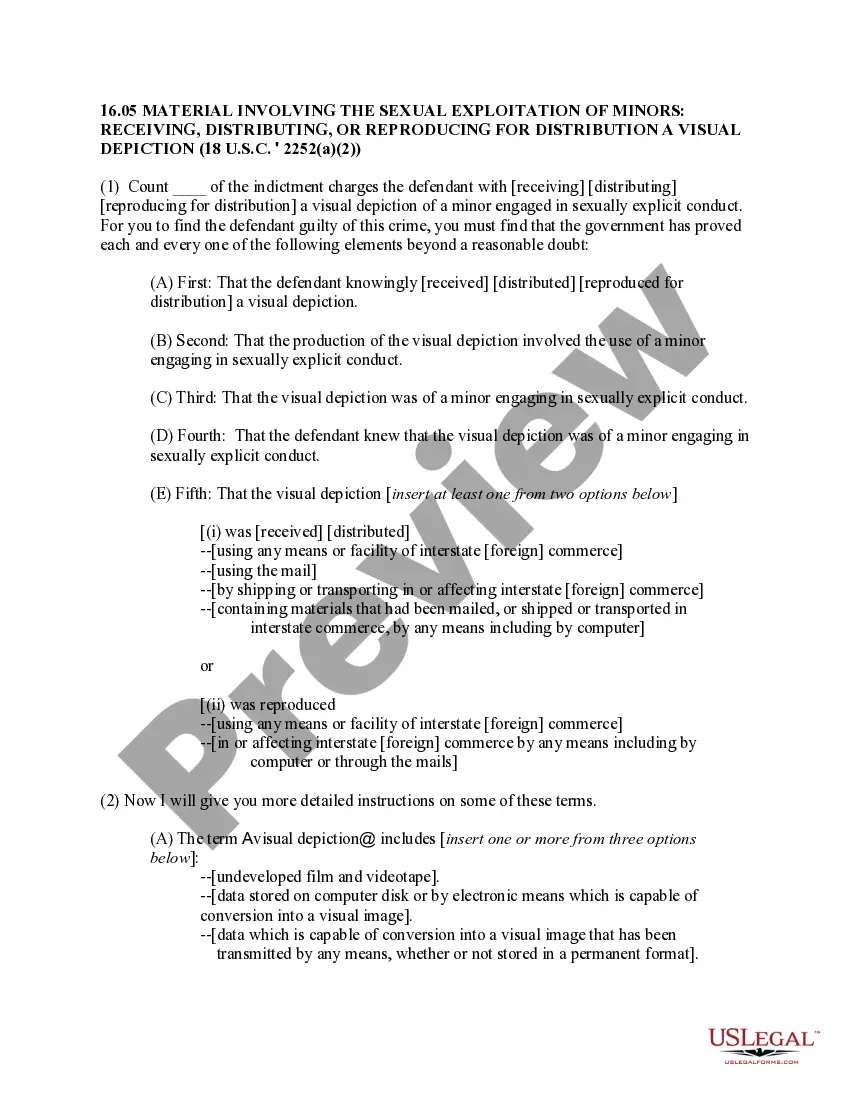

A guaranty is a contract under which one person agrees to pay a debt or perform a duty if the other person who is bound to pay the debt or perform the duty fails to do so. A guaranty agreement is a type of contract. Thus, questions relating to such matters as validity, interpretation, and enforceability of guaranty agreements are decided in accordance with basic principles of contract law. A conditional guaranty contemplates, as a condition to liability on the part of the guarantor, the happening of some contingent event. A guaranty of the payment of a debt is distinguished from a guaranty of the collection of the debt, the former being absolute and the latter conditional.

Arkansas Conditional Guaranty of Payment of Obligation

Description

How to fill out Conditional Guaranty Of Payment Of Obligation?

US Legal Forms - one of the largest collections of legal documents in the United States - offers a variety of legal form templates that you can download or print.

By using the website, you can access thousands of forms for both business and personal purposes, organized by categories, states, or keywords. You can find the latest forms such as the Arkansas Conditional Guaranty of Payment of Obligation within minutes.

If you already have a subscription, Log In to obtain the Arkansas Conditional Guaranty of Payment of Obligation from the US Legal Forms library. The Download button will be available on every document you view. You can access all previously saved forms in the My documents tab of your account.

Make adjustments. Fill out, edit, and print as well as sign the saved Arkansas Conditional Guaranty of Payment of Obligation.

Each template you add to your account has no expiration date and is yours indefinitely. So, if you want to download or print another copy, just go to the My documents section and click on the form you need. Access the Arkansas Conditional Guaranty of Payment of Obligation with US Legal Forms, one of the most extensive libraries of legal document templates. Utilize thousands of professional and state-specific templates that meet your business or personal needs.

- If you wish to use US Legal Forms for the first time, here are some simple instructions to help you get started.

- Ensure you have selected the correct form for your city/state. Select the Review button to examine the form's details. Review the form summary to confirm you have chosen the correct form.

- If the form does not meet your requirements, utilize the Search field at the top of the screen to find one that does.

- Once you are satisfied with the form, affirm your choice by clicking the Get now button. Then, select the pricing plan you prefer and enter your details to register for an account.

- Process the payment. Use your credit card or PayPal account to finalize the payment.

- Select the format and download the form to your device.

Form popularity

FAQ

1 : a pledge to pay another's debt or to perform another's duty in case of the other's default or inadequate performance compare letter of credit. 2 : guarantee sense 3. 3 : guarantor. 4 : something given as security : pledge. 5 : the protection of a right afforded by legal provision (as in a constitution)

A typical mortgage loan requires the borrower and/or its principals to execute a bad boy guaranty (a/k/a recourse carve out guaranty), which provides for personal liability against the borrower and principals of borrower upon the occurrence of certain enumerated bad acts committed by the borrower or its principals.

Guarantee Obligations means, as to any Person, any obligation of such Person guaranteeing or intended to guarantee any Indebtedness of any primary obligor in any manner, whether directly or indirectly, including any obligation of such Person, whether or not contingent, (i) to purchase any such Indebtedness or any

Put another way, a guaranty of collection requires that the debtor must exhaust certain remedies against the debtor before proceeding against the guarantor, while a guaranty of payment means that the lender can proceed directly against the guarantor even if the debtor is solvent and otherwise able to pay.

According to the Restatement, a party may enforce a guaranty under one of three theories: A promise to be surety for the performance of a contractual obligation, made to the obligee, is binding if: The promise is in writing and signed by the promisor and recites a purported consideration; or.

Guaranty Obligation means, as applied to any Person, any direct or indirect liability, contingent or otherwise, of such Person for any Indebtedness, lease, dividend or other obligation (the primary obligation) of another Person (the primary obligor), if the purpose or intent of such Person in incurring such

Put another way, a guaranty of collection requires that the debtor must exhaust certain remedies against the debtor before proceeding against the guarantor, while a guaranty of payment means that the lender can proceed directly against the guarantor even if the debtor is solvent and otherwise able to pay.

Purpose of GuarantyThe guarantor agrees to pay the obligations of the borrower under the loan agreement in the event that the borrower does not pay. In addition to being an alternate source of repayment, guaranties provide evidence that the guarantor intends to stand behind the borrower.

A guaranty of payment is an independent agreement by a person or an entity to pay the loan when it goes into default. Even if the borrower is unable or unwilling to pay back the loan, the Bank can require the guarantor to pay it back.