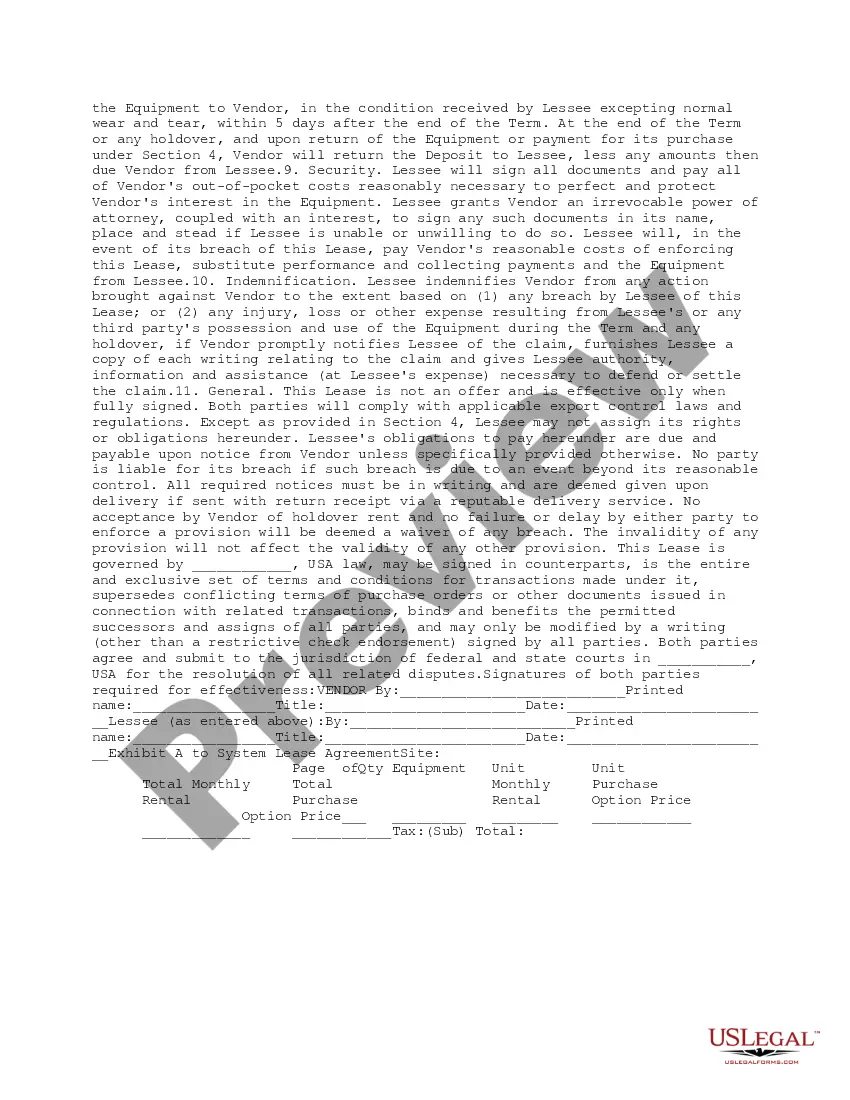

This is an equipment/technology lease. The vendor leases the equipment/technology to the lessee, and is responsible for delivery. The document contains clauses on rent, term of the lease, purchase option, substitution, and all other terms common to such an agreement.

Alabama Equipment Technology Lease

Description

How to fill out Equipment Technology Lease?

You are able to commit several hours online looking for the legal file template that suits the federal and state requirements you require. US Legal Forms offers 1000s of legal kinds which can be reviewed by specialists. You can actually download or print the Alabama Equipment Technology Lease from your assistance.

If you already possess a US Legal Forms accounts, you are able to log in and click the Acquire button. After that, you are able to complete, modify, print, or sign the Alabama Equipment Technology Lease. Every legal file template you get is your own property forever. To acquire another version for any purchased form, go to the My Forms tab and click the corresponding button.

If you are using the US Legal Forms internet site the first time, adhere to the easy instructions listed below:

- Initially, ensure that you have selected the best file template to the county/area of your choice. Look at the form outline to ensure you have picked the correct form. If offered, use the Review button to look throughout the file template also.

- In order to find another edition from the form, use the Look for field to find the template that meets your requirements and requirements.

- Once you have discovered the template you would like, simply click Purchase now to move forward.

- Pick the pricing program you would like, type your references, and sign up for a merchant account on US Legal Forms.

- Full the purchase. You may use your credit card or PayPal accounts to cover the legal form.

- Pick the structure from the file and download it to the gadget.

- Make changes to the file if needed. You are able to complete, modify and sign and print Alabama Equipment Technology Lease.

Acquire and print 1000s of file themes utilizing the US Legal Forms Internet site, that provides the largest assortment of legal kinds. Use specialist and status-certain themes to deal with your company or specific requires.

Form popularity

FAQ

For leases generally exceeding one year the applicable accounting rules dictate that the lessee account for a leased asset as though it has been purchased. The lessee records the leased right as an item of property, plant, and equipment, which is then depreciated over its useful life to the lessee.

At the end of the lease agreement, you may continue leasing the equipment and continue making payments, upgrade the equipment and get new technology into your business or return the equipment, depending upon the type of agreement in place.

A lessor is the owner of an asset that is leased, or rented, to another party, known as the lessee. Lessors and lessees enter into a binding contract, known as the lease agreement, that spells out the terms of their arrangement.

Equipment Lease Types Operating Leases. An operating lease is a contract that permits one company to use another company's equipment in exchange for fixed monthly payments over a specific period of time. ... Finance Leases (or Capital Leases) ... $1 Buyout Lease. ... Purchase Option Lease. ... Sale-Leaseback (or Leaseback) ... TRAC Lease.

In a finance lease agreement, ownership of the asset is transferred to the lessee at the end of the lease term. In contrast, in an operating lease agreement, the ownership of the asset remains during and after the lease term with the leasing company. Flexible payments are one of the benefits of a finance lease.

You are the lessee and the owner of the equipment, or the lender, is the lessor in a lease agreement. Once the lease period ends, the equipment is returned to the owner. In some cases, you may have the option to buy the equipment.

Leasing Business Equipment It is a long-term legal agreement that allows the company to use the equipment for business during the tenure of the lease agreement. Under the equipment lease financing agreement, the business owner must pay a monthly fee to the lender, who purchases or owns the equipment.

A capital lease is longer-term, and the lessee effectively owns the leased asset, recording both the leased asset and the lease obligation on its balance sheet. Capital lease payments are structured like loan repayments; only the interest portion is tax-deductible.