Alabama Creditors Holding Unsecured Nonpriority Claims - Schedule F - Form 6F - Post 2005

Description

How to fill out Creditors Holding Unsecured Nonpriority Claims - Schedule F - Form 6F - Post 2005?

Are you presently in the place that you need to have paperwork for sometimes business or personal uses virtually every day time? There are tons of lawful papers layouts accessible on the Internet, but finding versions you can trust is not effortless. US Legal Forms gives a huge number of type layouts, much like the Alabama Creditors Holding Unsecured Nonpriority Claims - Schedule F - Form 6F - Post 2005, which can be written in order to meet federal and state demands.

When you are already knowledgeable about US Legal Forms internet site and also have a merchant account, merely log in. Afterward, you may down load the Alabama Creditors Holding Unsecured Nonpriority Claims - Schedule F - Form 6F - Post 2005 template.

Should you not offer an bank account and wish to start using US Legal Forms, adopt these measures:

- Get the type you need and ensure it is to the appropriate town/area.

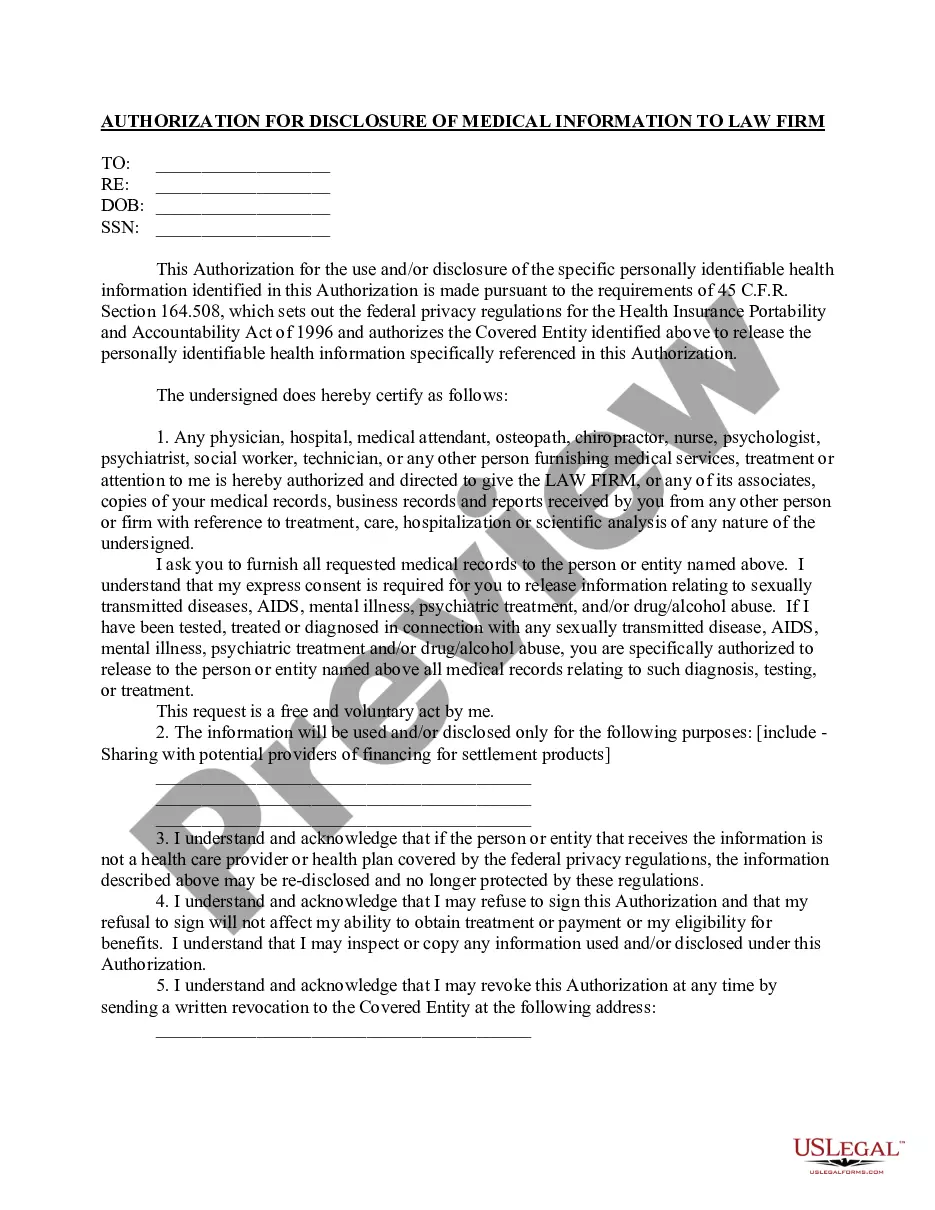

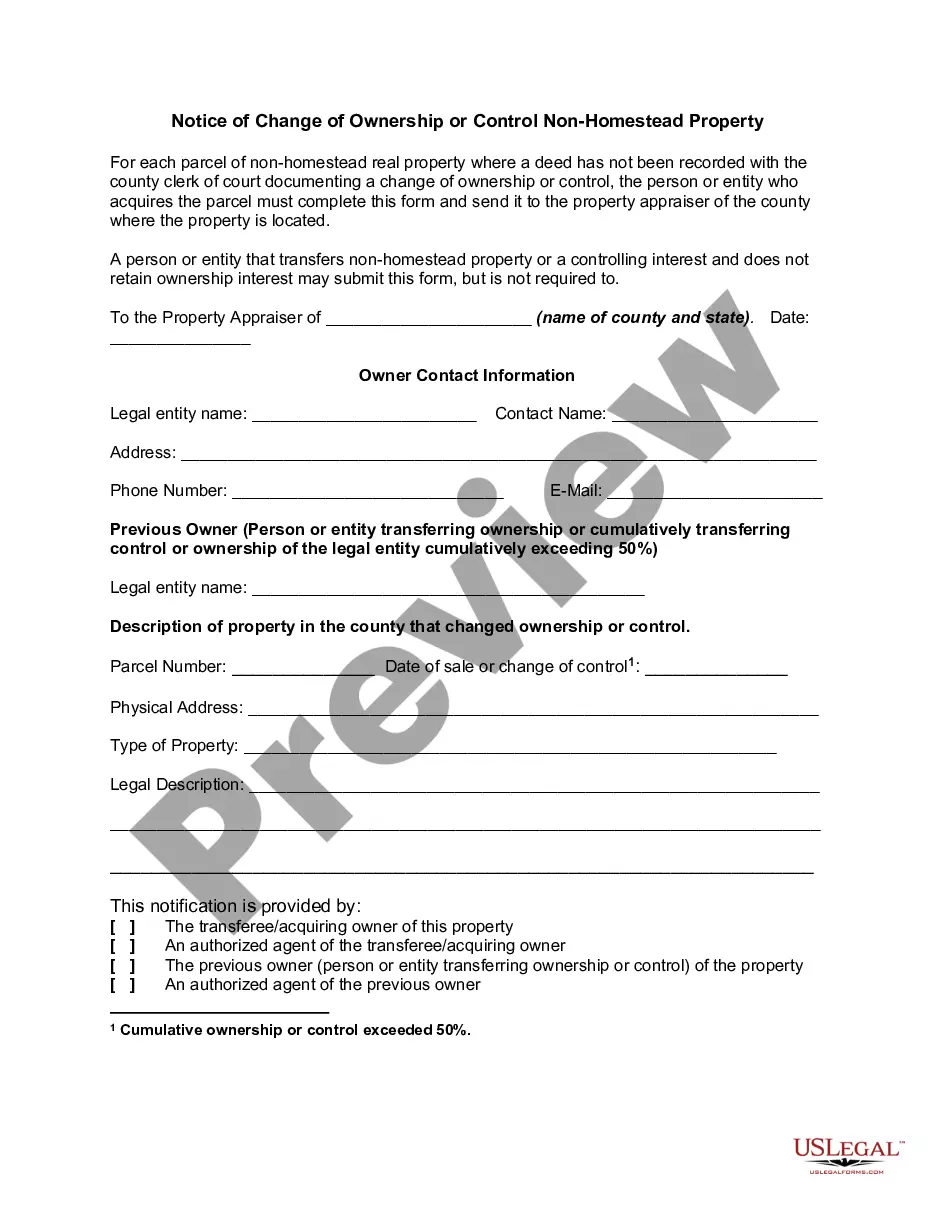

- Use the Preview button to check the shape.

- Look at the description to ensure that you have selected the appropriate type.

- In the event the type is not what you`re seeking, utilize the Research industry to obtain the type that suits you and demands.

- Once you discover the appropriate type, click Purchase now.

- Choose the prices plan you want, fill out the specified details to create your bank account, and pay for an order making use of your PayPal or Visa or Mastercard.

- Pick a hassle-free paper format and down load your backup.

Discover every one of the papers layouts you have bought in the My Forms menu. You can obtain a more backup of Alabama Creditors Holding Unsecured Nonpriority Claims - Schedule F - Form 6F - Post 2005 whenever, if needed. Just click the needed type to down load or printing the papers template.

Use US Legal Forms, probably the most comprehensive collection of lawful kinds, to save lots of efforts and stay away from mistakes. The assistance gives skillfully produced lawful papers layouts that can be used for a range of uses. Produce a merchant account on US Legal Forms and begin making your daily life a little easier.

Form popularity

FAQ

A creditor schedule is a statement that details the balances of the creditor control account and compares them with the individual creditor balances. A debtor schedule compares the individual customer balances with the balances of the debtor control account.

General unsecured claims have the lowest priority of all claims. After the bankruptcy estate pays administrative expenses, priority unsecured claims, and secured claims, general unsecured creditors will receive a pro rata (equal percentage) distribution of the remaining funds.

An unsecured creditor is an individual or institution that lends money without obtaining specified assets as collateral. This poses a higher risk to the creditor because it will have nothing to fall back on should the borrower default on the loan.

Examples of unsecured debts include credit cards, medical expenses, utility bills, most taxes, and personal loans.

What is an Unsecured Claim? Unsecured claims are the opposite of secured claims: There is no property to seize, repossess, or foreclose upon. Examples of unsecured claims are child support debt, alimony debt, credit card debt, tax debts, and personal loans.

Priority unsecured claims include the following types of claims: the administrative expenses of the Chapter 11 case, wage claims of up to $10,950 per employee, wage benefit claims of employees up to certain limits, consumer deposit claims of up to $2,425 each, most divorce-related claims, and tax claims.

A creditor with an unsecured claim has a promise to pay from the borrower but doesn't have a lien. There are two types of unsecured claims: Priority unsecured claims. These debts aren't dischargeable in bankruptcy, and, if money is available, the claim will get paid before nonpriority unsecured claims.

Under the priority system, certain unsecured creditors are entitled to full payment before other unsecured creditors receive anything at all. Whether a creditor filed a proof of claim form within the deadline also influences the order of payment.