Under the Fair Credit Reporting Act, a consumer reporting agency, on request by and proper identification of the consumer, must clearly and accurately disclose to the consumer:

the nature and substance of certain information in its files on the consumer;

the sources of most of that information;

the recipients of any consumer report on the consumer furnished for employment purposes within the two-year period preceding the request, and for any other purpose within the one-year period preceding the request;

the dates, original payees, and amounts of any checks on which is based any adverse characterization of the consumer, included in the file at the time of the disclosure; and

a record of all inquiries received by the agency during the one-year period preceding the request that identified the consumer in connection with a credit or insurance transaction that was not initiated by the consumer.

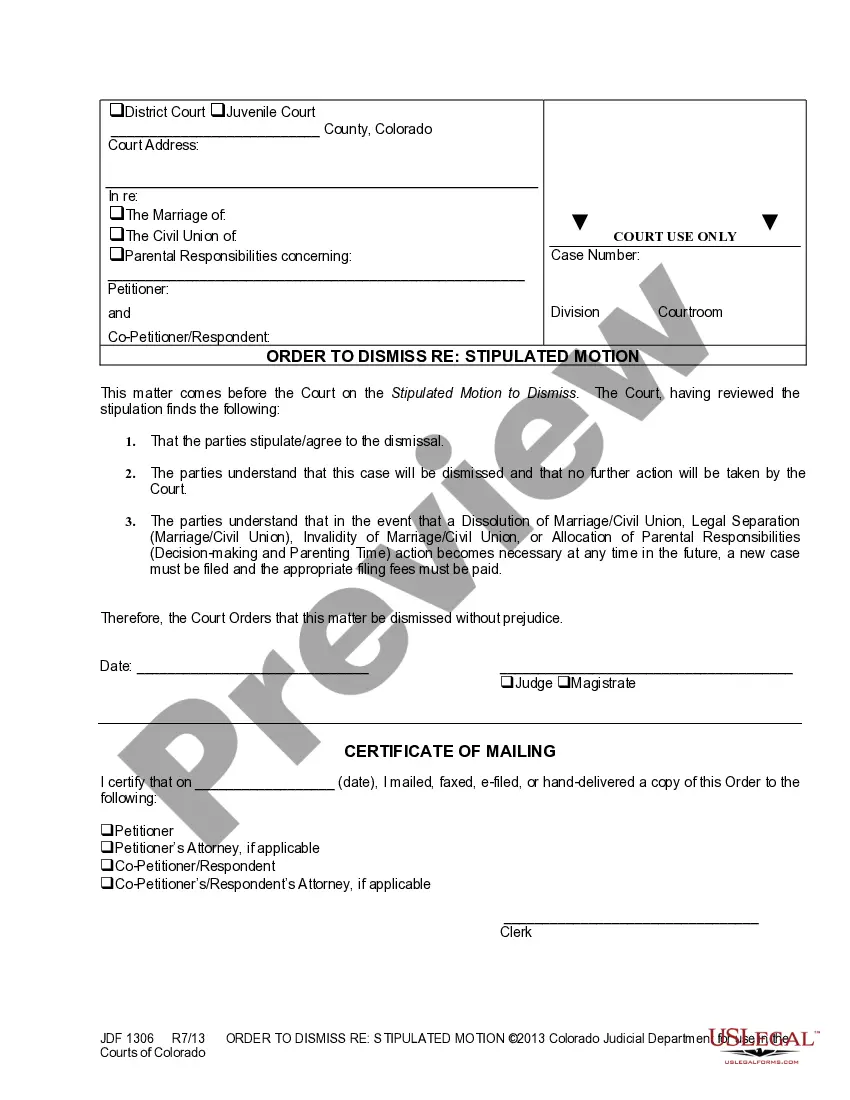

Arkansas Request for Disclosure as to Nature and Scope of Investigative Consumer Report

Description

How to fill out Request For Disclosure As To Nature And Scope Of Investigative Consumer Report?

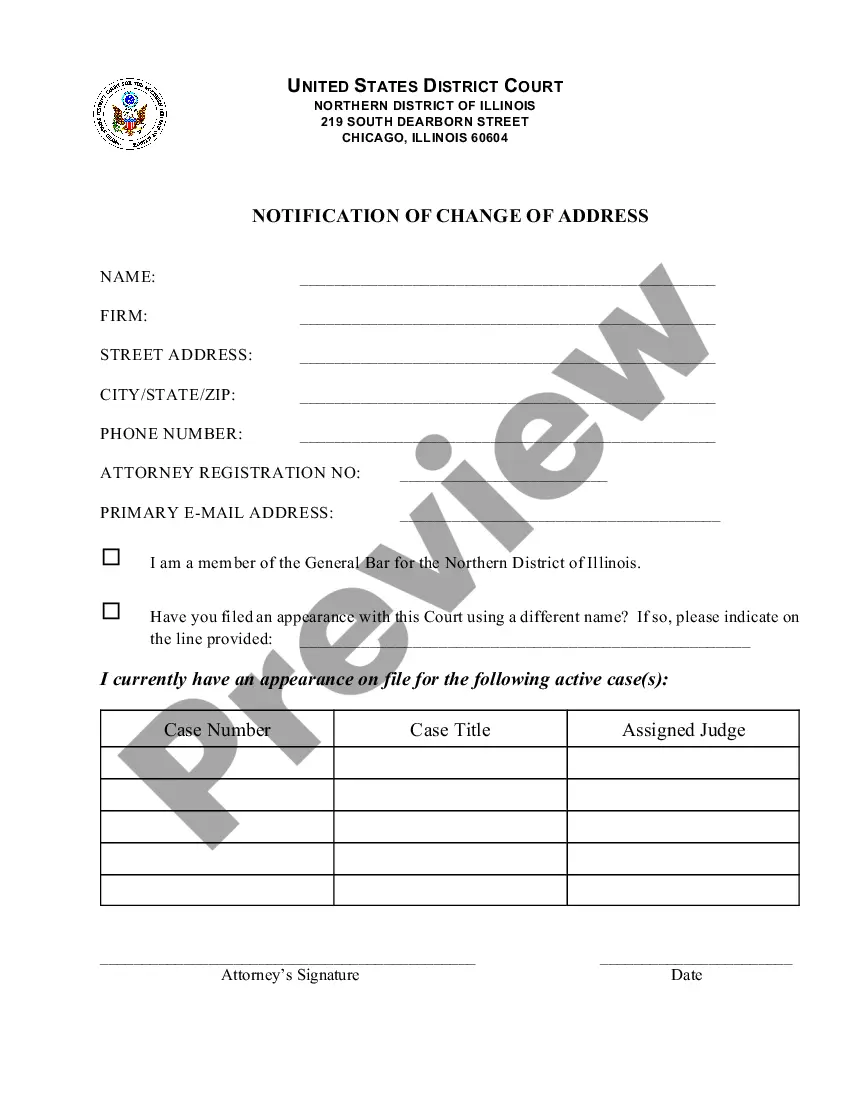

You can invest several hours on the Internet searching for the legitimate papers format that meets the federal and state demands you need. US Legal Forms provides 1000s of legitimate forms which are examined by specialists. It is simple to download or produce the Arkansas Request for Disclosure as to Nature and Scope of Investigative Consumer Report from our service.

If you currently have a US Legal Forms bank account, it is possible to log in and then click the Download button. Following that, it is possible to complete, revise, produce, or sign the Arkansas Request for Disclosure as to Nature and Scope of Investigative Consumer Report. Every single legitimate papers format you acquire is your own permanently. To have an additional duplicate of the obtained kind, go to the My Forms tab and then click the corresponding button.

If you use the US Legal Forms site initially, stick to the straightforward instructions below:

- Initially, make certain you have chosen the proper papers format for your region/area that you pick. Read the kind description to ensure you have picked out the appropriate kind. If accessible, use the Review button to look throughout the papers format at the same time.

- In order to discover an additional edition in the kind, use the Lookup industry to obtain the format that fits your needs and demands.

- When you have located the format you would like, click Acquire now to carry on.

- Select the pricing strategy you would like, type in your credentials, and register for a free account on US Legal Forms.

- Full the transaction. You should use your credit card or PayPal bank account to pay for the legitimate kind.

- Select the format in the papers and download it in your device.

- Make changes in your papers if required. You can complete, revise and sign and produce Arkansas Request for Disclosure as to Nature and Scope of Investigative Consumer Report.

Download and produce 1000s of papers layouts using the US Legal Forms Internet site, that provides the biggest variety of legitimate forms. Use specialist and status-certain layouts to handle your company or person requirements.

Form popularity

FAQ

Investigative Reports These obligations include giving written notice that you may request or have requested an investigative consumer report, and giving a statement that the person has a right to request additional disclosures and a summary of the scope and substance of the report.

The Act (Title VI of the Consumer Credit Protection Act) protects information collected by consumer reporting agencies such as credit bureaus, medical information companies and tenant screening services. Information in a consumer report cannot be provided to anyone who does not have a purpose specified in the Act.

The Fair Credit Reporting Act (FCRA) , 15 U.S.C. § 1681 et seq., governs access to consumer credit report records and promotes accuracy, fairness, and the privacy of personal information assembled by Credit Reporting Agencies (CRAs).

The FCRA requires any prospective user of a consumer report, for example, a lender, insurer, landlord, or employer, among others, to have a legally permissible purpose to obtain a report.

Consumer Financial Protection Bureau.

The Fair Credit Reporting Act (FCRA) governs how credit bureaus can collect and share information about individual consumers. Businesses check credit reports for many purposes, such as deciding whether to make a loan or sell insurance to a consumer. Employers may check them, too.