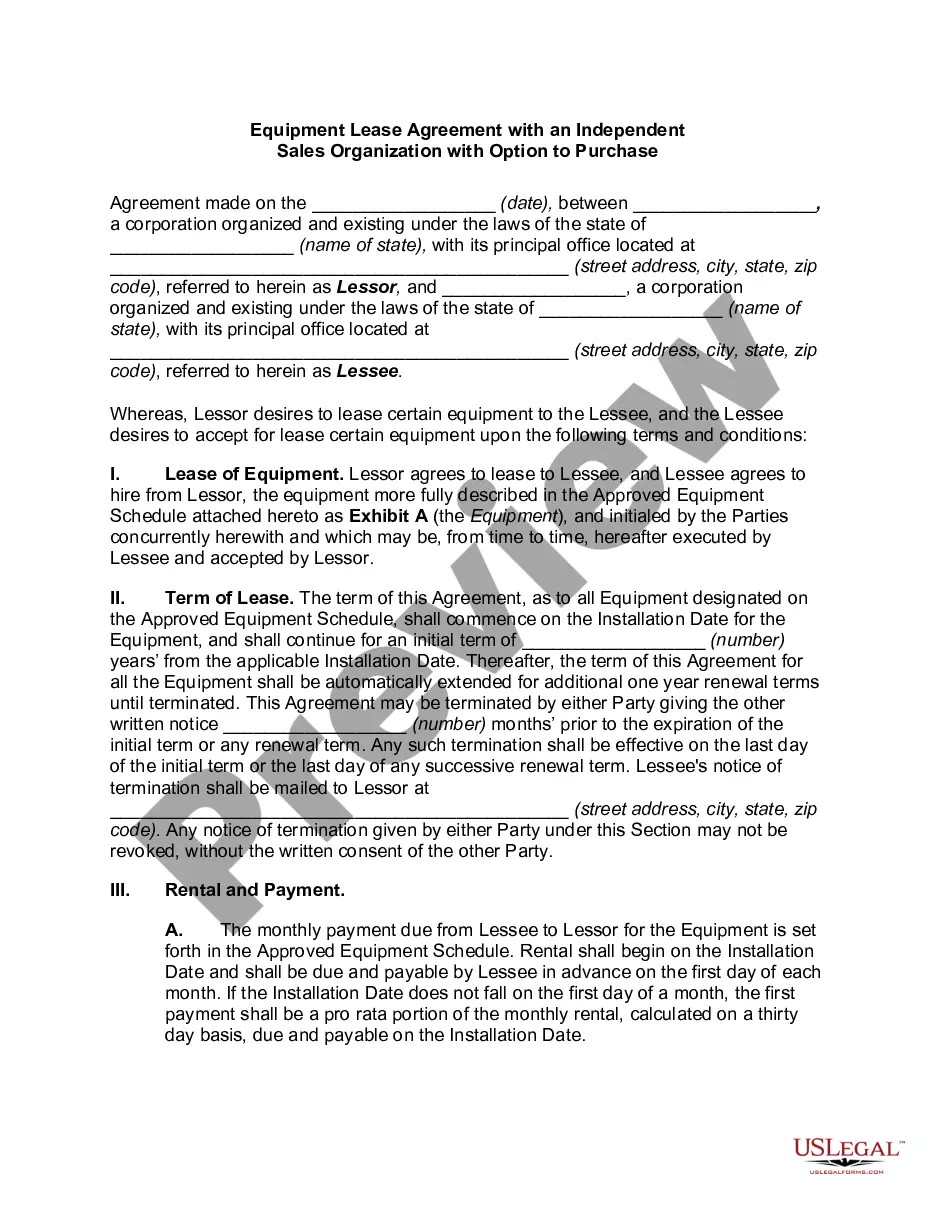

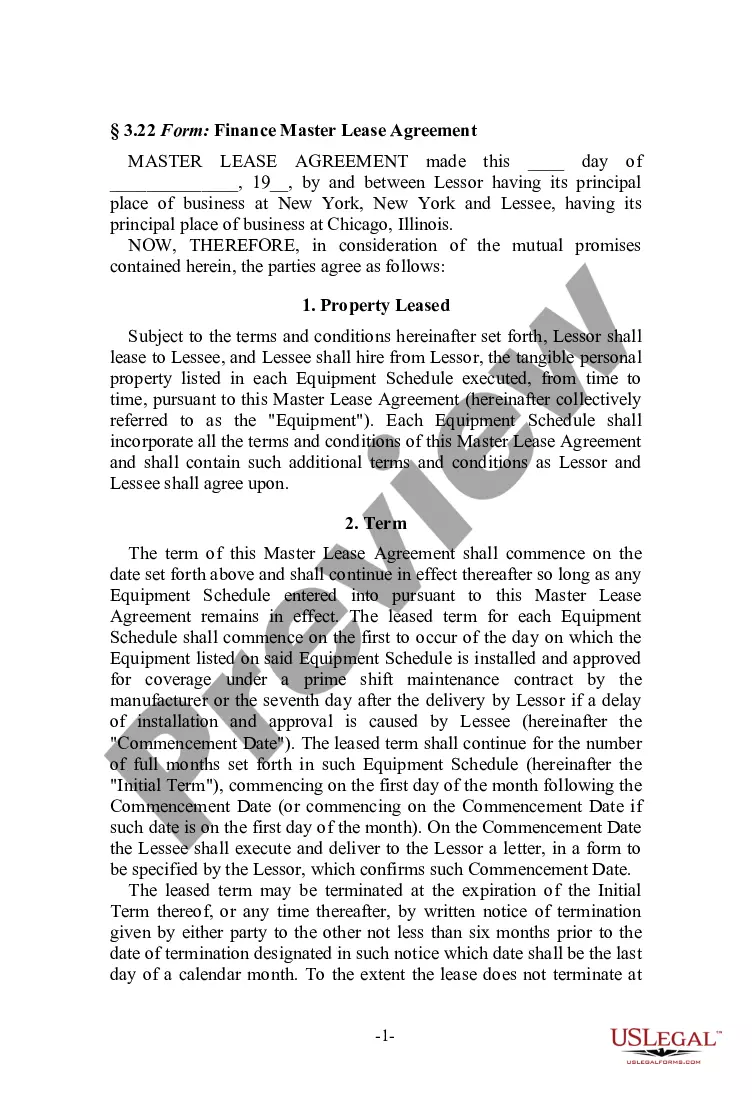

Alabama Master Equipment Lease Agreement

Description

How to fill out Master Equipment Lease Agreement?

US Legal Forms - one of the largest repositories of legal documents in the United States - provides a variety of legal form templates that you can download or print.

Through the website, you can find thousands of forms for business and personal purposes, organized by categories, states, or keywords. You can obtain the latest editions of forms such as the Alabama Master Equipment Lease Agreement within moments.

If you already have a subscription, Log In and download the Alabama Master Equipment Lease Agreement from the US Legal Forms library. The Download button will appear on every form you view. You have access to all previously downloaded forms in the My documents tab of your account.

Every template you added to your account does not expire and is yours indefinitely. So, if you want to download or print another copy, simply go to the My documents section and click on the form you need.

Access the Alabama Master Equipment Lease Agreement with US Legal Forms, one of the most comprehensive collections of legal document templates. Utilize thousands of professional and state-specific templates that meet your business or personal needs and requirements.

- Ensure you have chosen the correct form for your area/county. Click on the Preview button to review the form's details. Check the form description to make sure you have selected the accurate form.

- If the form does not meet your needs, use the Search field at the top of the screen to find one that does.

- If you are pleased with the form, confirm your choice by clicking the Purchase now button. Then, select the pricing plan you prefer and provide your details to register for the account.

- Complete the payment. Use your credit card or PayPal account to finalize the purchase.

- Select the format and download the form to your device.

- Make modifications. Fill in, edit, and print and sign the downloaded Alabama Master Equipment Lease Agreement.

Form popularity

FAQ

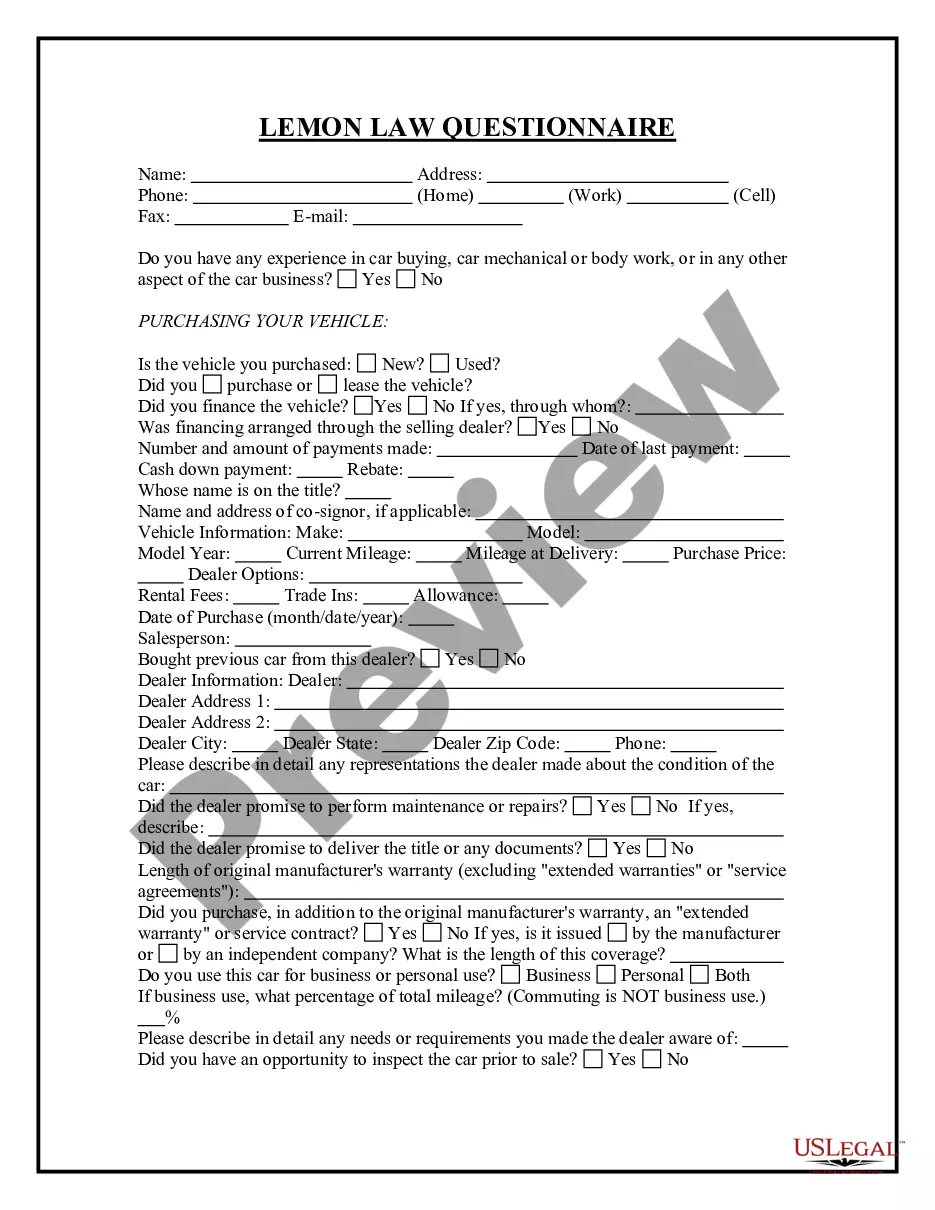

Here are some of the most important items to cover in your lease or rental agreement.Names of all tenants.Limits on occupancy.Term of the tenancy.Rent.Deposits and fees.Repairs and maintenance.Entry to rental property.Restrictions on tenant illegal activity.More items...?21 Sept 2006

A written lease agreement must contain:The names and addresses of both parties;The description of the property;The rental amount and reasonable escalation;The frequency of rental payments, i.e. monthly;The amount of the deposit;The lease period;The notice period for termination of contract;More items...

A lessee must capitalize a leased asset if the lease contract entered into satisfies at least one of the four criteria published by the Financial Accounting Standards Board (FASB). An asset should be capitalized if: The lessee automatically gains ownership of the asset at the end of the lease.

The equipment account is debited by the present value of the minimum lease payments and the lease liability account is the difference between the value of the equipment and cash paid at the beginning of the year. Depreciation expense must be recorded for the equipment that is leased.

For example, if the present value of all lease payments for a production machine is $100,000, record it as a debit of $100,000 to the production equipment account and a credit of $100,000 to the capital lease liability account. Lease payments.

These are eight clauses that a landlord should include in a lease agreement in California:Security Deposits.Specific Payment Requirements.Late Rent Fees.Rent Increases.Notice of Entry.Rental Agreement Disclosures.Gas and Electricity Disclosure.Recreational Marijuana and Rentals.

Most leases and rental agreements include a clause in which the tenant agrees that the premises are in habitable (livable) condition and promises to alert the landlord to any defective or dangerous condition. Tenant's repair and maintenance responsibilities.

A Capital Lease is treated like a purchase for tax and depreciation purposes. The leased equipment is shown as an asset and/or a liability on the lessee's balance sheet, and the tax benefits of ownership may be realized, including Section 179 deductions.

Accounting: Lease is considered an asset (leased asset) and liability (lease payments). Payments are shown on the balance sheet. Tax: As the owner, the lessee claims depreciation expense and interest expense.

Leasing works like a rental agreement. You pay the equipment's owner a set fee every agreed period and you can use the asset as though it was your own. Under a lease, nobody else can use the equipment without your permission and for all intents and purposes, it's as though you own the piece of equipment.