Alabama Form of Certificate of Designations, Preferences and Rights of Series C Convertible Preferred Stock

Description

How to fill out Form Of Certificate Of Designations, Preferences And Rights Of Series C Convertible Preferred Stock?

Choosing the right legitimate document design can be quite a battle. Naturally, there are tons of web templates accessible on the Internet, but how will you find the legitimate kind you need? Make use of the US Legal Forms website. The service gives 1000s of web templates, like the Alabama Form of Certificate of Designations, Preferences and Rights of Series C Convertible Preferred Stock, that can be used for organization and personal needs. Each of the forms are checked by professionals and satisfy federal and state requirements.

In case you are previously registered, log in for your accounts and click on the Obtain option to obtain the Alabama Form of Certificate of Designations, Preferences and Rights of Series C Convertible Preferred Stock. Make use of your accounts to appear with the legitimate forms you possess purchased formerly. Proceed to the My Forms tab of your respective accounts and obtain yet another duplicate of the document you need.

In case you are a fresh user of US Legal Forms, listed here are simple guidelines so that you can follow:

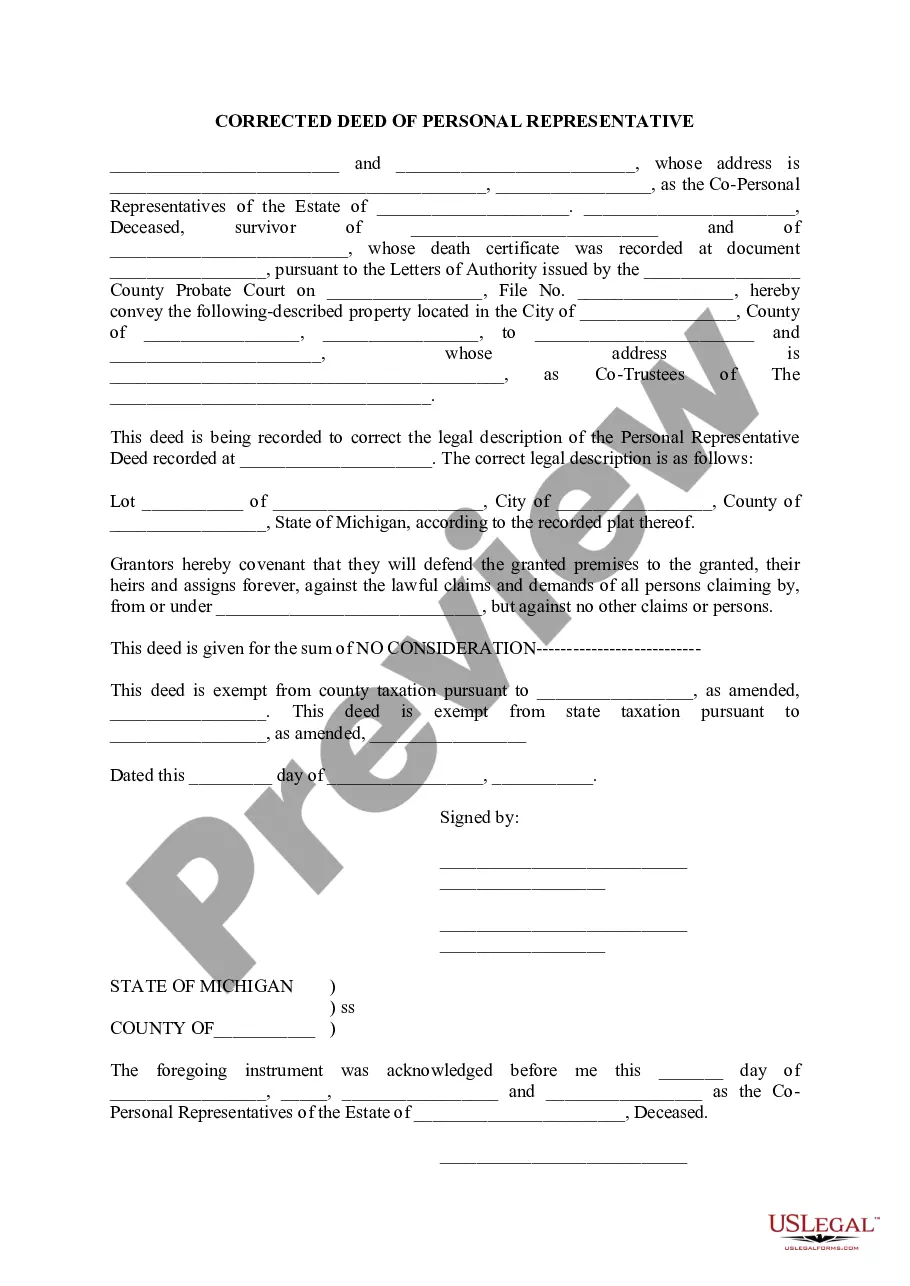

- Very first, make sure you have chosen the right kind for the town/area. You may check out the shape using the Preview option and study the shape outline to make sure it is the right one for you.

- When the kind will not satisfy your preferences, utilize the Seach area to discover the proper kind.

- When you are positive that the shape is acceptable, click on the Purchase now option to obtain the kind.

- Pick the pricing plan you need and enter the essential details. Make your accounts and pay money for your order with your PayPal accounts or bank card.

- Select the submit structure and obtain the legitimate document design for your device.

- Full, modify and print and signal the attained Alabama Form of Certificate of Designations, Preferences and Rights of Series C Convertible Preferred Stock.

US Legal Forms is definitely the most significant library of legitimate forms for which you can discover different document web templates. Make use of the service to obtain expertly-produced paperwork that follow condition requirements.

Form popularity

FAQ

Redeemable convertible preference share It is liable to be redeemed by that body corporate. On redemption, the shareholder receives: an agreed cash amount; or. an agreed number of ordinary shares in the issuing body corporate.

The benefits of convertible preferred stock include flexibility, potential for capital appreciation, dividend payments, and priority in liquidation. However, convertible preferred stock also has several drawbacks, such as dilution of ownership, lower dividend rates, higher costs, and risk of conversion.

Convertible preferred stock offers the investor the benefits of both preferred stock and common stock. Investors get the stability, liquidation priority, and higher dividends of preferred stock, but they also have the option to convert their shares into common stock later if they believe that the price will go up.

Similar to previous stages of financing, the series C round primarily relies on raising capital through the sale of preferred shares. The shares are likely to be convertible shares. They offer holders the right to exchange them for common stock in the company at some date in the future.

Class C Preferred Stock means the Issuer's Preferred Stock, Series C. Based on 7 documents. 7. Class C Preferred Stock means capital stock, issued in one or more series, having the rights and obligations specified with respect to Class C Preferred Stock in the Charter and these Bylaws.

Cumulative preference shares give shareholders the right to receive cumulative dividend payouts from the company even if they are not profitable. These dividends will be counted as arrears in years when the company is not profitable. And will be paid in full from the year when the business is profitable.

Series C Convertible Preferred Stock means the Series C Convertible Redeemable Preferred Stock, par value $. 01 per share, of the Company, having the same voting rights as the Class A Common Stock determined on an as converted basis.

A preferred stock certificate is a document that identifies the ownership share of an investor in a corporation.