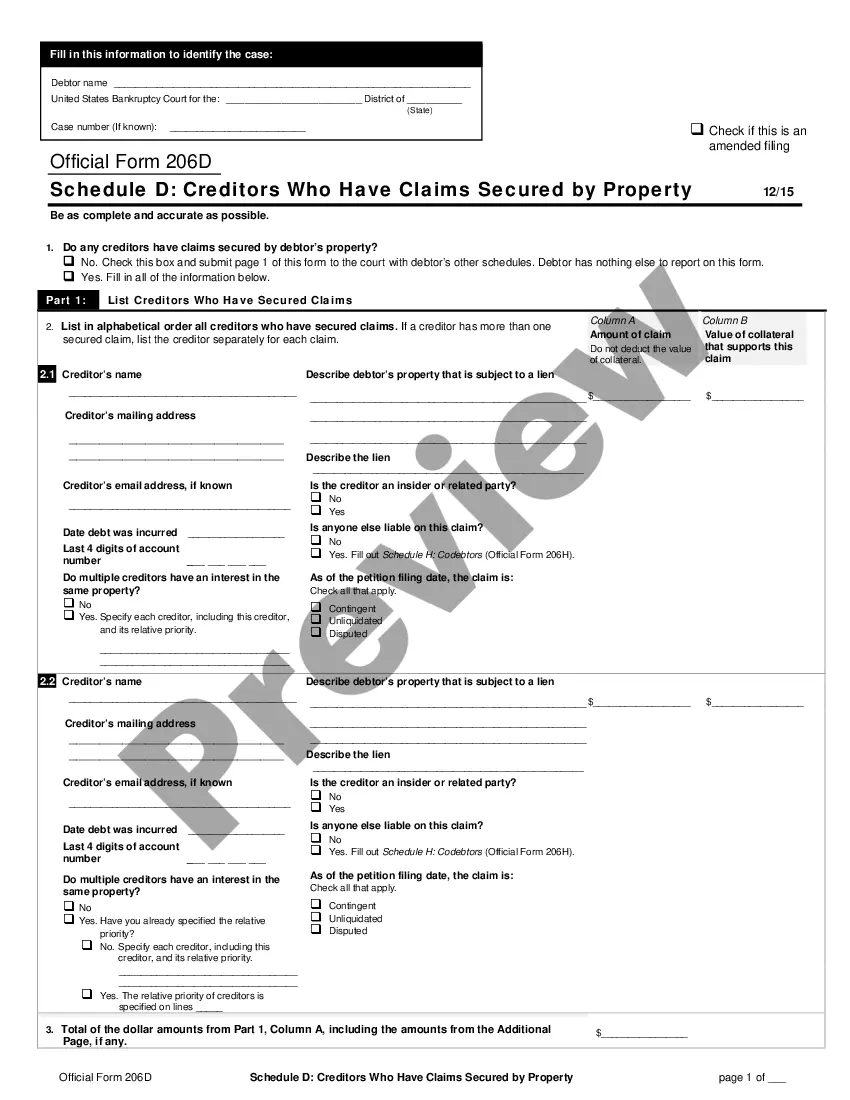

Alabama Real Property - Schedule A - Form 6A - Post 2005

Description

How to fill out Real Property - Schedule A - Form 6A - Post 2005?

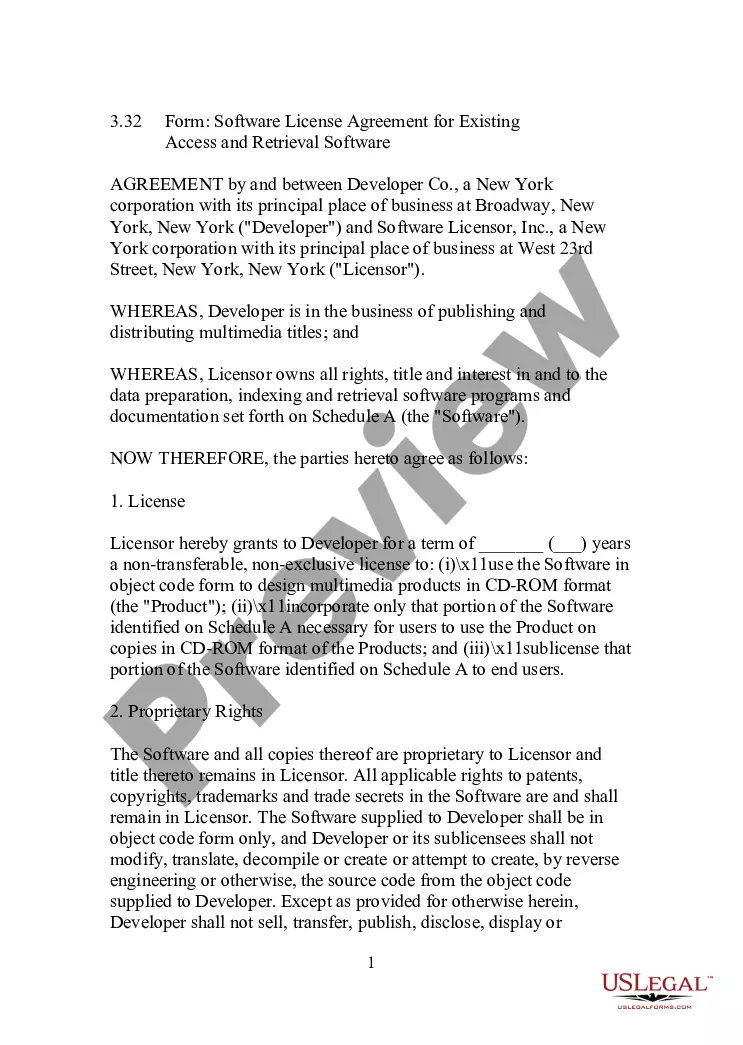

Choosing the best legal document format can be a battle. Obviously, there are tons of templates available on the net, but how will you find the legal kind you require? Use the US Legal Forms site. The services gives a huge number of templates, for example the Alabama Real Property - Schedule A - Form 6A - Post 2005, which you can use for company and private needs. All of the types are examined by specialists and fulfill federal and state requirements.

Should you be already signed up, log in to your bank account and click the Down load button to have the Alabama Real Property - Schedule A - Form 6A - Post 2005. Utilize your bank account to appear through the legal types you may have acquired earlier. Proceed to the My Forms tab of your respective bank account and get one more duplicate from the document you require.

Should you be a brand new customer of US Legal Forms, here are basic instructions for you to follow:

- Initially, ensure you have selected the right kind for the town/state. It is possible to check out the form making use of the Preview button and read the form description to make sure this is the right one for you.

- If the kind is not going to fulfill your preferences, take advantage of the Seach field to find the appropriate kind.

- Once you are certain that the form is suitable, click the Get now button to have the kind.

- Pick the prices prepare you need and enter the essential details. Design your bank account and purchase your order using your PayPal bank account or bank card.

- Opt for the file file format and acquire the legal document format to your device.

- Full, revise and print out and indication the acquired Alabama Real Property - Schedule A - Form 6A - Post 2005.

US Legal Forms will be the most significant library of legal types in which you can see various document templates. Use the company to acquire expertly-manufactured papers that follow status requirements.

Form popularity

FAQ

2 form from each employer. Other earning and interest statements (1099 and 1099INT forms) Receipts for charitable donations; mortgage interest; state and local taxes; medical and business expenses; and other taxdeductible expenses if you are itemizing your return.

You can also electronically file for free through My Alabama Taxes (MAT). For more information on MAT filing go to . Yes, almost any return that can be filed electronically for the IRS can also be filed electronically for Alabama.

Alaska, Arizona, California, Colorado, Hawaii, Idaho, New Mexico, Nevada, Oregon, Utah, Washington, Wyoming: Internal Revenue Service, P.O. Box 7704, San Francisco, CA 94120-7704.

Alabama Department of Revenue, P O Box 154, Montgomery, AL 36135-0001. When should I file my Alabama Individual Income Tax Return? Generally, your Alabama Individual Income Tax Return is due on April 15th, unless the 15th is a weekend or holiday, then the return is due the next business day.

In Alabama, the real estate transfer tax rate is $0.50 per $500 of the purchase price, or 0.1% and officially records the transfer of the deed. The exact amount owed for your transaction will depend on how much your home sells for.

Those whose filing status is ?Married Filing Joint Return? and whose gross income for the year is at least $10,500 must file an Alabama Individual Income Tax Return while an Alabama resident. Nonresidents must file a return if their Alabama income exceeds the allowable prorated personal exemption.

Current forms and booklets are also available at the nearest Alabama Taxpayer Service Center. Go to for location and contact information. You may also place an order online for forms to be mailed to you by going to .

Section 40-18-86, Code of Alabama 1975, provides for income tax withholding at a rate of 3% or 4% on sales or transfers of real property and associated tangible personal property by nonresidents of Alabama. This Code Section is applicable to any sale or transfer occurring on or after August 1, 2008.