Alabama Special Improvement Project and Assessment

Description

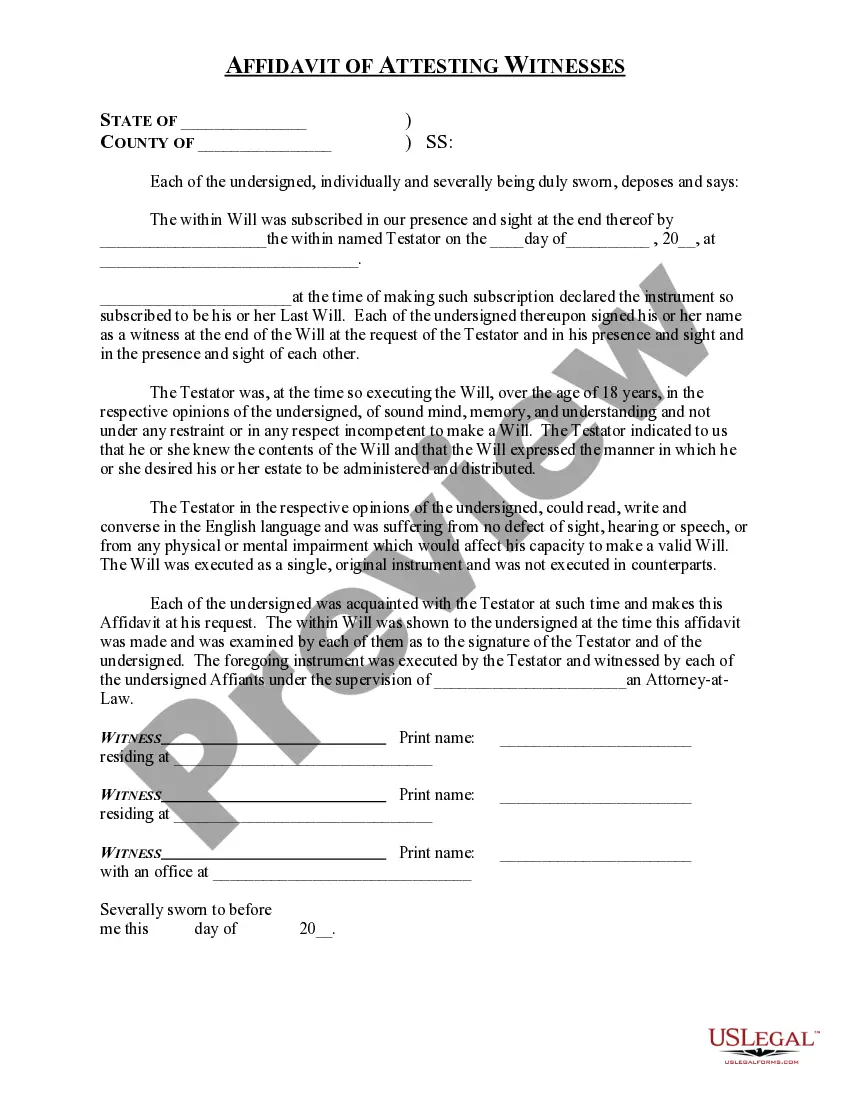

How to fill out Special Improvement Project And Assessment?

If you wish to complete, acquire, or printing legal document templates, use US Legal Forms, the greatest variety of legal varieties, which can be found on the web. Take advantage of the site`s simple and easy hassle-free look for to obtain the paperwork you require. Numerous templates for enterprise and specific uses are categorized by groups and states, or key phrases. Use US Legal Forms to obtain the Alabama Special Improvement Project and Assessment in a few click throughs.

Should you be currently a US Legal Forms buyer, log in to the profile and then click the Obtain switch to find the Alabama Special Improvement Project and Assessment. You can also accessibility varieties you earlier downloaded inside the My Forms tab of the profile.

If you are using US Legal Forms initially, refer to the instructions below:

- Step 1. Make sure you have selected the shape to the right city/nation.

- Step 2. Make use of the Preview choice to check out the form`s articles. Don`t neglect to learn the information.

- Step 3. Should you be not happy with the form, use the Lookup discipline near the top of the display to locate other versions of the legal form design.

- Step 4. Upon having found the shape you require, go through the Buy now switch. Opt for the pricing prepare you prefer and add your credentials to register on an profile.

- Step 5. Approach the financial transaction. You may use your Мisa or Ьastercard or PayPal profile to finish the financial transaction.

- Step 6. Select the file format of the legal form and acquire it in your device.

- Step 7. Comprehensive, edit and printing or indicator the Alabama Special Improvement Project and Assessment.

Each and every legal document design you get is the one you have forever. You have acces to each and every form you downloaded with your acccount. Select the My Forms section and select a form to printing or acquire once more.

Contend and acquire, and printing the Alabama Special Improvement Project and Assessment with US Legal Forms. There are thousands of professional and status-certain varieties you can utilize to your enterprise or specific requirements.

Form popularity

FAQ

The property owner may be entitled to a homestead exemption if he or she owns a single-family residence and occupies it as their primary residence on the first day of the tax year for which they are applying.

Property owners are given 30 days to file an appeal after receiving written notice of valuation. The Code of Alabama 1975, Sections 40-3-20, 40-3-24, and 40-3-25 detail the appeals process. If you believe your property value is incorrect, you may file a written protest to the County Board of Equalization (BOE).

Deadline to apply is December 31st. If you are sixty-five years old or older, you are entitled to an exemption from the STATE portion of your property taxes.

A homestead exemption is defined as a single-family owner-occupied dwelling and the land thereto, not exceeding 160 acres.

Regular Homestead Exemption (H1) is available to those who own and occupy single family residences and use this property for no other purpose. The amount of this exemption is $4,000 assessed value for state and $3,000 for county.

If you are over 65 years of age, or permanent and totally disabled (regardless of age), or blind (regardless of age), you are exempt from the state portion of property tax. County taxes may still be due. Please contact your local taxing official to claim your homestead exemption.