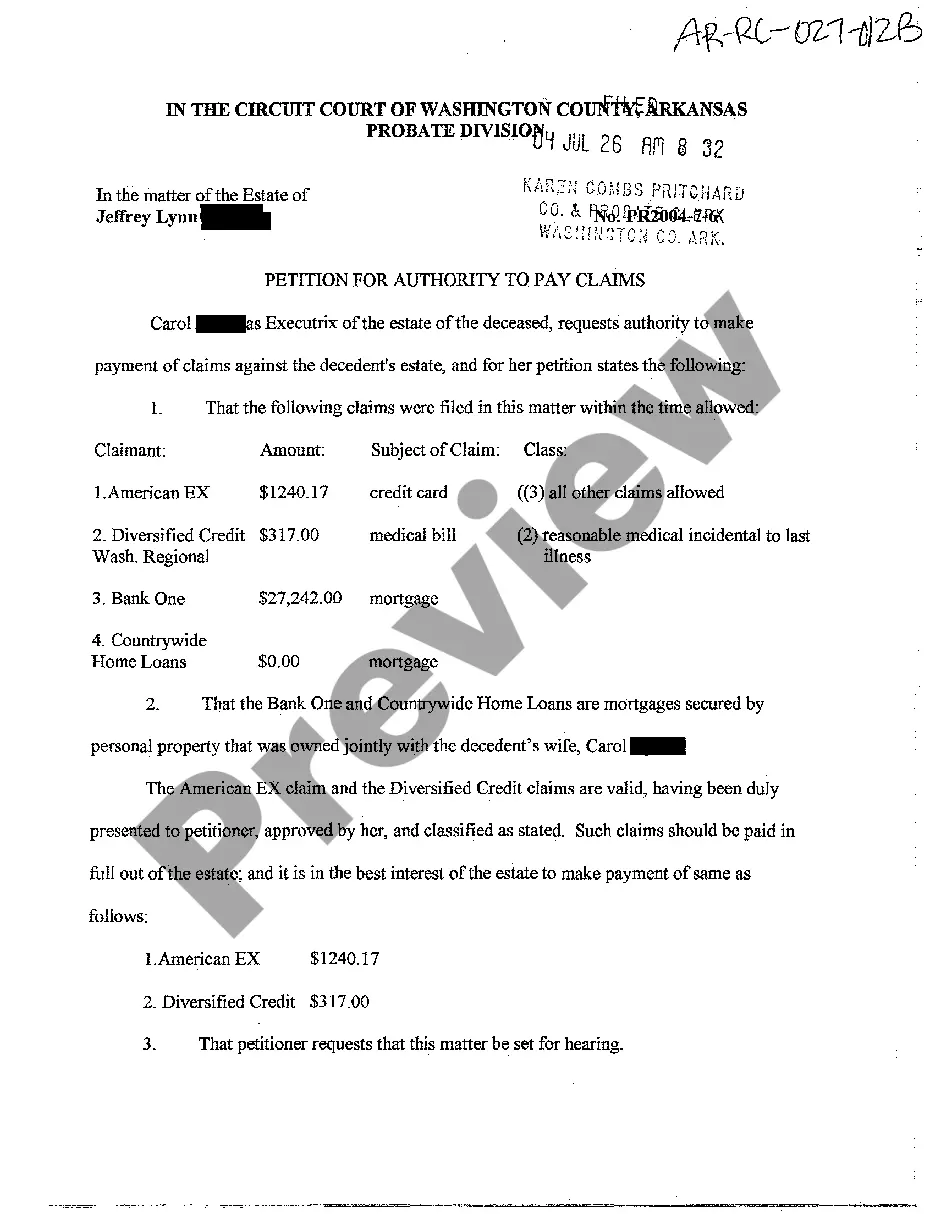

Arkansas Petition for Authority to Pay Claims

Description

How to fill out Arkansas Petition For Authority To Pay Claims?

Among a variety of paid and complimentary samples available online, you cannot be assured of their trustworthiness.

For instance, it is unclear who developed them or if they possess the necessary qualifications to handle what you require.

Always stay composed and utilize US Legal Forms!

If you are using our website for the first time, adhere to the following steps to quickly obtain your Arkansas Petition for Authority to Pay Claims.

- Obtain Arkansas Petition for Authority to Pay Claims templates drafted by experienced attorneys.

- Avoid the costly and lengthy task of searching for a lawyer.

- And then compensating them to create a document you can source by yourself.

- If you possess a subscription, Log In to your account.

- And locate the Download button adjacent to the file you seek.

- You will also gain access to all previously downloaded documents in the My documents menu.

Form popularity

FAQ

Filing a workers' compensation claim can be worth it if your injury affects your ability to work. This claim provides benefits such as medical coverage and wage replacement, which can significantly support your recovery. Each case is different, so weighing your options and understanding the implications of your decision is essential. Reaching out for guidance can help you make an informed choice.

To file a workers' compensation claim in Arkansas, you must notify your employer of your injury as soon as possible. After that, complete the necessary forms and submit them to the Arkansas Workers' Compensation Commission. Documenting your injury and keeping copies of all related paperwork is essential. If you encounter any difficulties, consider seeking assistance through platforms like USLegalForms to navigate the requirements.

In Arkansas, you can generally file a workers' compensation claim up to two years from the date of your injury. However, if your injury was not immediately apparent, this time frame may extend. It's crucial to act promptly and keep track of any incidents that could affect your eligibility. If you're uncertain about your specific situation, consulting with a legal professional can provide clarity.

To obtain a sales tax ID in Arkansas, you must complete the online application through the Arkansas Department of Finance and Administration. This process is straightforward and typically requires basic business information. Once you submit your application, you will receive your sales tax ID which allows you to collect sales tax legally. Remember, having this ID is essential for complying with Arkansas tax regulations.