Alabama Software Support Services Agreement by Licensor

Description

How to fill out Software Support Services Agreement By Licensor?

Selecting the optimal authorized document template can be challenging. Naturally, there are countless designs available online, but how can you discover the official form you need? Utilize the US Legal Forms website. The service provides numerous templates, including the Alabama Software Support Services Agreement by Licensor, that can be utilized for both business and personal purposes. All of the documents are verified by experts and comply with state and federal standards.

If you are already registered, Log In to your account and click the Download button to obtain the Alabama Software Support Services Agreement by Licensor. Use your account to search through the authorized documents you have acquired previously. Navigate to the My documents tab in your account and retrieve another copy of the document you need.

If you are a new user of US Legal Forms, here are simple instructions for you to follow: First, ensure you have selected the appropriate form for your region/state. You can review the form using the Review button and examine the form summary to ensure this is the correct one for you. If the form does not meet your needs, use the Search field to find the right form. Once you are confident the form is accurate, click the Acquire now button to obtain the form. Choose the pricing plan you prefer and enter the required information. Create your account and pay for the order using your PayPal account or credit card. Select the file format and download the authorized document template to your device. Complete, edit, print, and sign the received Alabama Software Support Services Agreement by Licensor. US Legal Forms is the largest repository of authorized documents where you can find a variety of file templates. Use the service to obtain professionally created documents that adhere to state regulations.

Form popularity

FAQ

Licensing agreements can take many forms, and they serve various purposes. Common examples include software licensing agreements, which allow users to operate specific software under set terms, and franchise agreements, which permit individuals to operate a business using a brand's name and systems. Additionally, the Alabama Software Support Services Agreement by Licensor outlines the responsibilities between the software provider and the user, ensuring clear expectations for support and maintenance. For those seeking tailored legal documents, US Legal Forms offers various templates, including agreements relevant to Alabama.

A software licensing agreement is a formal document that grants permission to use a specific software product under defined conditions. This agreement protects the rights of the software creator while allowing users to access and utilize the software. When exploring options like the Alabama Software Support Services Agreement by Licensor, it is important to understand how these agreements work together to provide comprehensive software management.

The legal contract between a licensor and a purchaser is known as a software license agreement. This document governs the terms of use, ownership rights, and limitations on the software. An Alabama Software Support Services Agreement by Licensor may also be involved, providing additional support services to enhance the user experience.

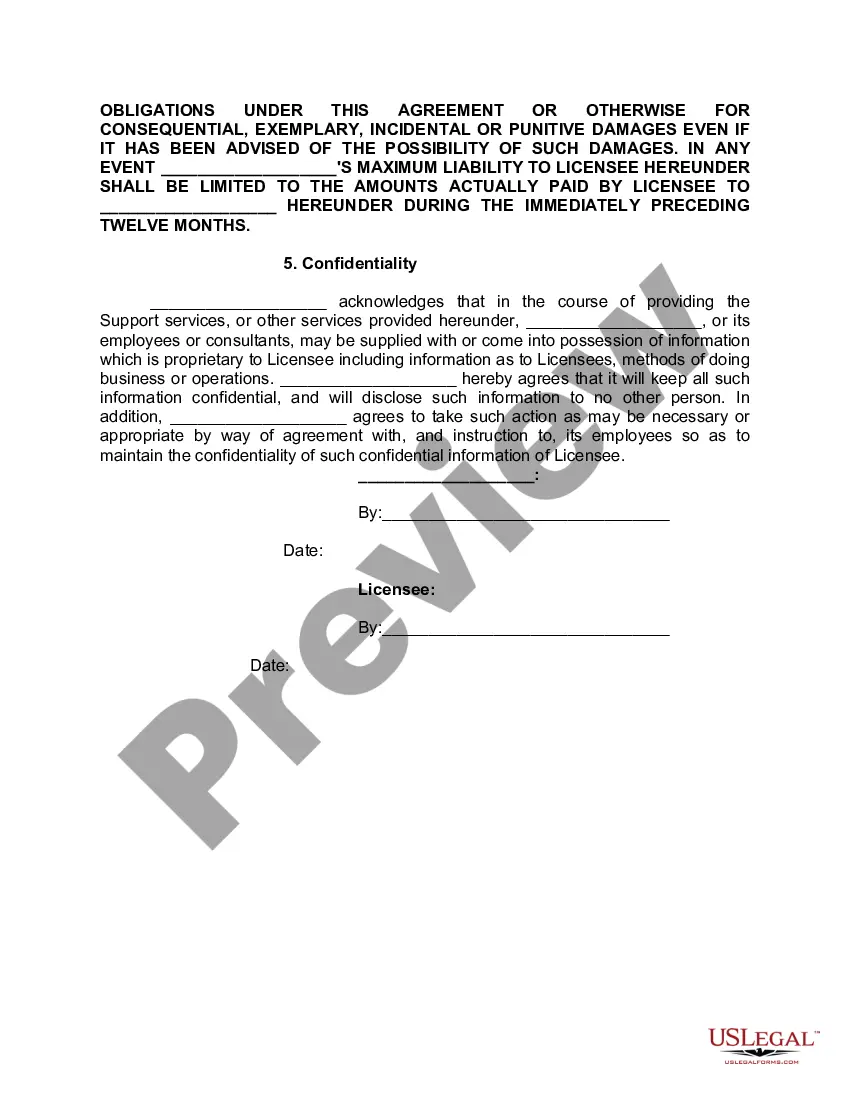

A software support agreement is a contract that outlines the support services provided for software products. This agreement typically includes details on response times, maintenance, and troubleshooting. When you consider an Alabama Software Support Services Agreement by Licensor, it ensures that users receive the necessary support to maximize their software's effectiveness.

While Alabama law does not require an operating agreement for LLCs, having one is highly recommended. An operating agreement outlines the management structure and operational procedures of the LLC. For businesses involved in software licensing, such as those relying on an Alabama Software Support Services Agreement by Licensor, an operating agreement can help clarify roles and responsibilities.

The legal contract between the software manufacturer and the user is typically referred to as a software license agreement. This document defines how the software can be used and the responsibilities of both parties. An Alabama Software Support Services Agreement by Licensor may also accompany this contract to cover ongoing support and maintenance.

The three main types of software contracts include license agreements, service agreements, and maintenance agreements. Each of these contracts serves a distinct purpose, such as granting usage rights, providing support services, or ensuring software updates. Understanding the differences is crucial, especially when considering an Alabama Software Support Services Agreement by Licensor.

A software licensing agreement is a legal document that outlines the terms under which a software user may use a software program. This agreement often specifies the rights and obligations of both the licensor and the licensee. In the context of an Alabama Software Support Services Agreement by Licensor, it ensures clarity on how the software can be utilized and supported.