Alabama Restructuring Agreement

Description

How to fill out Restructuring Agreement?

Have you been in a placement that you need to have files for either organization or individual reasons just about every day? There are tons of authorized papers templates accessible on the Internet, but finding types you can rely isn`t straightforward. US Legal Forms provides thousands of kind templates, such as the Alabama Restructuring Agreement, which are created in order to meet federal and state requirements.

If you are already acquainted with US Legal Forms web site and possess a merchant account, merely log in. Following that, it is possible to obtain the Alabama Restructuring Agreement template.

Unless you come with an account and want to begin to use US Legal Forms, adopt these measures:

- Obtain the kind you need and make sure it is for that proper area/region.

- Take advantage of the Preview key to review the form.

- Look at the outline to actually have chosen the proper kind.

- In case the kind isn`t what you`re searching for, take advantage of the Look for area to get the kind that meets your requirements and requirements.

- Once you get the proper kind, simply click Buy now.

- Opt for the rates strategy you desire, submit the specified information to make your money, and buy the order making use of your PayPal or credit card.

- Decide on a hassle-free data file file format and obtain your duplicate.

Find all of the papers templates you may have purchased in the My Forms menus. You can aquire a additional duplicate of Alabama Restructuring Agreement whenever, if required. Just go through the necessary kind to obtain or print out the papers template.

Use US Legal Forms, probably the most substantial assortment of authorized forms, to save efforts and prevent errors. The assistance provides expertly created authorized papers templates that can be used for a selection of reasons. Generate a merchant account on US Legal Forms and initiate creating your life a little easier.

Form popularity

FAQ

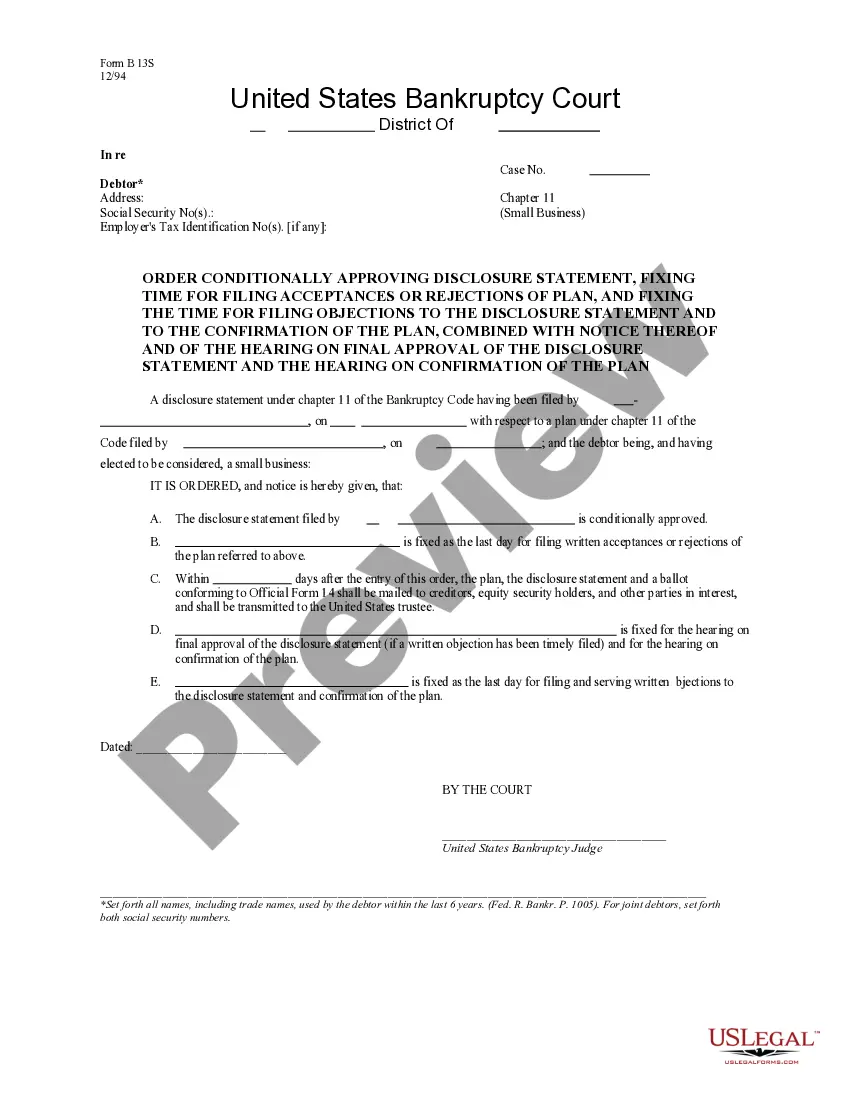

Not all debts are discharged. The debts discharged vary under each chapter of the Bankruptcy Code. Section 523(a) of the Code specifically excepts various categories of debts from the discharge granted to individual debtors. Therefore, the debtor must still repay those debts after bankruptcy.

Section 1141(d)(1) generally provides that confirmation of a plan discharges a debtor from any debt that arose before the date of confirmation. After the plan is confirmed, the debtor is required to make plan payments and is bound by the provisions of the plan of reorganization.

If your company owes a current employee wages when it files for Chapter 11, then the employee's paychecks should not be interrupted. The company will ask the court's permission to keep paying its employees as long as it stays in business.

The RSA allows the parties involved to negotiate and agree upon the terms of the treatment of claims and the course of the bankruptcy process before the commencement of the case and to memorialize those agreements in the form of a written agreement.

Examples Of Chapter 11 Bankruptcy While Chapter 11 bankruptcies may appear to be a lot more successful than Chapter 7 situations, history shows that most companies entering Chapter 11 don't survive either. Less than 10% of Chapter 11 filings have actually been successful.

Secured creditors like banks are going to get paid first. This is because their credit is secured by assets?typically ones that your business controls. Your plan and the courts may consider how integral the assets are that secure your loans to determine which secured creditors get paid first though.

Chapter 11 can allow a business that is experiencing serious financial difficulties to regroup and get back on track. However, it is complex, costly, and time-consuming. For these reasons, a company must consider Chapter 11 reorganization only after careful analysis and exploration of all other possible alternatives.

The discharge received by an individual debtor in a Chapter 11 case discharges the debtor from all pre-confirmation debts except those that would not be dischargeable in a Chapter 7 case filed by the same debtor.