Alabama Memorandum of Trust Agreement

Description

How to fill out Memorandum Of Trust Agreement?

US Legal Forms - one of several biggest libraries of legitimate forms in the States - provides an array of legitimate document layouts you may obtain or produce. Using the website, you can find 1000s of forms for enterprise and individual functions, sorted by categories, suggests, or keywords and phrases.You can find the most recent types of forms like the Alabama Memorandum of Trust Agreement in seconds.

If you already possess a registration, log in and obtain Alabama Memorandum of Trust Agreement from the US Legal Forms catalogue. The Down load option will show up on every single type you view. You get access to all previously acquired forms from the My Forms tab of your bank account.

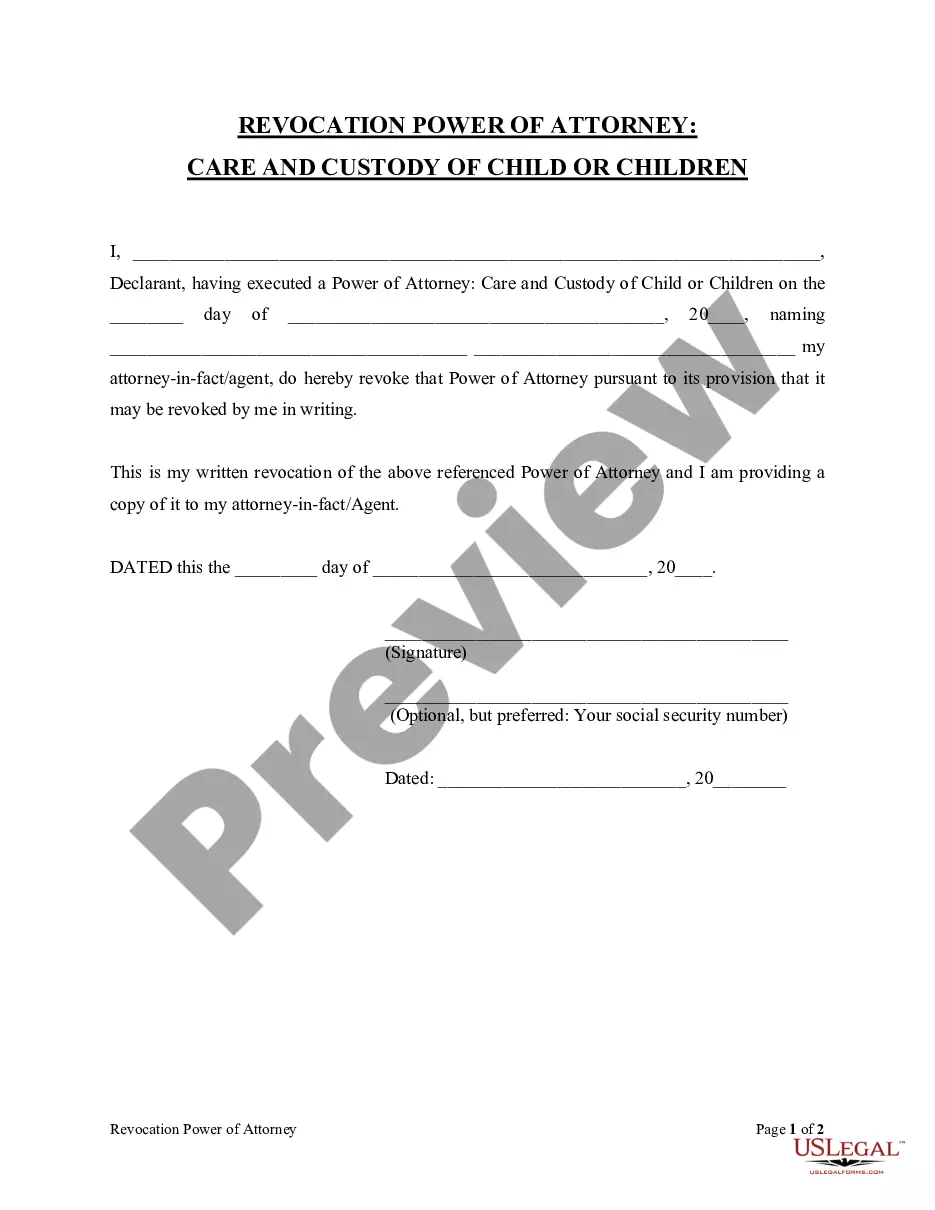

If you would like use US Legal Forms the very first time, allow me to share basic instructions to help you began:

- Ensure you have selected the best type to your city/county. Select the Review option to review the form`s information. Look at the type information to ensure that you have selected the proper type.

- In case the type doesn`t suit your demands, use the Search field on top of the display screen to obtain the one who does.

- In case you are happy with the form, affirm your selection by simply clicking the Buy now option. Then, opt for the costs strategy you favor and provide your qualifications to sign up to have an bank account.

- Process the financial transaction. Utilize your Visa or Mastercard or PayPal bank account to accomplish the financial transaction.

- Find the format and obtain the form on your gadget.

- Make alterations. Load, change and produce and sign the acquired Alabama Memorandum of Trust Agreement.

Each web template you put into your account lacks an expiration particular date which is the one you have for a long time. So, if you wish to obtain or produce yet another backup, just go to the My Forms segment and then click about the type you need.

Get access to the Alabama Memorandum of Trust Agreement with US Legal Forms, the most considerable catalogue of legitimate document layouts. Use 1000s of skilled and express-particular layouts that fulfill your company or individual requirements and demands.

Form popularity

FAQ

The cost of creating a living trust in Alabama varies significantly depending on the method you choose to use. There are online websites you can use that will cost you no more than a few hundred dollars. Using an attorney, on the other hand, may cost upwards of $1,000. How to Create a Living Trust in Alabama | SmartAsset smartasset.com ? estate-planning ? living-trust-ala... smartasset.com ? estate-planning ? living-trust-ala...

To create your own living trust in Alabama, you need to first create or have the trust document created for you. It must include the name of the trustee and list your beneficiary or beneficiaries. This legal document must then be signed by the settlor in front of a notary public who will notarize the signature. Create a living trust in Alabama | ? ... ? Estate Planning ? ... ? Estate Planning

To make a living trust in Alabama, you: Choose whether to make an individual or shared trust. Decide what property to include in the trust. Choose a successor trustee. Decide who will be the trust's beneficiaries?that is, who will get the trust property. Create the trust document. Make a Living Trust in Alabama | Nolo Nolo ? legal-encyclopedia ? alabama... Nolo ? legal-encyclopedia ? alabama...

Can a family trust be contested. In California, only beneficiaries of a family trust and heirs of the settlor can contest its terms or formation. They are typically informed of their rights through advance notice from the trustee, as mandated by California Probate Code Section 16061.7.

Your rights as the beneficiary of an estate plan in Alabama As a beneficiary in Alabama, you have several rights. At the most basic level, you are entitled to receive information about the estate and its administration. You also have a right to an accounting of the estate's assets, debts, and distributions. Trust Beneficiary Rights in Alabama - Snug getsnug.com ? post ? trust-beneficiary-rights... getsnug.com ? post ? trust-beneficiary-rights...

A trustee has all the powers listed in the trust document, unless they conflict with California law or unless a court order says otherwise. The trustee must collect, preserve and protect the trust assets.

Whether or not the trustee can withhold funds from you depends on the terms of the trust itself. If the trust requires withholding distributions under certain circumstances, such as the beneficiary reaching a specific age, the trustee must follow those stipulations.

Some state laws allow beneficiaries to agree to remove a trustee for reasons unrelated to a trustee's bad acts. However, most states allow beneficiaries or other interested parties to ask a court to remove a trustee for bad acts such as gross negligence, bad faith, or a breach of their fiduciary duty.