US Legal Forms - one of many biggest libraries of lawful forms in the United States - offers a wide array of lawful file web templates you are able to download or produce. Making use of the website, you will get a large number of forms for business and specific purposes, categorized by groups, suggests, or keywords.You can get the latest versions of forms much like the Arkansas Agreement Between Heirs and Third Party Claimant as to Division of Estate in seconds.

If you currently have a subscription, log in and download Arkansas Agreement Between Heirs and Third Party Claimant as to Division of Estate in the US Legal Forms catalogue. The Download switch can look on each type you see. You have accessibility to all formerly delivered electronically forms inside the My Forms tab of your respective profile.

If you wish to use US Legal Forms for the first time, here are easy instructions to help you get started out:

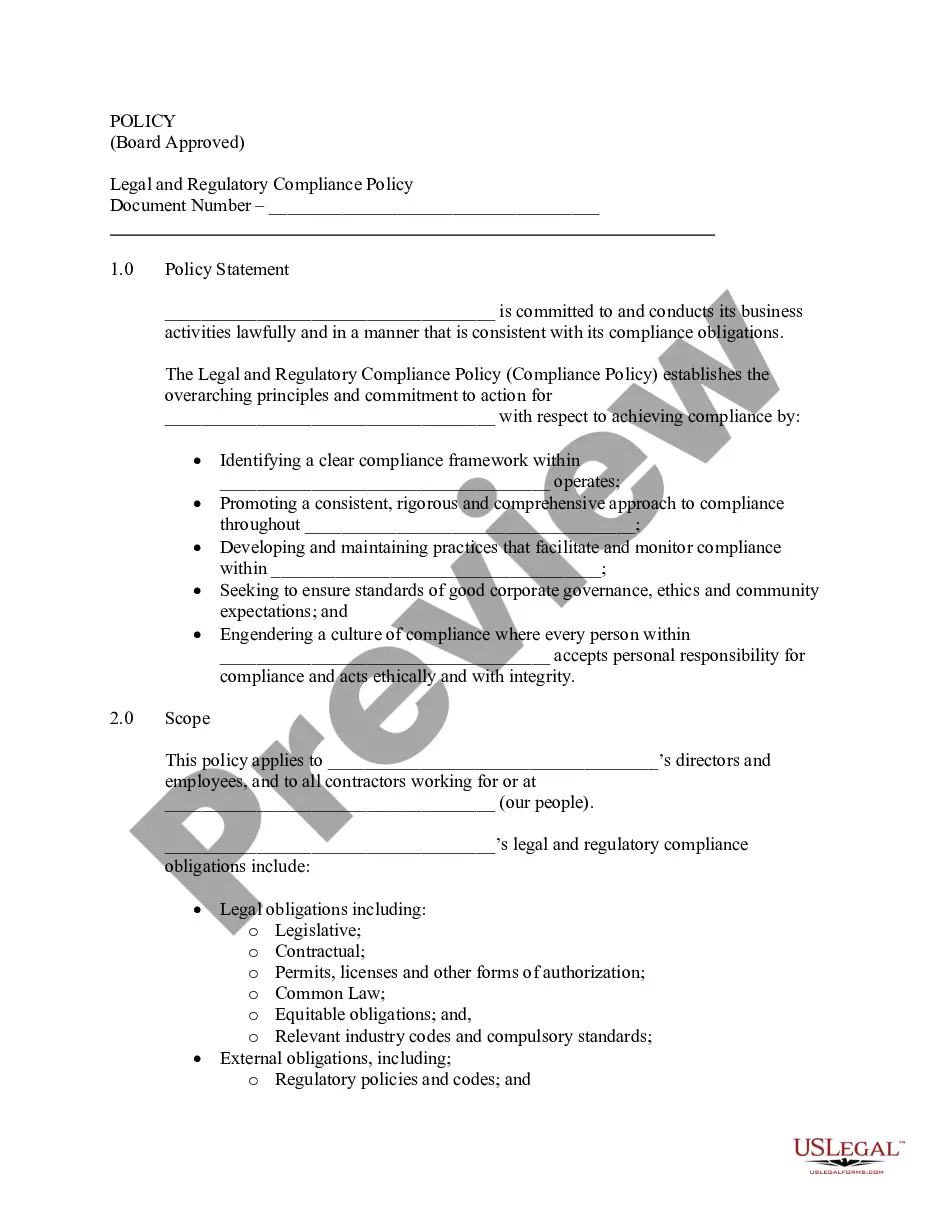

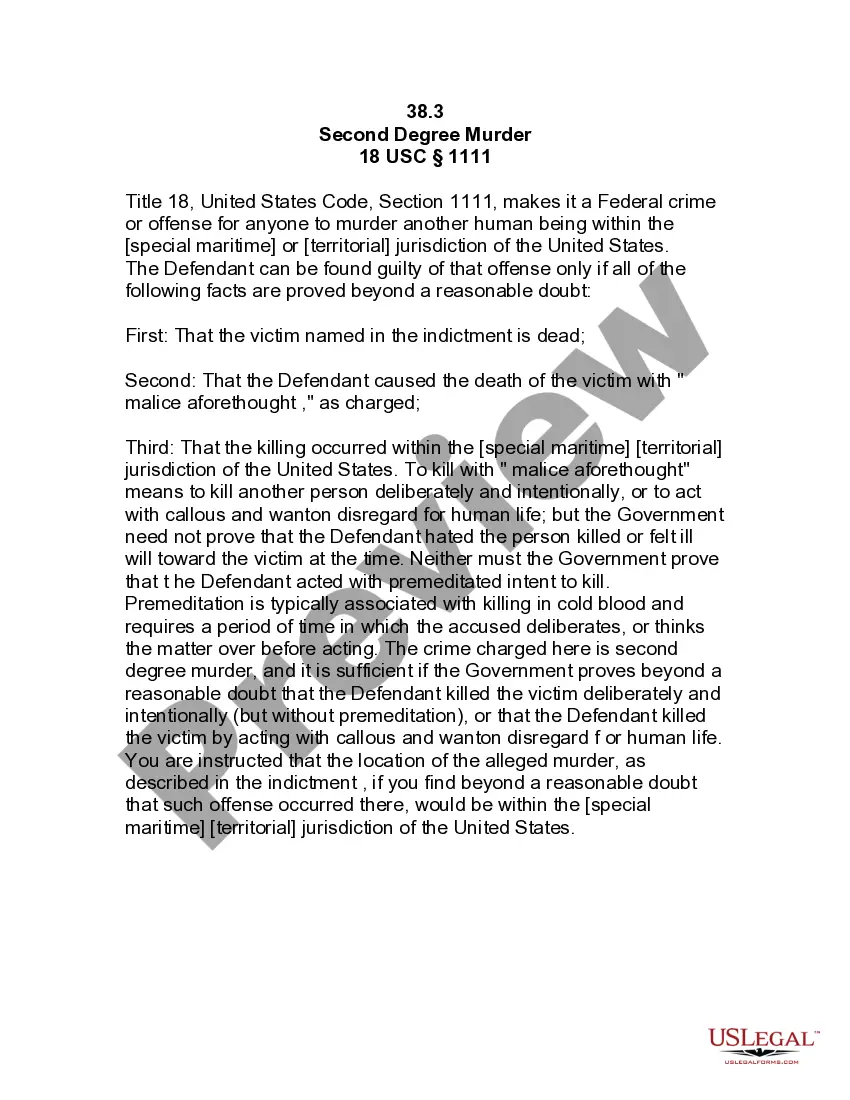

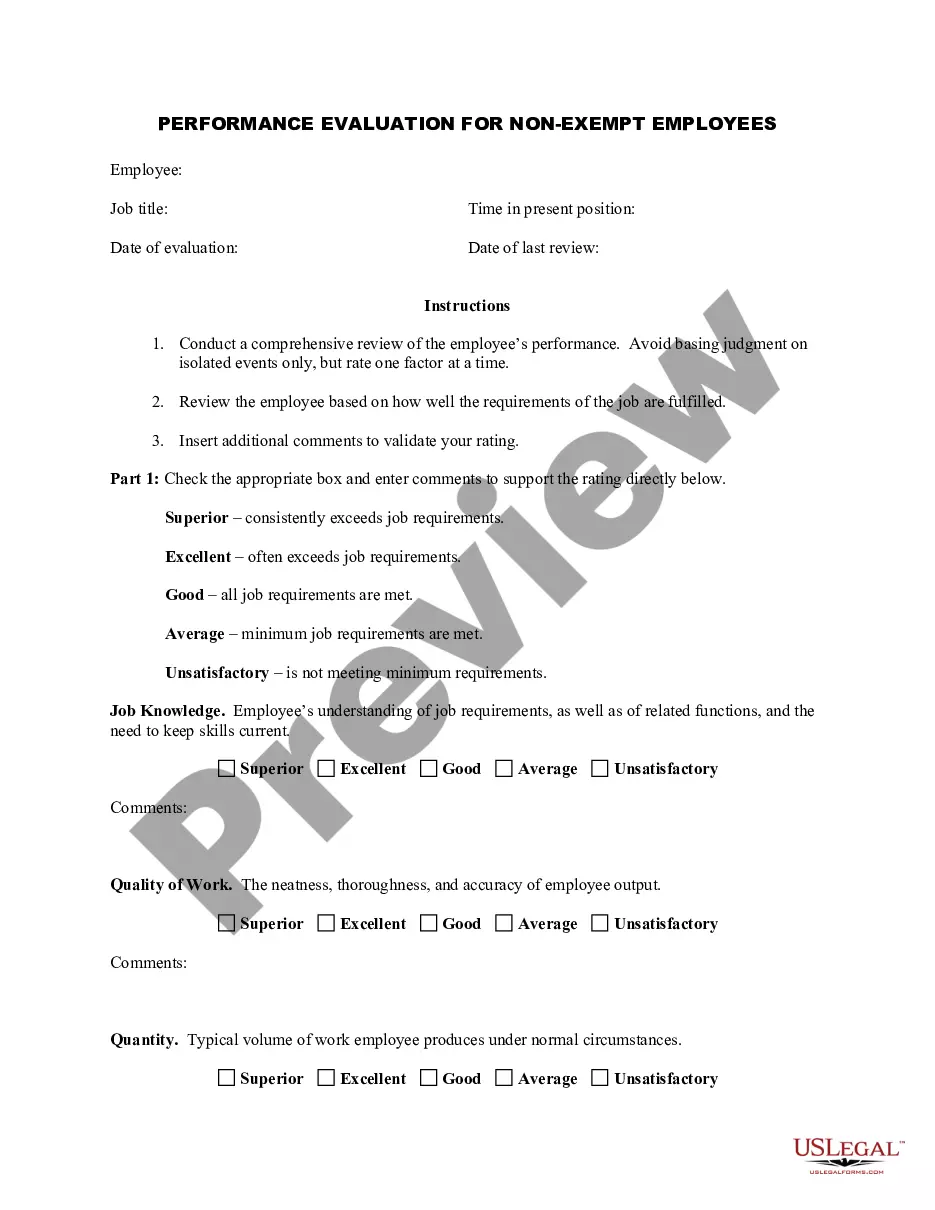

- Ensure you have selected the right type for the metropolis/region. Click the Preview switch to review the form`s content. Read the type information to ensure that you have chosen the correct type.

- When the type does not suit your requirements, make use of the Research industry towards the top of the display to obtain the one which does.

- In case you are pleased with the form, verify your choice by clicking on the Get now switch. Then, select the rates plan you favor and supply your references to register to have an profile.

- Process the transaction. Make use of charge card or PayPal profile to accomplish the transaction.

- Find the structure and download the form on your gadget.

- Make alterations. Fill out, change and produce and indicator the delivered electronically Arkansas Agreement Between Heirs and Third Party Claimant as to Division of Estate.

Every template you put into your money lacks an expiry day and is your own eternally. So, if you wish to download or produce another version, just visit the My Forms area and then click around the type you will need.

Gain access to the Arkansas Agreement Between Heirs and Third Party Claimant as to Division of Estate with US Legal Forms, one of the most extensive catalogue of lawful file web templates. Use a large number of specialist and condition-specific web templates that fulfill your small business or specific requirements and requirements.