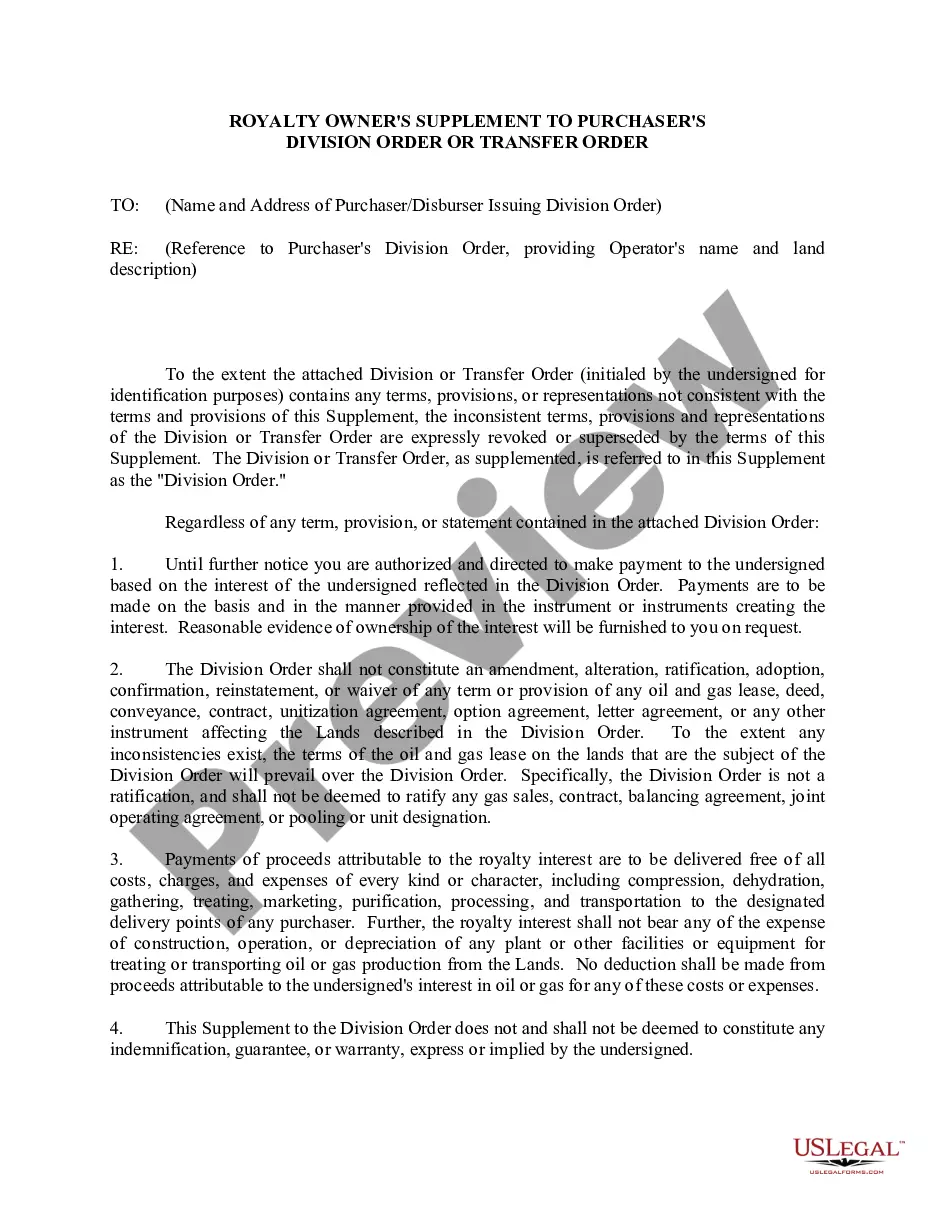

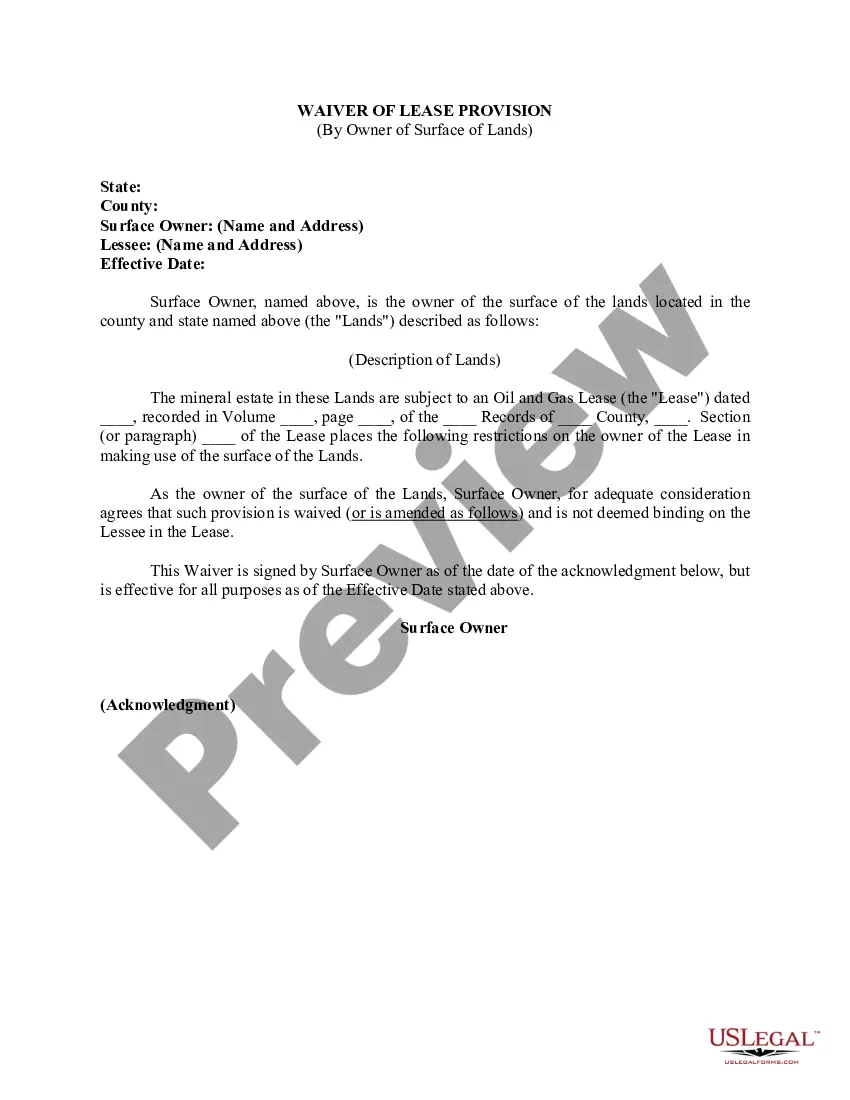

Alabama Royalty Owner's Statement of Ownership

Description

How to fill out Royalty Owner's Statement Of Ownership?

US Legal Forms - one of many biggest libraries of authorized kinds in the USA - offers a variety of authorized file layouts it is possible to down load or produce. Using the internet site, you can find a large number of kinds for organization and individual uses, sorted by classes, claims, or keywords and phrases.You will find the latest models of kinds just like the Alabama Royalty Owner's Statement of Ownership in seconds.

If you already possess a monthly subscription, log in and down load Alabama Royalty Owner's Statement of Ownership from the US Legal Forms library. The Down load button will show up on each type you view. You have access to all previously delivered electronically kinds within the My Forms tab of your respective accounts.

In order to use US Legal Forms the very first time, listed below are simple instructions to help you get started out:

- Ensure you have picked out the best type for your personal city/county. Click the Preview button to analyze the form`s content material. Look at the type explanation to actually have chosen the appropriate type.

- When the type does not satisfy your requirements, make use of the Look for discipline towards the top of the monitor to find the one that does.

- If you are content with the shape, validate your decision by clicking the Acquire now button. Then, opt for the pricing plan you favor and provide your credentials to register for an accounts.

- Process the purchase. Make use of charge card or PayPal accounts to finish the purchase.

- Find the formatting and down load the shape on your product.

- Make alterations. Load, modify and produce and indicator the delivered electronically Alabama Royalty Owner's Statement of Ownership.

Each and every template you put into your account lacks an expiration time and is also yours for a long time. So, if you would like down load or produce another version, just check out the My Forms segment and click on about the type you need.

Get access to the Alabama Royalty Owner's Statement of Ownership with US Legal Forms, by far the most extensive library of authorized file layouts. Use a large number of expert and express-particular layouts that meet your company or individual requirements and requirements.

Form popularity

FAQ

You MUST Use Both Form 40 and Form 40NR If: The part year resident return should include only income and deductions during the period of residency, and the nonresident return should include only income and deductions during the period of nonresidency.

Individual Income FormMaking a PaymentCurrent Form 40 ? Individual Income Tax ReturnAlabama Department of Revenue P. O. Box 2401 Montgomery, AL 36140 -0001Current Form E40- Individual Income Tax Return (Payments)Alabama Department of Revenue P. O. Box 327467 Montgomery, AL 36132-74676 more rows Forms Mailing Addresses - Alabama Department of Revenue alabama.gov ? individual-corporate alabama.gov ? individual-corporate

All partnerships Section 810-3-28-. 01 - Partnership Returns (1) (a) All partnerships having "substantial nexus" from property owned or business conducted in this state shall file the Alabama Form 65 on or before the due date, including extension. Partnership Returns, Ala. Admin. Code r. 810-3-28-.01 - Casetext casetext.com ? alabama-administrative-code ? sect... casetext.com ? alabama-administrative-code ? sect...

The Alabama Form 65 is similar to the federal Form 1065 in many ways. And, the Form 65 requires that an Alabama Schedule K-1 be completed for any entity that was a partner or owner during the taxable year. Partnership/Limited Liability Company Return of Income Alabama Department of Revenue (.gov) ? 2021/10 Alabama Department of Revenue (.gov) ? 2021/10 PDF

Form 40 No Payment: Alabama Department of Revenue, P O Box 154, Montgomery, AL 36135-0001.

If the return is not timely filed, include the $50 penalty and a completed Form BIT-V. Form BIT-V is available at our Web site: .revenue.alabama.gov.

through (passthrough) entity is a legal business entity that passes all its income on to the owners or investors of the business. Flowthrough entities are a common device used to avoid double taxation on earnings.

Alabama Form 41 Schedule E to report supplemental income from rents, royalties, partnerships, S Corporation, estates. Form 41 and schedule K-1 Fiduciary Income tax return Alabama Department of Revenue (.gov) ? 2021/10 Alabama Department of Revenue (.gov) ? 2021/10 PDF

Ing to the Alabama business privilege tax law, every corporation, limited liability entity, and disregarded entity doing business in Alabama or organized, incorporated, qualified, or registered under the laws of Alabama is required to file an Alabama Business Privilege Tax Return and Annual Report.