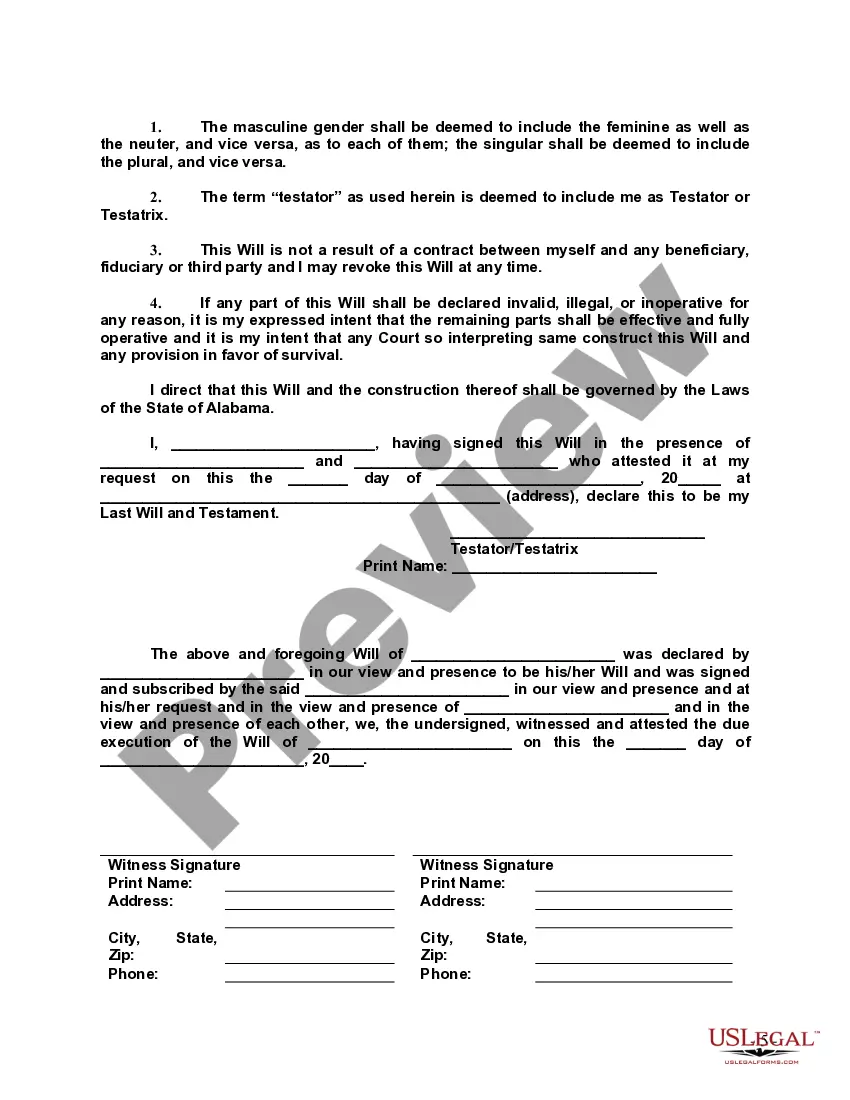

This Legal Last Will and Testament Form with Instructions, called a Pour Over Will, leaves all property that has not already been conveyed to your trust, to your trust. This form is for people who are establishing, or have established, a Living Trust. A living trust is a trust established during a person's lifetime in which a person's assets and property are placed within the trust, usually for the purpose of estate planning. A "pour-over" will allows a testator to set up a trust prior to his death, and provide in his will that his assets (in whole or in part) will "pour over" into that already-existing trust at the time of his death.

Alabama Last Will and Testament with All Property to Trust called a Pour Over Will

Description

How to fill out Alabama Last Will And Testament With All Property To Trust Called A Pour Over Will?

Utilizing the Alabama Legal Last Will and Testament Form with All Property to Trust known as a Pour Over Will templates crafted by experienced attorneys helps you avoid complications when completing paperwork.

Easily download the form from our site, fill it in, and ask a legal expert to verify it.

This can save you considerably more time and effort than seeking a lawyer to create a document entirely from the ground up to meet your specifications.

Don't forget to thoroughly verify all entered information for accuracy before sending it or mailing it out. Reduce the time spent on document creation with US Legal Forms!

- If you’ve previously purchased a US Legal Forms subscription, simply Log In to your profile and navigate back to the sample page.

- Locate the Download button near the templates you are reviewing.

- After obtaining a document, you can access all your saved samples in the My documents section.

- In case you lack a subscription, there's no issue.

- Just adhere to the step-by-step instructions provided below to register for your account online, obtain, and complete your Alabama Legal Last Will and Testament Form with All Property to Trust known as a Pour Over Will template.

- Verify and ensure that you are downloading the correct state-specific form.

Form popularity

FAQ

An example of a pour-over will is a legal document that ensures all your assets are transferred into a trust upon your passing. For instance, if you have created a trust to manage your estate, your Alabama Last Will and Testament with All Property to Trust called a Pour Over Will will direct that any remaining assets after your death should be poured over into that trust. This helps to streamline the distribution of your property according to your wishes. Utilizing tools like US Legal Forms can make creating your pour-over will straightforward and effective.

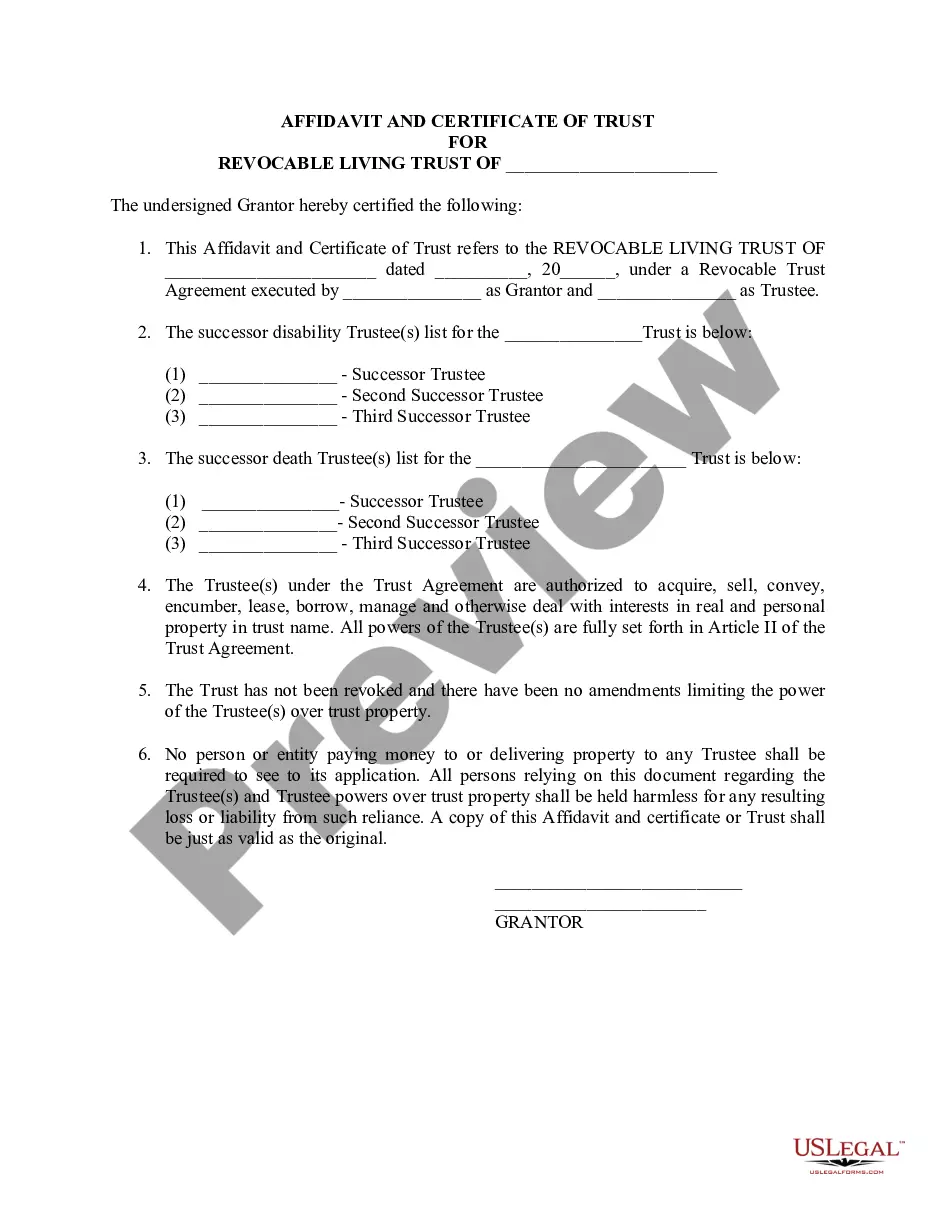

Yes, a pour-over will is closely tied to a trust. It acts as a safety net that ensures any assets not already placed in the trust during your lifetime are transferred to it upon your passing. The Alabama Last Will and Testament with All Property to Trust called a Pour Over Will is particularly effective for this purpose. By using our platform, you can easily create this type of will to ensure a smooth transition of your assets into your trust.

In Alabama, a deed can take precedence over a will. If you transfer property through a deed, that property is no longer considered part of your estate and thus not governed by your will. Therefore, if you have established an Alabama Last Will and Testament with All Property to Trust called a Pour Over Will, you should be mindful of how your deeds are structured so that your intentions are clearly reflected.

In general, a will does not override a trust. Instead, a will and a trust serve different purposes in estate planning. The Alabama Last Will and Testament with All Property to Trust called a Pour Over Will ensures that any assets not included in the trust are transferred to it upon your death. This means that while your will doesn't override your trust, it complements it by funneling assets into the trust.

Beneficiaries do indeed have priority regarding distributions from an Alabama Last Will and Testament with All Property to Trust called a Pour Over Will, but it can vary with trust terms. Generally, if a trust is properly established, the trustee is obligated to follow the trust's instructions, regardless of the beneficiaries' preferences. Understanding the roles of beneficiaries and trustees can clarify how assets are managed and distributed.

Individuals might choose to establish a trust over an Alabama Last Will and Testament with All Property to Trust called a Pour Over Will for several key reasons. Trusts provide immediate access to assets upon death, avoiding the lengthy probate process. They also allow for precise control over how and when beneficiaries receive their inheritance, making them a strategic choice for complex family situations.

Determining whether an Alabama Last Will and Testament with All Property to Trust called a Pour Over Will is more powerful than a trust depends on individual circumstances. Generally, trusts offer more control over asset distribution while avoiding probate, therefore providing greater privacy and efficiency. However, wills are simpler and can be easier to execute when each case is straightforward.

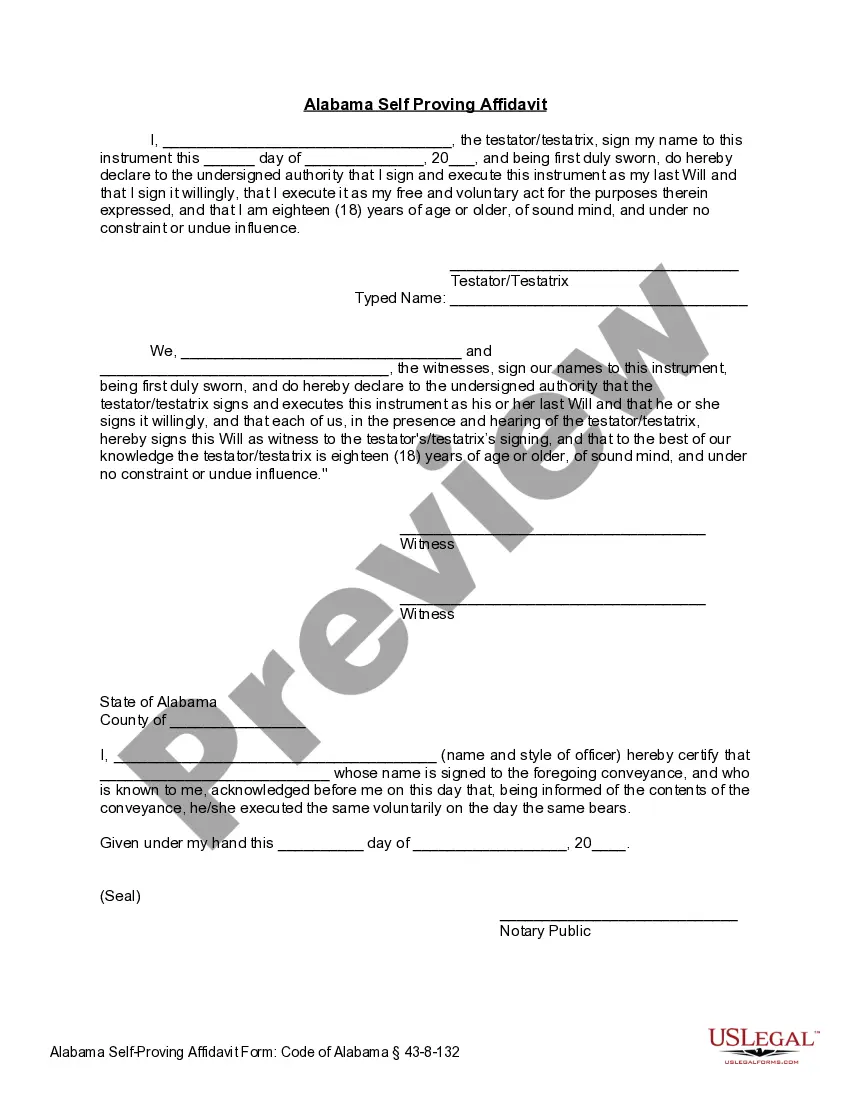

Wills must be filed with the probate court in Alabama to ensure their legal enforceability. This requirement applies to any will, including an Alabama Last Will and Testament with All Property to Trust called a Pour Over Will. By filing your will, you're taking an essential step in protecting your legacy and ensuring your wishes are honored after your passing.

Yes, it is mandatory to file a will in Alabama after the testator's death. This legal requirement is essential for the validity of your wishes as outlined in your Alabama Last Will and Testament with All Property to Trust called a Pour Over Will. Filing the will with the probate court allows for the proper administration of your estate and helps prevent any disputes among heirs.

over will works hand in hand with a trust, acting as a safety net for any assets not transferred to the trust during your lifetime. When you establish an Alabama Last Will and Testament with All Property to Trust called a Pour Over Will, any remaining assets not already in the trust will "pour over" into the trust upon your death. This ensures your trust is funded and that your assets are distributed according to your wishes.