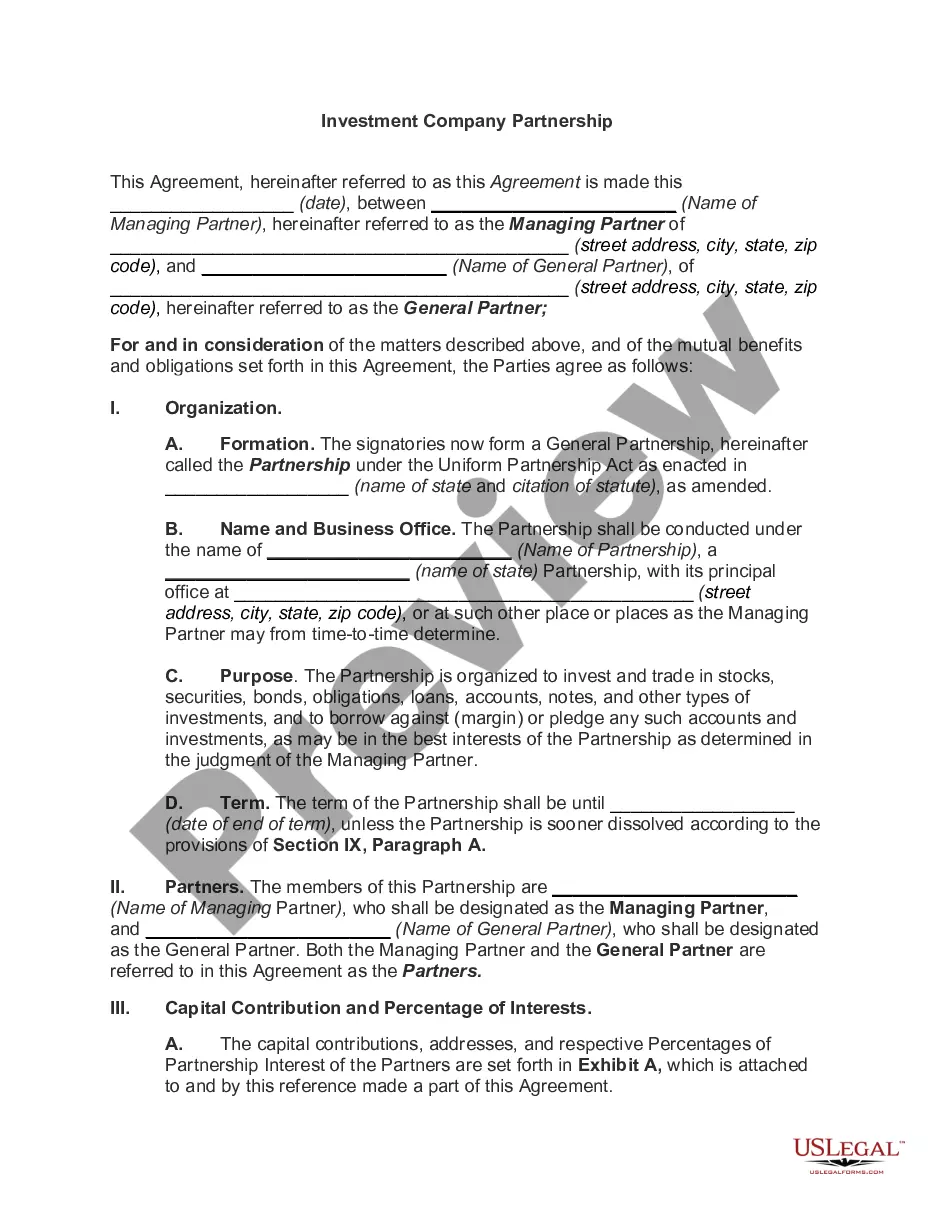

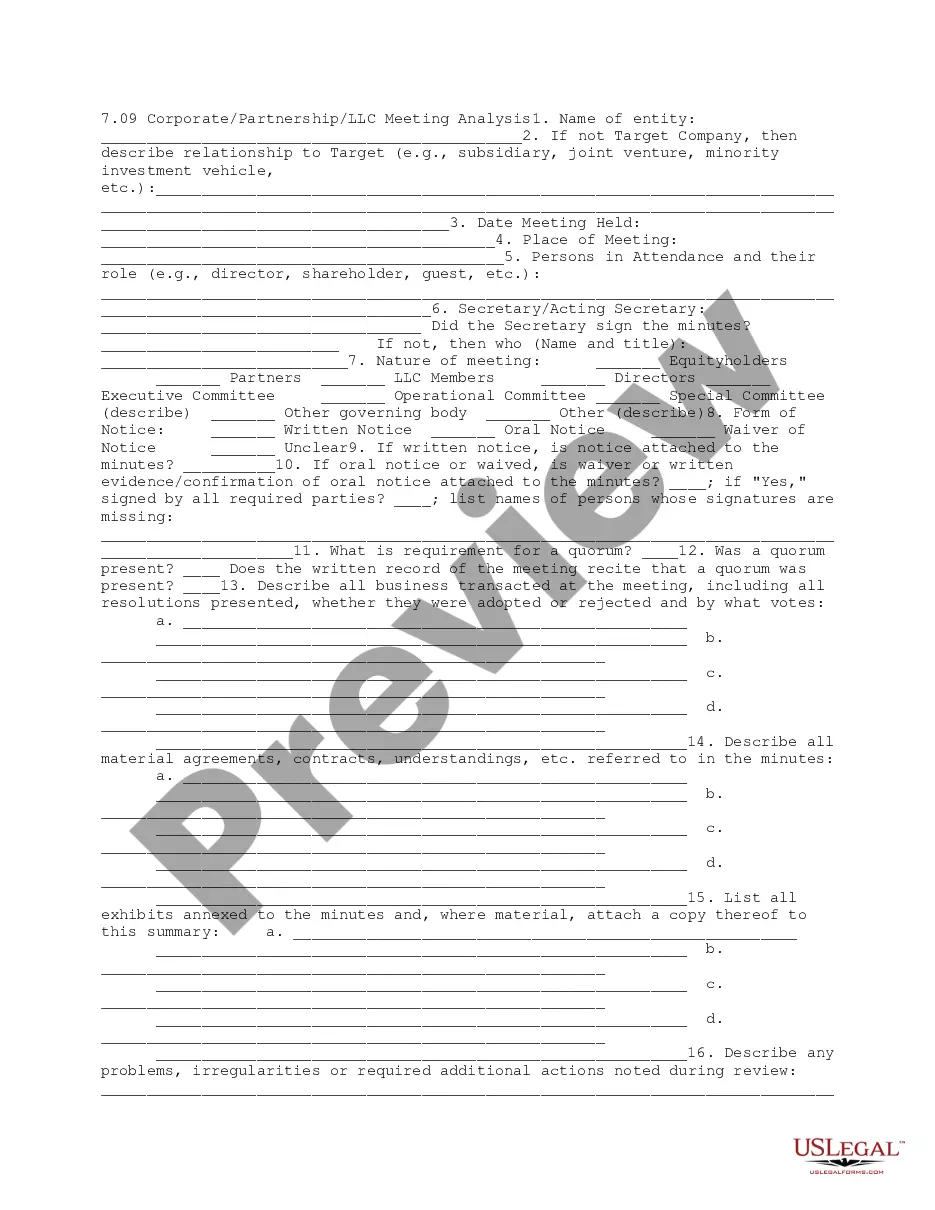

This due diligence form is used to summarize data for each partnership entity associated with the company in business transactions.

Alabama Partnership Data Summary

Description

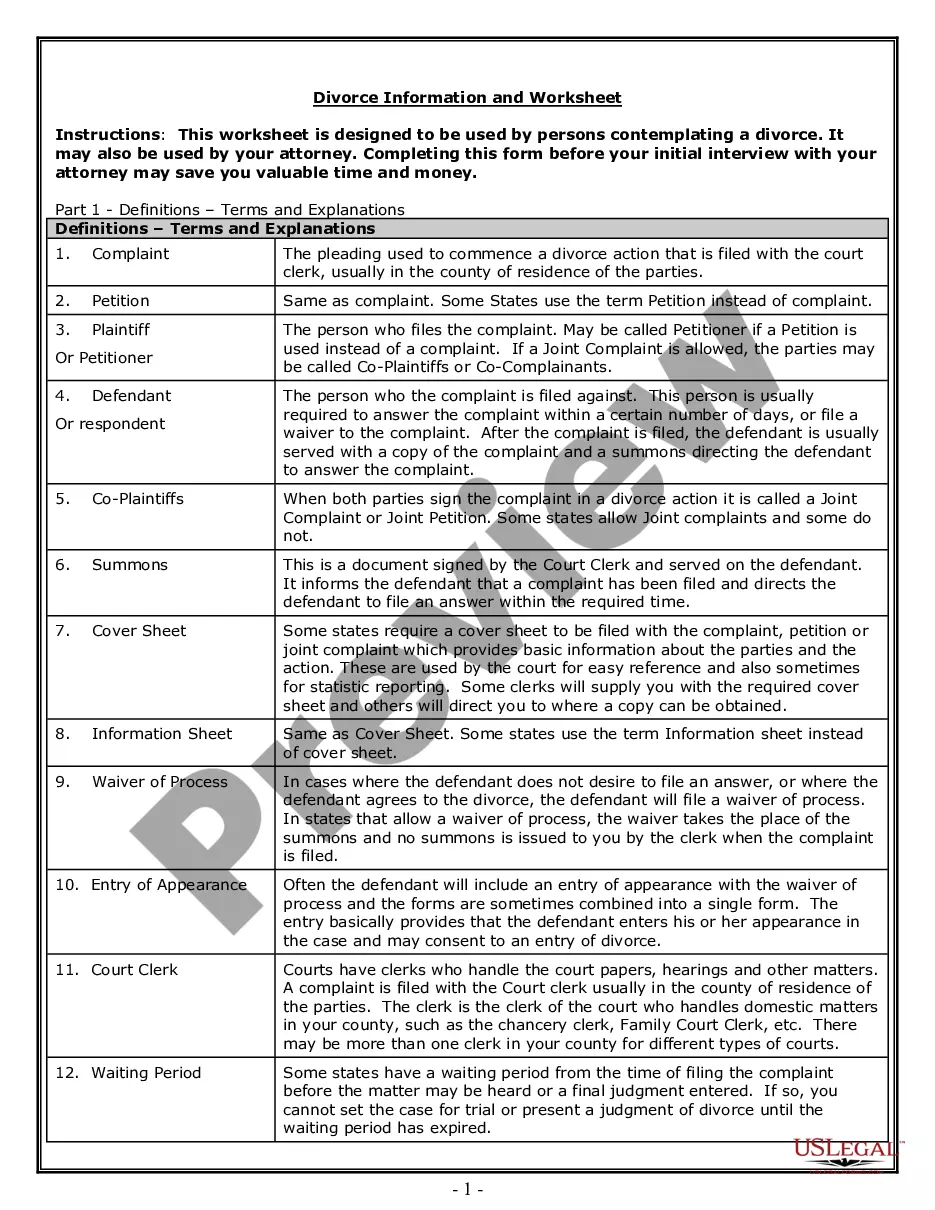

How to fill out Partnership Data Summary?

If you desire to sum up, acquire, or print approved document templates, utilize US Legal Forms, the largest collection of legal forms, which can be accessed online.

Employ the site’s straightforward and user-friendly search to locate the documents you require.

Various templates for business and personal purposes are organized by categories and states, or keywords.

Step 4. Once you have found the form you need, click the Acquire now button. Choose your preferred pricing plan and enter your details to sign up for an account.

Step 5. Complete the transaction. You can use your Visa, Mastercard, or PayPal account to finish the transaction.

- Utilize US Legal Forms to find the Alabama Partnership Data Summary in just a few clicks.

- If you are already a US Legal Forms customer, Log In to your account and click the Acquire button to retrieve the Alabama Partnership Data Summary.

- You can also access forms you have previously saved from the My documents tab of your account.

- If this is your first time using US Legal Forms, follow the steps below.

- Step 1. Ensure you have selected the form for the correct city/region.

- Step 2. Use the Preview option to examine the form’s content. Be sure to review the explanation.

- Step 3. If you are not satisfied with the form, use the Search field at the top of the screen to find other versions of the legal form template.

Form popularity

FAQ

In Alabama, all partnerships with any income, deductions, or credits must file a partnership return. This includes general partnerships, limited partnerships, and limited liability partnerships. The Alabama Partnership Data Summary provides the necessary details to ensure your partnership returns are filed accurately and on time.

Every partnership operating in Alabama must file a partnership return, regardless of income or losses. This return is essential for properly reporting the partnership's income to both federal and state tax authorities. The Alabama Partnership Data Summary outlines the specific forms and deadlines necessary for compliance.

Certain entities are exempt from ad valorem taxes in Alabama, including non-profit organizations and some government entities. Additionally, various property types may qualify for exemptions. The Alabama Partnership Data Summary can help clarify which exemptions may be applicable to your business situation.

Alabama BPT, or Business Privilege Tax, must be filed by all entities that conduct business in Alabama. This includes partnerships, sole proprietorships, and corporations regardless of their residency status. Use the Alabama Partnership Data Summary to understand your filing requirements and deadlines to avoid penalties.

Non-residents must file an Alabama tax return if they earn income from sources within Alabama. This applies to partnerships where non-resident partners receive Alabama-sourced income. The Alabama Partnership Data Summary offers insights into how these returns should be filed, ensuring that all partners meet their tax responsibilities.

Any business operating in Alabama is generally required to file the Alabama business privilege tax. This includes sole proprietors, partnerships, and corporations. If you're unsure about your obligations, the Alabama Partnership Data Summary provides a clear overview of the circumstances that mandate this filing.

Alabama Form 40 should be filed with the Alabama Department of Revenue. You can submit your form through the department's website or mail it directly to their office. For partnerships, the Alabama Partnership Data Summary may assist in completing Form 40 correctly, ensuring compliance and accuracy in your filings.

To report partnership distributions in Alabama, you'll need to gather all relevant information including distribution amounts and the partners involved. Typically, partnerships must use IRS Form 1065 to report income, deductions, and distributions. The Alabama Partnership Data Summary can help streamline this process by providing guidance on allocations and necessary forms.

Yes, Alabama mandates annual reports for Limited Liability Companies (LLCs) as well as partnerships. These reports help maintain business compliance and transparency. Through the Alabama Partnership Data Summary, you can navigate the requirements and ensure your LLC meets all expectations smoothly.

You cannot see whether someone else filed taxes due to confidentiality regulations. However, you may obtain general data about compliance through Alabama Partnership Data Summary, which summarizes partnership activities without breaching privacy. For accurate information, always consider consulting with an expert.