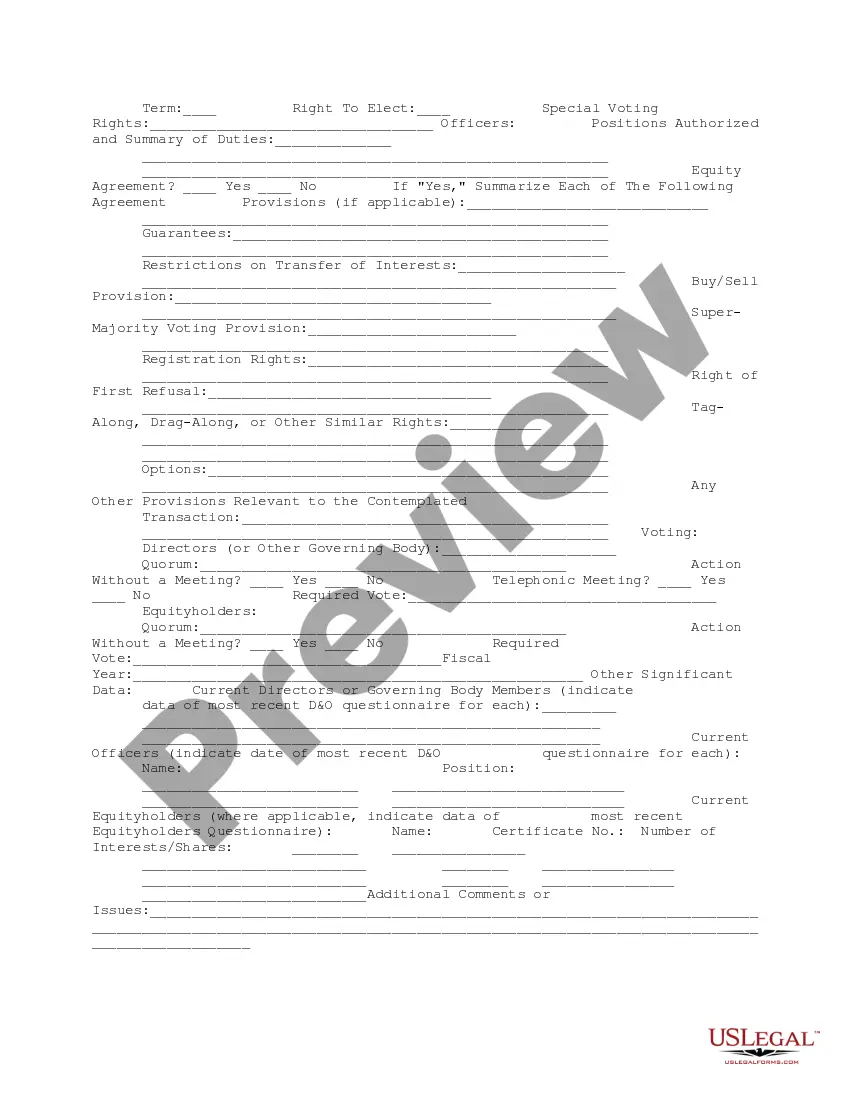

This form is a due diligence data summary to be prepared for the company and each of its Subsidiaries in business transactions.

Alabama Company Data Summary

Description

How to fill out Company Data Summary?

US Legal Forms - one of the largest collections of legal documents in the country - offers a diverse selection of legal document templates that you can download or print.

Through the website, you can access thousands of templates for business and personal purposes, arranged by categories, states, or keywords. You can find the latest versions of forms like the Alabama Business Data Summary in just minutes.

If you already have a monthly subscription, Log In and retrieve the Alabama Business Data Summary from the US Legal Forms library. The Download button will be visible for each template you navigate to. You can access all previously downloaded forms from the My documents section of your account.

Complete the transaction using your Visa or Mastercard or PayPal account.

Select the format and download the form to your device. Make modifications. Fill in, edit, and print as well as sign the downloaded Alabama Business Data Summary. Every document you add to your account has no expiration date and is yours permanently. Therefore, if you need to download or print another copy, simply go to the My documents section and click on the form you wish to access. Get the Alabama Business Data Summary with US Legal Forms, the most extensive library of legal document templates. Utilize a multitude of professional and state-specific templates that fulfill your business or personal needs and requirements.

- Ensure you have selected the correct form for your city/state.

- Click on the Review button to check the form's details.

- Examine the form information to make sure you've selected the appropriate template.

- If the form does not meet your needs, use the Search field at the top of the screen to find a suitable one.

- If you are content with the form, confirm your choice by clicking the Buy now button.

- Next, choose the pricing plan you desire and enter your details to create an account.

Form popularity

FAQ

Most businesses operating in Alabama need to file an Alabama PPT, or Business Privilege Tax. This includes various types of corporations and limited liability companies, regardless of their income levels. Meeting these filing requirements is crucial for maintaining compliance with state laws. For more accurate guidance on filing, explore the insights provided in the Alabama Company Data Summary.

Certain entities are exempt from paying the business privilege tax in Alabama, including nonprofit organizations and some governmental entities. Additionally, businesses generating less than $500,000 in gross receipts may also qualify for exemption. Understanding these exemptions can significantly benefit business owners. For comprehensive details, reference the Alabama Company Data Summary.

Alabama businesses that have a physical presence or generate revenue in the state are required to file Alabama PPT, or Business Privilege Tax. This applies to most corporations and limited liability entities operating in Alabama. It’s essential to understand this obligation to avoid fines and penalties. The Alabama Company Data Summary offers resources to help clarify these responsibilities.

Yes, the Alabama Secretary of State requires businesses to file an Annual Report to maintain good standing. This is a straightforward requirement that helps the state keep accurate records of business entities. Failure to file can lead to penalties or loss of your business charter. For more details on this process, you can consult the Alabama Company Data Summary.

To file Alabama Form 40, you can submit your return electronically through the Alabama Department of Revenue's website. Alternatively, you can mail your completed form to the appropriate address based on your county. Ensure that all information is accurate to avoid delays, and refer to the Alabama Company Data Summary for further procedures and recommendations.

In Alabama, partnerships are required to file an Alabama partnership return if they have income that is sourced from Alabama. This includes both domestic and foreign partnerships that conduct business within the state. It's important to file to ensure proper reporting of income and compliance with tax regulations. You can find detailed information in the Alabama Company Data Summary.

In addition to UAB, which is often recognized for its large workforce, other significant employers include industries like aerospace and automotive manufacturing. Companies like Airbus and Mercedes-Benz have established operations in Alabama, creating thousands of jobs. The Alabama Company Data Summary will help you understand the dynamics of these employers and their contributions to state employment levels. Stay informed to seize potential opportunities.

Manufacturing is the number one industry in Alabama, significantly contributing to the state's economy. With a strong presence in automotive and aerospace sectors, Alabama attracts both local and international companies. The Alabama Company Data Summary provides detailed insights into this vital industry and its growth trends. Knowing the leading industries can help you identify opportunities for investment and employment.

The largest employer in Alabama is the University of Alabama at Birmingham (UAB). With thousands of employees, UAB plays a crucial role in the state’s economy, particularly in healthcare and education. For a deeper understanding, consult the Alabama Company Data Summary for additional information on how this institution influences employment and community development. Their impact extends beyond just the workforce.

Several Fortune 500 companies operate in Alabama, showcasing the state's robust economy. Notable names include Regions Financial Corporation and HCA Healthcare. By reviewing the Alabama Company Data Summary, you can gain insights into these major players and their impact on local job markets. This information is vital for anyone interested in understanding the economic landscape of Alabama.