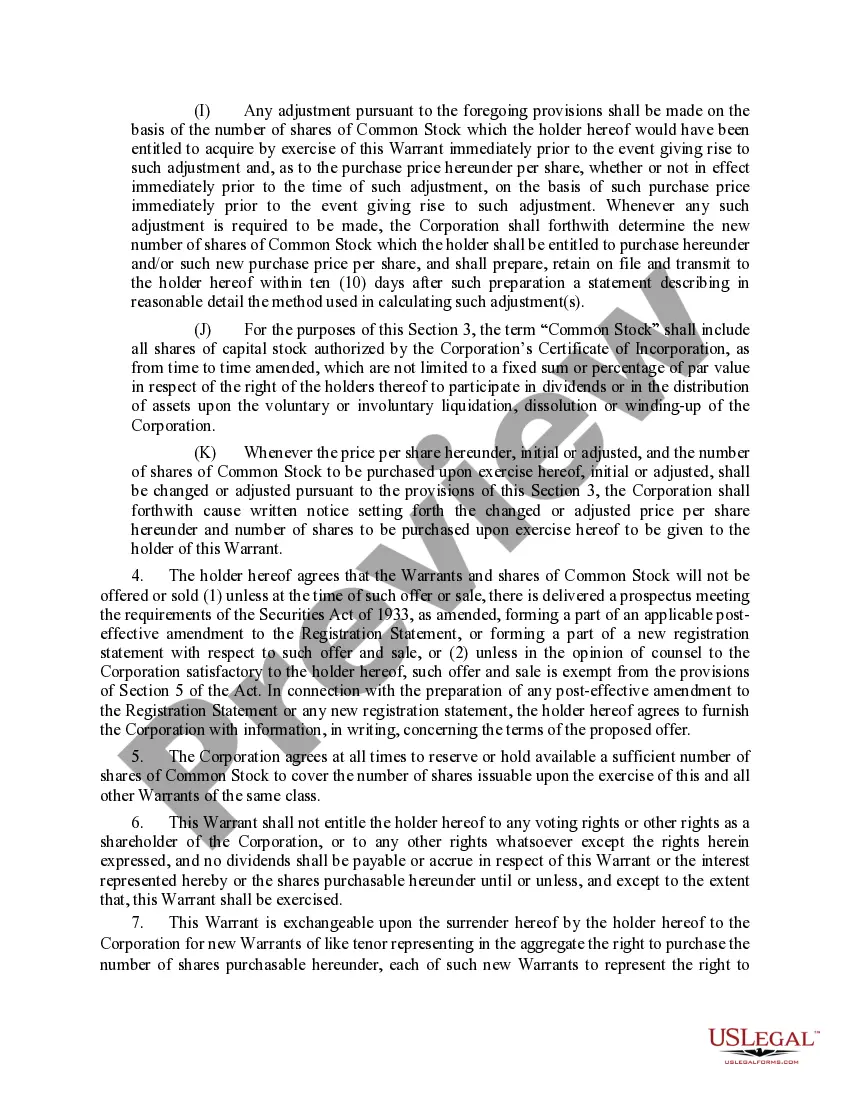

Alabama Warrant Agreement of Herley Industries, Inc.

Description

How to fill out Warrant Agreement Of Herley Industries, Inc.?

Choosing the right legitimate record design can be a have difficulties. Needless to say, there are a variety of web templates available on the net, but how do you discover the legitimate form you want? Take advantage of the US Legal Forms website. The assistance delivers thousands of web templates, including the Alabama Warrant Agreement of Herley Industries, Inc., which can be used for company and personal requires. Each of the forms are inspected by experts and satisfy federal and state needs.

If you are currently registered, log in to your bank account and then click the Download key to find the Alabama Warrant Agreement of Herley Industries, Inc.. Make use of bank account to look from the legitimate forms you have purchased in the past. Go to the My Forms tab of your own bank account and get an additional duplicate of the record you want.

If you are a brand new end user of US Legal Forms, allow me to share straightforward directions that you can adhere to:

- Very first, make certain you have selected the right form for the town/state. You are able to look through the form while using Preview key and study the form information to make sure it will be the best for you.

- If the form will not satisfy your requirements, make use of the Seach field to discover the right form.

- When you are positive that the form would work, click the Get now key to find the form.

- Pick the prices plan you want and type in the required information and facts. Make your bank account and pay for the transaction using your PayPal bank account or bank card.

- Opt for the submit format and down load the legitimate record design to your device.

- Full, modify and print out and signal the attained Alabama Warrant Agreement of Herley Industries, Inc..

US Legal Forms may be the biggest collection of legitimate forms where you can find different record web templates. Take advantage of the company to down load appropriately-produced paperwork that adhere to express needs.

Form popularity

FAQ

A warrant is an agreement between two parties ? the ?issuer? (i.e., a company) and the ?holder? of the warrant ? that entitles the holder to purchase the issuer's stock at a specified price within a certain time frame.

Warrants and call options are both types of securities contracts. A warrant gives the holder the right, but not the obligation, to buy common shares of stock directly from the company at a fixed price for a pre-defined time period.

What Is Warrant Coverage? Warrant coverage is an agreement between a company and one or more shareholders where the company issues a warrant equal to some percentage of the dollar amount of an investment. Warrants, similar to options, allow investors to acquire shares at a designated price.

A warrant agreement is an agreement to purchase stock, also called a stock warrant. The agreement provides one party the right to purchase a company's stock at a specific price and at a specific date.

Companies often issue stock warrants by attaching the warrant to a bond or other security that they use to raise capital. The warrant helps attract investors and also represents potential future capital for the issuing company.