the design you desire, click on Buy now to carry on.

- Select the costs strategy you desire, key in your references, and register for a free account on US Legal Forms.

- Complete the financial transaction. You can use your bank card or PayPal bank account to fund the legal type.

- Select the file format of the papers and download it for your system.

- Make alterations for your papers if possible. It is possible to complete, revise and indicator and printing Georgia Employee Stock Ownership Plan of Franklin Savings Bank - Detailed.

Obtain and printing a large number of papers layouts using the US Legal Forms site, which provides the largest variety of legal types. Use professional and condition-distinct layouts to take on your company or person demands.

Form popularity

FAQ

While ESOPs offer tax benefits and can boost employee morale, there are downsides to keep in mind. These programs can be expensive and potentially lower the value of your business, which could impact your long-term exit strategy.

After the employee terminates, the company can make the distribution in shares, cash, or some of both. Cash is paid to the employee directly. Often, company shares are immediately repurchased by the ESOP, and the employee receives cash equivalent to fair market value as determined by the most recent annual valuation.

An ESOP is an employee benefit plan that enables employees to own part or all of the company they work for. at fair market value (unless there's a public market for the shares). So, the employee receives the value of his or her shares from the trust, usually in the form of cash.

An employee stock ownership plan (ESOP) is an IRC section 401(a) qualified defined contribution plan that is a stock bonus plan or a stock bonus/money purchase plan.

An ESOP is a retirement benefit. But it's different than a 401(k) or pension plan. It's an exclusive option for C- and S-corporations. Assets are primarily invested in company stock.

ESOP participants don't invest their own money. Rather, their shares of company stock are earned over time. After an ESOP trust is established, the company uses funds that would typically go toward income tax liabilities to pay the selling owner for the shares sold to the ESOP.

ESOP rules set a limit of 25% of salary as the maximum amount that can be contributed to a participant's account annually, though most companies contribute between 6-10% of salary annually. The 25% is a combined limit that includes ESOPs, 401(k)s, profit sharing, and stock bonus plans offered by the company.

Stock options allow employees to buy a piece of your company at a discount in exchange for their dedication and commitment. As a small business, you can consider offering stock options as a great way to compensate employees and help build a hardworking and innovative staff.