Satisfaction, Release or Cancellation of Mortgage by Individual

Assignments Generally: Lenders, or holders of mortgages or deeds of trust, often assign mortgages or deeds of trust to other lenders, or third parties. When this is done the assignee (person who received the assignment) steps into the place of the original lender or assignor. To effectuate an assignment, the general rules is that the assignment must be in proper written format and recorded to provide notice of the assignment.

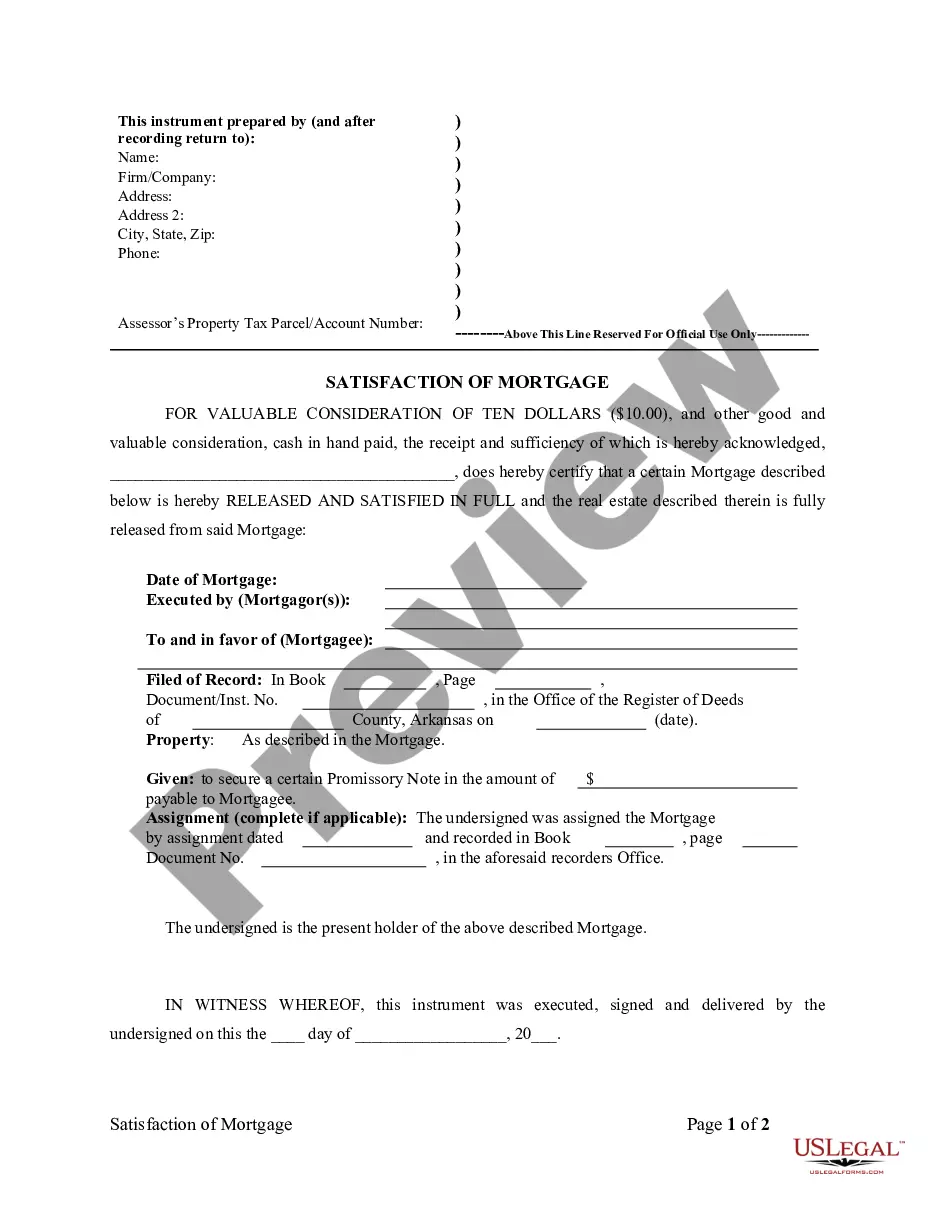

Satisfactions Generally: Once a mortgage or deed of trust is paid, the holder of the mortgage is required to satisfy the mortgage or deed of trust of record to show that the mortgage or deed of trust is no longer a lien on the property. The general rule is that the satisfaction must be in proper written format and recorded to provide notice of the satisfaction. If the lender fails to record a satisfaction within set time limits, the lender may be responsible for damages set by statute for failure to timely cancel the lien. Depending on your state, a satisfaction may be called a Satisfaction, Cancellation, or Reconveyance. Some states still recognize marginal satisfaction but this is slowly being phased out. A marginal satisfaction is where the holder of the mortgage physically goes to the recording office and enters a satisfaction on the face of the the recorded mortgage, which is attested by the clerk.

Arkansas Law

Assignment: An assignment must be in writing and recorded.

Demand to Satisfy: Upon full satisfaction, at the request of the person making satisfaction, the mortgagee shall acknowledge satisfaction thereof on the margin of the record in which the mortgage is recorded.

Recording Satisfaction: If any mortgagee shall receive full satisfaction for the amount due on any mortgage, then, at the request of the person making satisfaction, the mortgagee shall acknowledge satisfaction thereof on the margin of the record in which the mortgage is recorded.

Marginal Satisfaction: The clerks in counties which use other than paper recording systems shall not allow satisfactions by marginal notations after December 31, 1995. Satisfactions by marginal notations made in counties which use other than paper recording systems after December 31, 1995, are void.

Penalty: If any person receiving satisfaction does not, within sixty (60) days after being requested, acknowledge satisfaction, he shall forfeit to the party aggrieved any sum not exceeding the amount of the mortgage money, to be recovered by a civil action.

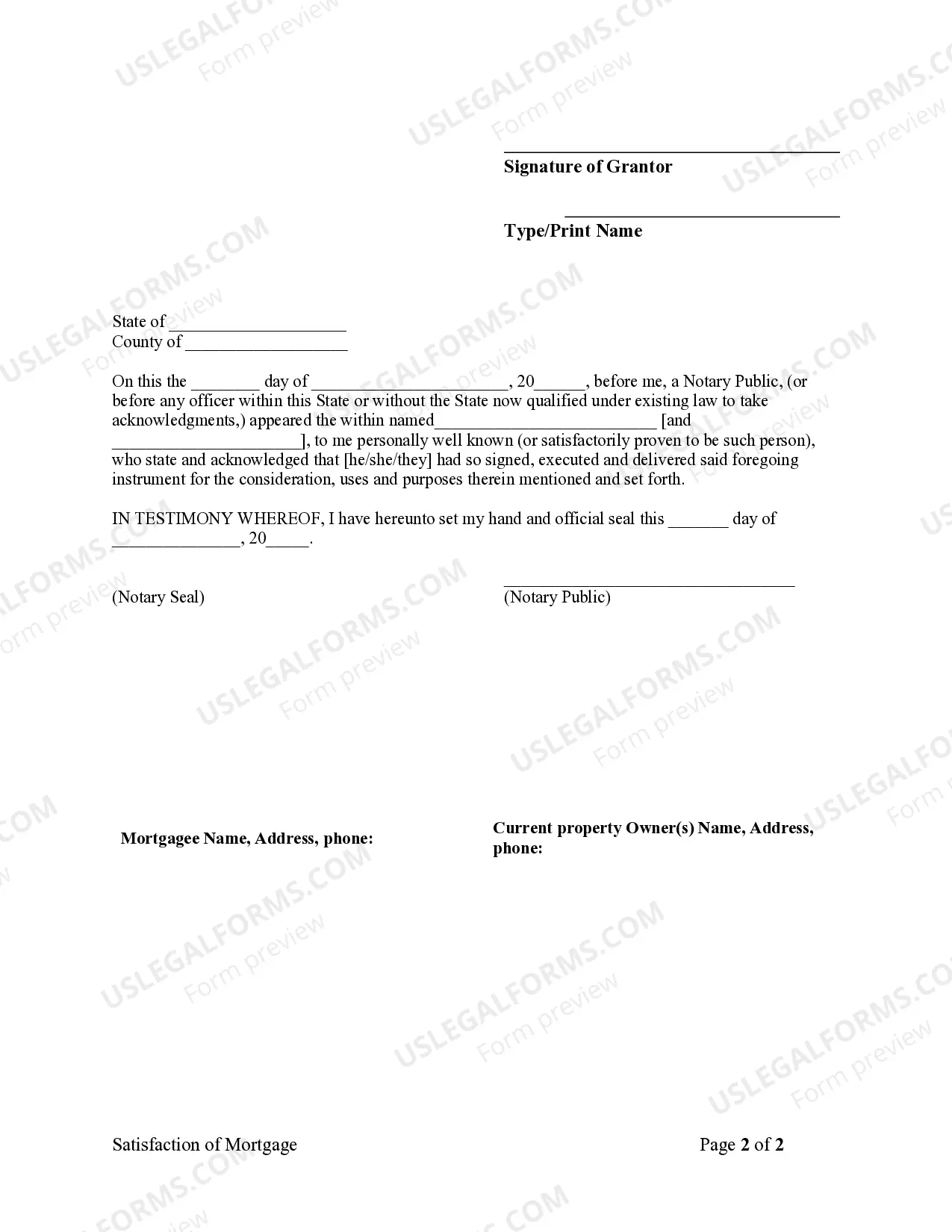

Acknowledgment: An assignment or satisfaction must contain a proper Arkansas acknowledgment, or other acknowledgment approved by Statute.

Arkansas Statutes

14-15-407. Manner of recording. [assignment, satisfaction]

Without delay, each recorder shall record every deed, mortgage, conveyance, deed of trust, bond, or other writing delivered to him or her for record with the acknowledgment, proofs, and certificates written on or attached to the writing and all other papers therein referred to and annexed thereto in the order and as of the time when the writing has been delivered for record by:

(1) Entering them word for word and letter for letter;

(2) Noting at the foot of each record all interlineations, erasures, and words visibly written on erasures; and

(3) Noting at the foot of the record the date of the month and year when the instrument so recorded was delivered to him or her or deposited in his or her office for record.

18-40-101. Proof or acknowledgment Recording.

All mortgages of real estate shall be proven or acknowledged in the same manner that deeds for the conveyance of real estate are required by law to be proven or acknowledged. When so proven or acknowledged they shall be recorded in the counties in which the lands lie.

18-40-104. Acknowledgment of satisfaction on record.

(a) If a mortgagee or his or her executor, administrator, or assignee receives full satisfaction for the amount due on any mortgage, then at the request of the person making satisfaction, the mortgagee shall acknowledge satisfaction of the amount due on the mortgage on the margin of the record in which the mortgage is recorded.

(b) Acknowledgment of satisfaction, made as stated in subsection (a) of this section, shall have the effect to release the mortgage, bar all actions brought on the mortgage, and revest in the mortgagor or his or her legal representative all title to the mortgaged property.

(c) The trustee of a deed of trust or a person employed by the trustee shall reconvey all or any part of the property encumbered by a deed of trust to the person entitled to the property on written request of the beneficiary of the deed of trust for a reasonable fee plus costs.

(d) If a person receiving satisfaction does not, within sixty (60) days after being requested, acknowledge satisfaction as stated in subsection (a) of this section or request the trustee to reconvey the property as stated in subsection (c) of this section, he or she shall forfeit to the party aggrieved any sum not exceeding the amount of the mortgage money, to be recovered by a civil action in any court of competent jurisdiction.

(e) If a person receiving satisfaction does not, within sixty (60) days after being requested, acknowledge satisfaction as stated in subsection (a) of this section or fails to cause the trustee to reconvey the property as stated in subsection (c) of this section, then, in addition to the rights provided in subsection (d) of this section, a satisfaction affidavit may be recorded in the county where the lien is recorded which shall have the same effect as an acknowledgment of satisfaction as stated in subsection (b) of this section or a reconveyance of the property as stated in subsection (c) of this section.

(f) A satisfaction affidavit may be executed and recorded by a:

(1) Licensed attorney who prepared the original mortgage or deed of trust;

(2) Licensed attorney who represents the person making or having received satisfaction; or

(3) Licensed title agent employed by a title company that tendered the satisfaction on behalf of the person making satisfaction.

(g) A satisfaction affidavit shall:

(1) Be sworn to and acknowledged before a person authorized to administer an oath under the laws of this state;

(2) Conspicuously identify in its title that it is a "Satisfaction Affidavit"; and

(3) Contain the following information concerning the satisfaction:

(A) The names of all parties to the original instrument;

(B) The recording information, including the recording date of the original instrument;

(C) The date of payment and the amount paid to satisfy the indebtedness; and

(D) That more than sixty (60) days have elapsed since the request for the acknowledgement of satisfaction.

(h) A satisfaction affidavit may be prepared in substantially the following form:

SATISFACTION AFFIDAVIT

KNOW ALL PERSONS BY THESE PRESENTS that:

I, [Name of Affiant], am the [Attorney for the Mortgagor or Employee of a Title Company that Tendered the Satisfaction on Behalf of the Mortgagor].

[Name of Mortgagor] mortgaged certain real property to [Name of Mortgagee] to secure the original principal indebtedness of [Amount of Indebtedness] which was evidenced by that certain [Name of Instrument] recorded on [Date] in the real property records of [Name of County] County, Arkansas, as [Instrument Number or Book and Page].

On [Date], [Name of Mortgagor] tendered to [Name of Mortgagee] the sum of [Amount of Satisfaction], which sum represents the full satisfaction of the amount due on the [Name of Instrument]. [Name of Mortgagor] requested from [Name of Mortgagee] an acknowledgment of satisfaction on [Date]. More than sixty (60) days have elapsed since the request of the acknowledgement of satisfaction.

Further affiant sayeth naught.

WITNESS my hand and seal on this _____ day of __________, 20_____.

[Signature] Click here to view image.

On this __________ day of __________, 20_____, before me, a Notary Public in and for the said county and state, personally appeared ___________________, to me well known, and acknowledged that [he/she] had executed the foregoing document for the consideration, uses, and purposes therein mentioned and set forth.

IN WITNESS WHEREOF, I hereunto set my hand and official seal.

Notary Public

My Commission Expires:___________________

(i) A satisfaction affidavit that complies with this section in substantially the form provided by subsection (h) of this section or in a custom form shall be:

(1) Recorded by the county recorder in the land records of the county where the real property is located; and

(2) Indexed by the county recorder in the same manner as an acknowledgment of satisfaction.

(j) (1) Subsections (a) and (b) of this section do not apply in a county which uses a system other than a paper recording system.

(2) The clerk in a county which uses a system other than a paper recording system shall not allow a satisfaction by a marginal notation after December 31, 1995.

(3) A satisfaction by a marginal notation made in a county which uses a system other than a paper recording system after December 31, 1995, is void.

18-40-106. Sufficiency of satisfaction – Transfer or assignment.

(a) (1) Satisfaction of any mortgage, deed of trust, vendor’s lien, or lien retained in deed or note made and endorsed on the margin of the record where the instrument is recorded by the mortgagee, trustee, beneficiary, agent of the owner of record of the indebtedness, or by the owner of record thereof, shall be full and complete protection for any subsequent purchaser, mortgagee, or judgment creditor of the mortgagor or grantor, unless there shall appear on the margin of the record where the instrument is recorded a memorandum showing that the mortgage, deed of trust, vendor’s lien, lien retained in deed or note, or other evidence of indebtedness secured thereby has been transferred or assigned.

(2) The memorandum shall be signed by the transferor or assignor, giving the name of the transferee or assignee, together with the date of the transfer or assignment, the signature to be attested and dated by the clerk.

(b) Where it shall appear from a memorandum endorsed upon the margin of the record and attested as provided in subsection (a) of this section that the mortgage, deed of trust, vendor’s lien, or other evidence of indebtedness has been transferred, satisfaction shall be made by the party appearing therein as the transferee.

(c) (1) This section does not apply in counties which use other than paper recording systems.

(2) The clerks in counties that use other than paper recording systems shall not allow any marginal endorsements to be made after December 31, 1995.

(3) In counties which use other than paper recording systems, marginal endorsements made after December 31, 1995, are void.

18-40-107. Attestation of satisfaction – Separate release.

(a) In all cases in which the party receiving satisfaction of any indebtedness secured by mortgage, deed of trust, or lien affecting real estate is required by law to acknowledge it on the margin of the record, the satisfaction shall be signed by the party and his or her signature shall be attested and dated by the clerk. The attestation by the clerk shall be evidence of the facts recited therein.

(b) The effectual discharge of any lien, deed of trust, or mortgage lien in note, bond, or other instrument may be made by a separate release deed or instrument duly executed, acknowledged, and recorded. This instrument when so recorded shall be of the same effect as a marginal entry.

(c) (1) Subsection (a) of this section does not apply in counties which use other than paper recording systems.

(2) In counties which use other than paper recording systems, the clerks shall not allow marginal notations of satisfaction of any indebtedness after December 31, 1995.

(3) In counties which use other than paper recording systems, marginal notations made after December 31, 1995, are void.