This document is an Investment Advisory Agreement that appoints the investment advisor as attorney-in-fact to the trustee. It details the duties and obligations of the investment advisor and provides indemnity to the advisor. It also spells out the duration and termination of the agreement and the governing law of the agreement.

Alabama Investment Advisory Agreement

Description

How to fill out Investment Advisory Agreement?

US Legal Forms - among the greatest libraries of authorized types in the United States - offers a wide range of authorized file templates it is possible to acquire or produce. While using web site, you can get thousands of types for enterprise and personal reasons, sorted by classes, suggests, or search phrases.You can get the newest types of types like the Alabama Investment Advisory Agreement within minutes.

If you already have a membership, log in and acquire Alabama Investment Advisory Agreement through the US Legal Forms local library. The Acquire switch will show up on every single develop you look at. You gain access to all formerly saved types in the My Forms tab of your bank account.

If you would like use US Legal Forms initially, here are simple instructions to get you began:

- Ensure you have chosen the proper develop for the metropolis/county. Click on the Preview switch to check the form`s content. See the develop explanation to actually have selected the proper develop.

- When the develop does not satisfy your requirements, use the Search industry towards the top of the monitor to discover the one which does.

- If you are pleased with the form, verify your choice by clicking on the Acquire now switch. Then, opt for the rates prepare you favor and supply your credentials to sign up for the bank account.

- Process the purchase. Use your credit card or PayPal bank account to accomplish the purchase.

- Pick the structure and acquire the form on your own gadget.

- Make modifications. Complete, revise and produce and sign the saved Alabama Investment Advisory Agreement.

Each design you included in your money lacks an expiry date and is yours forever. So, if you want to acquire or produce another version, just proceed to the My Forms section and then click in the develop you need.

Gain access to the Alabama Investment Advisory Agreement with US Legal Forms, probably the most comprehensive local library of authorized file templates. Use thousands of skilled and status-distinct templates that fulfill your organization or personal requires and requirements.

Form popularity

FAQ

This requires a securities license and registration with the Alabama Securities Commission, which means passing either the FINRA Series 6 or Series 7 exam as well as state securities law exams. Continuing education requirements of both the Alabama Department of Insurance and FINRA apply to variable annuity agents.

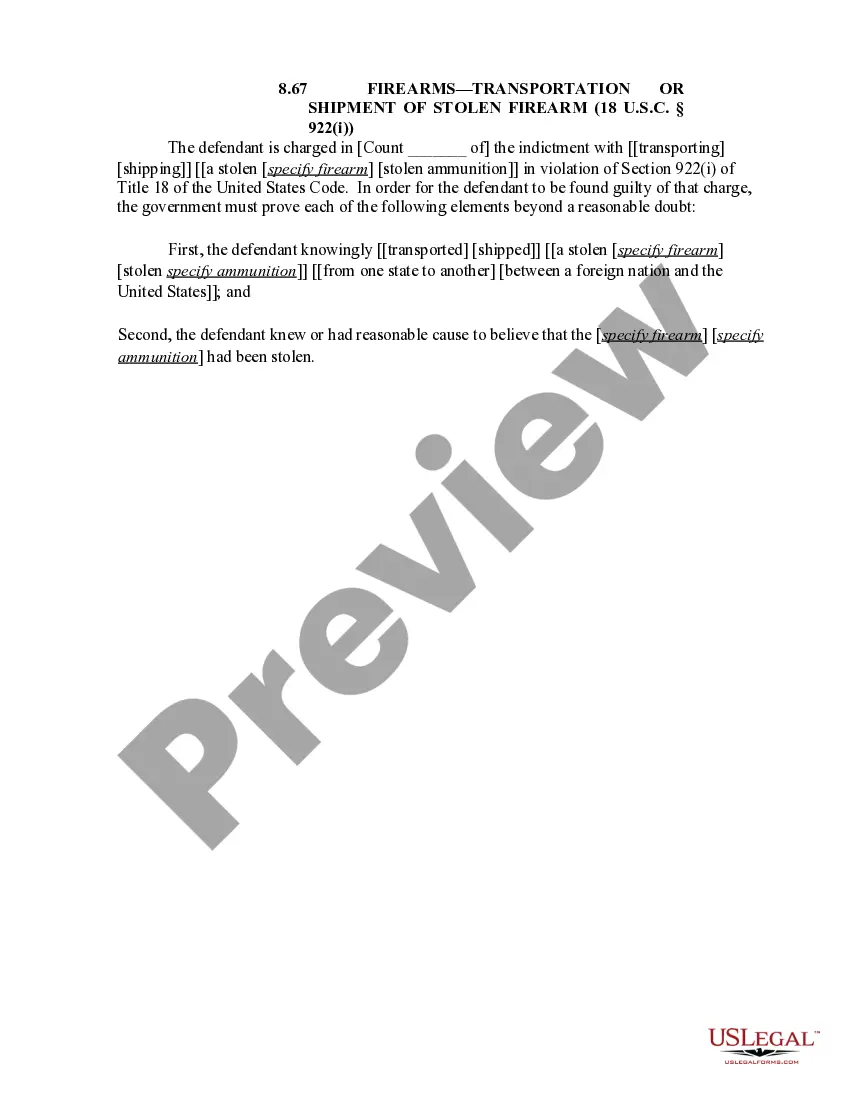

Your advisory contract with a client must be in writing and disclose the services to be provided, the term of the contract, the advisory fee or the formula for computing the fee the amount or the manner of calculation of the amount of the prepaid fee to be returned in the event of contract termination or nonperformance ...

1975, § 8-6-11(a)(9), any offer or sale of securities which is made in compliance with the following requirements of this rule will be deemed to be an exempt transaction and Code of Ala.

A Registered Investment Advisor (RIA) is an individual financial advisor or a company that provides its clients with financial advice. Unlike other types of financial advisors, RIAs have a fiduciary duty to act in your best interest.

While it may only take a month or two to get a firm registered as an RIA, typically advisors take about six months to fully complete the transition. Depending on the complexity of your business model, however, this timetable can be expanded or compressed down to weeks or even days.

Key Takeaways. Registered Investment Advisor (RIA)s are financial firms. To form an RIA, investment advisors must pass the Series 65 exam (or equivalent). RIAs must register with the SEC or state authorities, depending on the amount of money they manage.

In order to file a registered investment adviser application with the state of Alabama, one must first apply to the Financial Industry Regulatory Authority (FINRA) for an account (Entitlement) to their WebCRD/IARD on-line system (the web application for the registration of RIA's and their representatives).

This agreement spells out the scope and terms of the services your financial advisor will offer, as well as any authority you give them to manage your financial accounts. Knowing what's in the typical agreement can help you better understand what you're signing off on when working with a financial advisor.