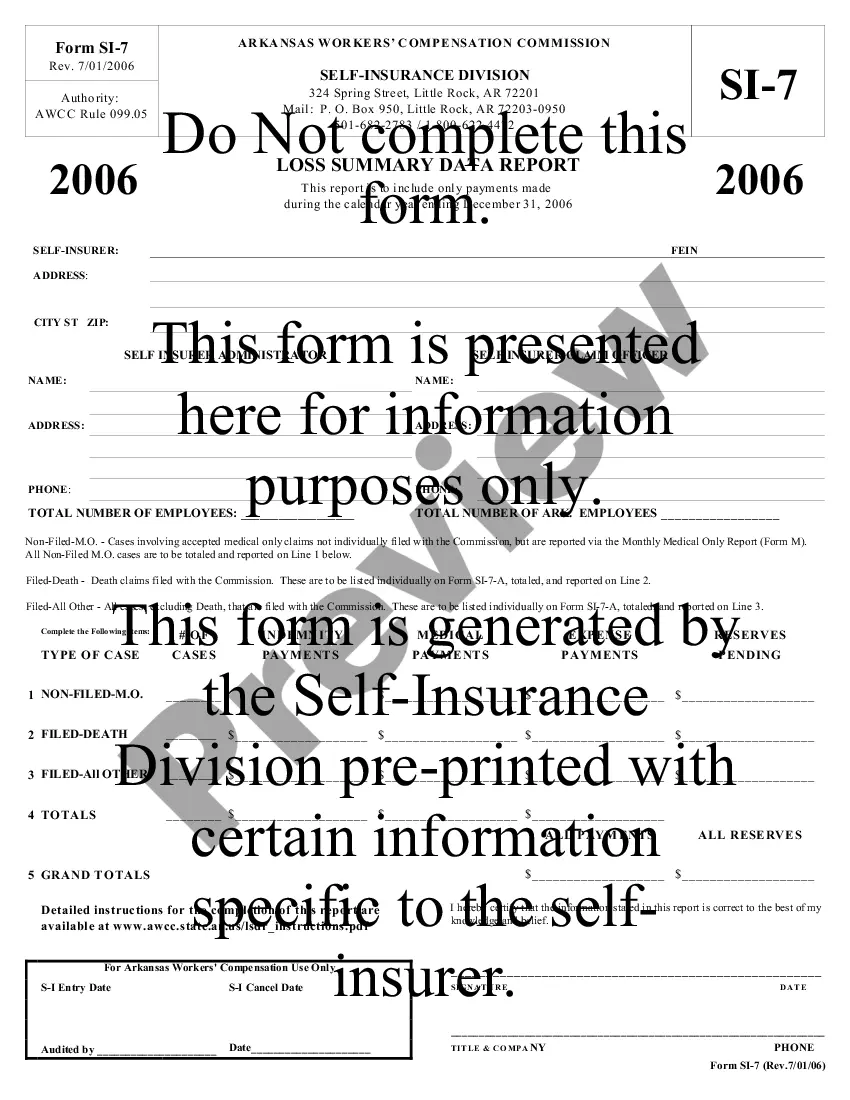

The Arkansas Loss Summary Data Report — Itemized Listing is a report that provides detailed information about losses incurred by companies in the state of Arkansas. It includes a breakdown of each type of loss, along with the specific dollar amount of the loss and the associated insurance company. This report is typically generated by insurance companies and is used to provide an accurate assessment of the losses incurred by companies in the state of Arkansas. The report is organized by type of loss, including property damage, theft, liability, medical expenses, and other losses. For each type of loss, the report provides the total amount of the loss, along with the insurance company and policy number associated with the loss. There are two types of Arkansas Loss Summary Data Report — Itemized Listing: one for direct losses and one for indirect losses. The direct losses report includes losses that are directly related to the company's operations, while the indirect losses report includes losses that are not directly related to the company's operations, such as those resulting from weather-related events or natural disasters.

Arkansas Loss Summary Data Report - Itemized Listing

Description

Get your form ready online

Our built-in tools help you complete, sign, share, and store your documents in one place.

Make edits, fill in missing information, and update formatting in US Legal Forms—just like you would in MS Word.

Download a copy, print it, send it by email, or mail it via USPS—whatever works best for your next step.

Sign and collect signatures with our SignNow integration. Send to multiple recipients, set reminders, and more. Go Premium to unlock E-Sign.

If this form requires notarization, complete it online through a secure video call—no need to meet a notary in person or wait for an appointment.

We protect your documents and personal data by following strict security and privacy standards.

Make edits, fill in missing information, and update formatting in US Legal Forms—just like you would in MS Word.

Download a copy, print it, send it by email, or mail it via USPS—whatever works best for your next step.

Sign and collect signatures with our SignNow integration. Send to multiple recipients, set reminders, and more. Go Premium to unlock E-Sign.

If this form requires notarization, complete it online through a secure video call—no need to meet a notary in person or wait for an appointment.

We protect your documents and personal data by following strict security and privacy standards.

Looking for another form?

How to fill out Arkansas Loss Summary Data Report - Itemized Listing?

Dealing with official paperwork necessitates focus, accuracy, and the utilization of well-prepared templates. For 25 years, US Legal Forms has been assisting individuals nationwide in achieving just that, so when you select your Arkansas Loss Summary Data Report - Itemized Listing template from our platform, you can be assured it complies with both federal and state laws.

Utilizing our service is simple and efficient. To acquire the necessary document, all you require is an account with an active subscription. Here’s a quick guide for you to locate your Arkansas Loss Summary Data Report - Itemized Listing in just a few minutes.

All documents are designed for multiple uses, including the Arkansas Loss Summary Data Report - Itemized Listing available on this page. If you need them again, you can fill them out without additional payment - simply navigate to the My documents section in your profile and complete your document whenever necessary. Experience US Legal Forms and prepare your business and personal paperwork swiftly and in complete legal adherence!

- Ensure to meticulously review the form content and its alignment with general and legal standards by previewing it or reading its description.

- Look for an alternative official template if the previously accessed one does not meet your needs or state laws (the option for this is located at the top page corner).

- Log In to your account and store the Arkansas Loss Summary Data Report - Itemized Listing in your desired format. If it’s your first time visiting our site, click Buy now to continue.

- Sign up for an account, select your subscription plan, and make a payment via credit card or PayPal.

- Choose the format in which you want to save your document and click Download. Print the blank version or include it in a professional PDF editor for paper-free submission.

Form popularity

FAQ

Filing a workers' compensation claim in Arkansas involves notifying your employer about the injury, filling out a claim form, and submitting necessary documentation. Prompt reporting is crucial to avoid complications. To navigate this process with ease, consult our Arkansas Loss Summary Data Report - Itemized Listing for a step-by-step guide.

The maximum compensation rate for workers' comp in Arkansas is subject to annual adjustments that reflect the state’s average weekly wage. Currently, the maximum rate is set to ensure that injured workers receive adequate support during recovery. For the latest figures and historical data, the Arkansas Loss Summary Data Report - Itemized Listing is an invaluable resource.

In Arkansas, certain individuals may be exempt from workers' compensation, including corporate officers and sole proprietors without employees, depending on specific criteria. However, it's important to ensure you meet exemption requirements to avoid penalties. You can find detailed criteria in our Arkansas Loss Summary Data Report - Itemized Listing.

To obtain a workers' compensation waiver in Arkansas, you must apply for an exemption through the Arkansas Workers' Compensation Commission. This typically involves demonstrating that you do not have any employees who require coverage. For a clear and thorough process, consider utilizing our Arkansas Loss Summary Data Report - Itemized Listing as a guide.

Yes, a single member LLC in Arkansas is generally required to have workers' compensation insurance if it has employees. This insurance protects both the owner and employees from work-related injuries. Understanding the specifics can be simplified with our Arkansas Loss Summary Data Report - Itemized Listing, which provides comprehensive information.

In Arkansas, the waiting period for workers' compensation is typically eight days. If you are unable to work due to a workplace injury, benefits will start after this period. You can access detailed Arkansas Loss Summary Data Report - Itemized Listing through our platform for insights into claim processing times.