Alabama Pricing Agreement

Description

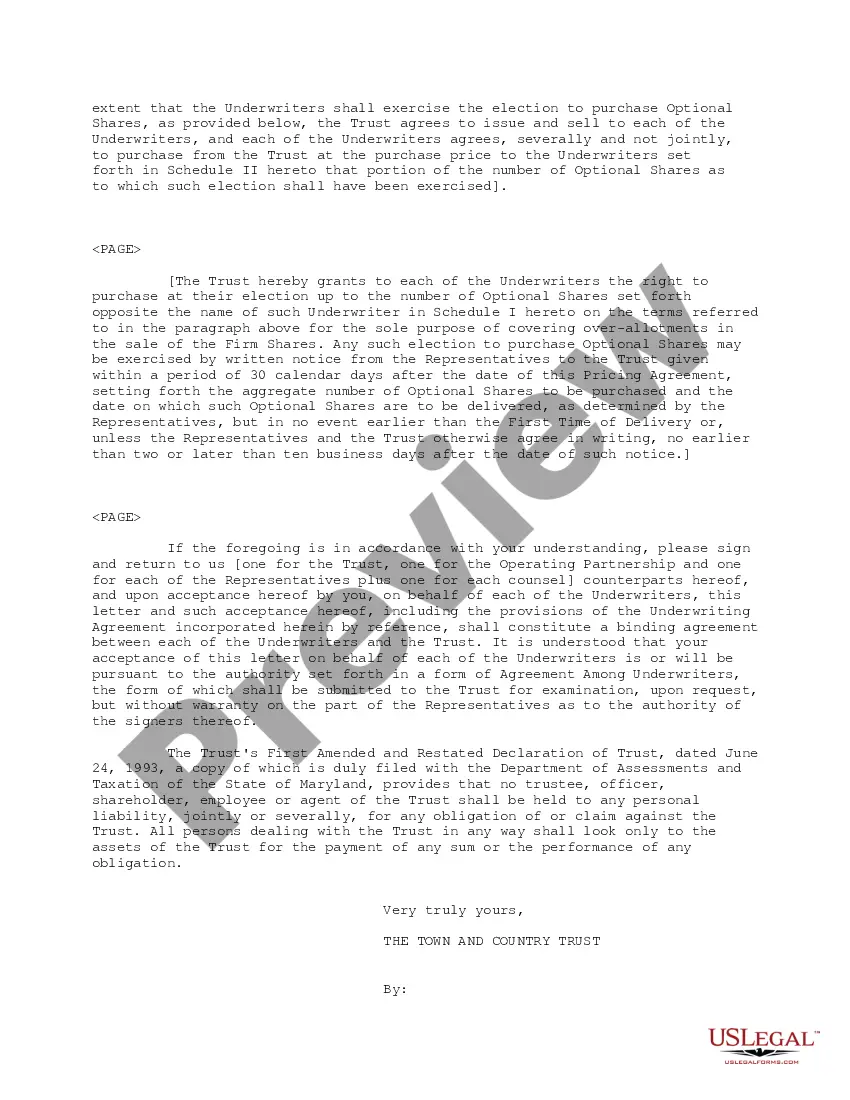

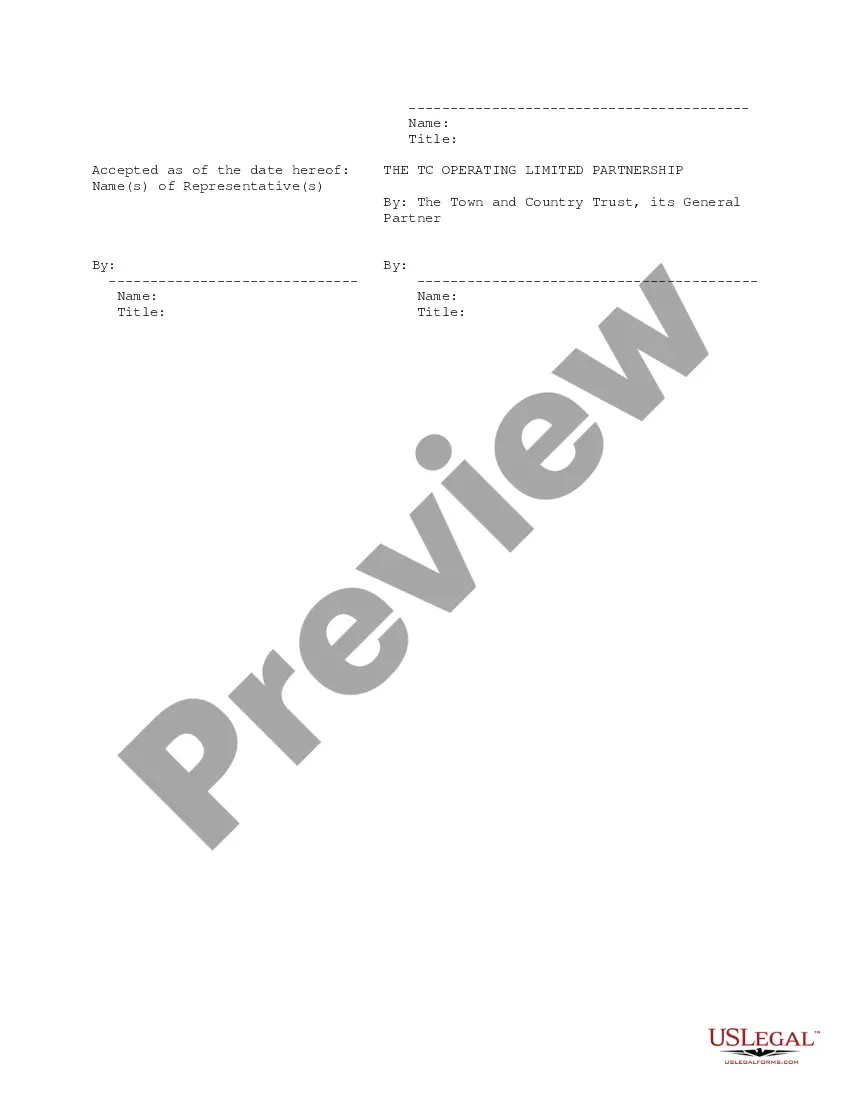

How to fill out Pricing Agreement?

If you wish to comprehensive, obtain, or printing lawful document layouts, use US Legal Forms, the greatest collection of lawful kinds, that can be found on-line. Take advantage of the site`s simple and convenient look for to get the documents you will need. Different layouts for enterprise and personal functions are sorted by groups and suggests, or keywords and phrases. Use US Legal Forms to get the Alabama Pricing Agreement with a few mouse clicks.

Should you be presently a US Legal Forms consumer, log in in your bank account and then click the Acquire button to have the Alabama Pricing Agreement. You may also entry kinds you formerly saved from the My Forms tab of your respective bank account.

Should you use US Legal Forms initially, follow the instructions under:

- Step 1. Make sure you have selected the form for the proper town/region.

- Step 2. Use the Preview method to check out the form`s content. Never forget to see the outline.

- Step 3. Should you be not satisfied with all the form, utilize the Lookup discipline near the top of the monitor to get other versions in the lawful form design.

- Step 4. When you have found the form you will need, select the Buy now button. Opt for the rates plan you prefer and put your qualifications to register for an bank account.

- Step 5. Procedure the deal. You can utilize your credit card or PayPal bank account to accomplish the deal.

- Step 6. Find the structure in the lawful form and obtain it on the gadget.

- Step 7. Total, change and printing or indication the Alabama Pricing Agreement.

Every single lawful document design you buy is the one you have eternally. You may have acces to every form you saved within your acccount. Click on the My Forms segment and choose a form to printing or obtain yet again.

Remain competitive and obtain, and printing the Alabama Pricing Agreement with US Legal Forms. There are many professional and status-specific kinds you can use for your personal enterprise or personal needs.

Form popularity

FAQ

To calculate your total business privilege tax due, you'll need to multiply your total net worth ($1,000,000) by your assigned tax rate (. 00125). So, in this case, your business privilege tax would be $1,250. The minimum tax payment for all entities is $100.

Minimum privilege tax is $100; plus the $10 Secretary of State annual report fee for corporations. For the taxable year beginning after December 31, 2022, taxpayers who would otherwise be subject to the minimum tax due of $100 shall pay $50 in lieu thereof.

Corporate income tax is a tax on the net income of corporations. In most cases, only corporations are subject to this tax. Privilege taxes are imposed on businesses for the right to conduct business in a given state.

Alabama has changed the minimum tax due on the Alabama privilege tax forms. On AL Forms BPT-IN, PPT, and CPT the minimum tax has been reduced from $100 to $50 for 2023.

The Determination Period is defined in Section 40-14A-1, Code of Alabama 1975, as ?the taxpayer's taxable year next preceding the taxpayer's current taxable year.? Generally, the Determination Period is the taxpayer's previous taxable year.

PPT ? S Corps, Limited Liability Companies, and PLLCs file a PPT form for their business privilege tax. The PPT form also includes the AL-, which is used for the annual report. Both are filed with Alabama's Department of Revenue.

Last summer, Governor Kay Ivey signed into law Act No. 2022-252, which amends the law regarding the minimum business privilege tax to be paid by small businesses, reducing the minimum-required fee from $100 to $50 in 2023 and to $0 in 2024.

The penalty for failure to timely file an Alabama business privilege tax return by the due date is 10% of the tax shown due with the return or $50, whichever is greater.