Alabama Employment Status Form

Description

How to fill out Employment Status Form?

Have you ever been in a location where you frequently need documents for potential business or specific objectives.

There are numerous official document templates accessible online, but locating reliable versions isn’t straightforward.

US Legal Forms offers thousands of templates, such as the Alabama Employment Status Form, which are designed to meet state and federal standards.

Once you find the appropriate form, click Get now.

Select the payment plan that you prefer, enter the necessary information to create your account, and complete your purchase using PayPal or a credit card.

- If you are already familiar with the US Legal Forms site and possess an account, simply Log In.

- Subsequently, you can download the Alabama Employment Status Form template.

- If you do not have an account and wish to start using US Legal Forms, follow these steps.

- Obtain the form you need and ensure it is appropriate for the correct city/state.

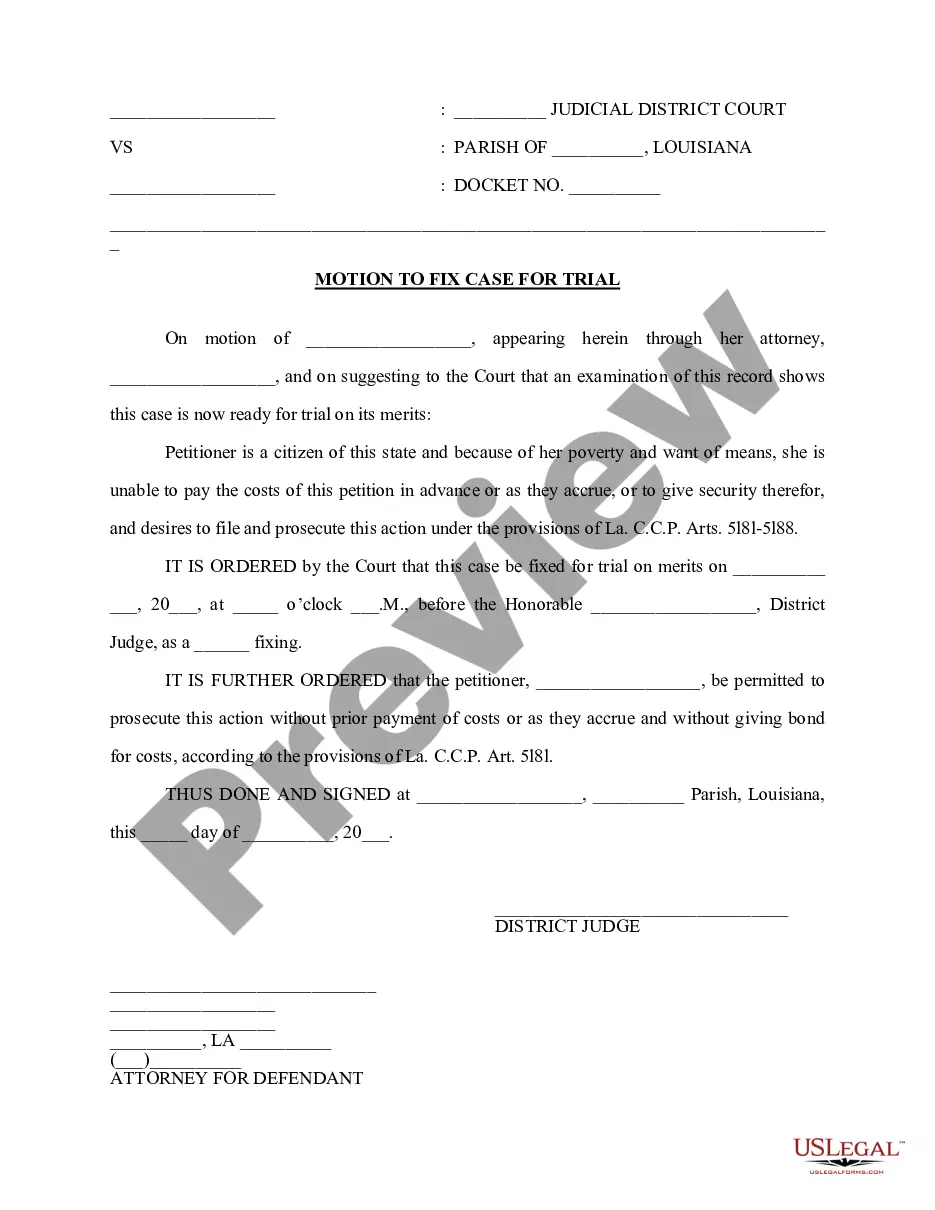

- Use the Preview button to review the form.

- Check the summary to confirm that you have chosen the correct form.

- If the form does not meet your needs, use the Search field to find the document that suits your requirements.

Form popularity

FAQ

When completing Form I-9, Employment Eligibility Verification, you, as the employer, must make the complete instructions to the form and the Lists of Acceptable Documents available to newly hired employees. Your employees must complete and sign Section 1 of Form I-9 no later than their first day of employment.

Each new employee will need to fill out the I-9 Employment Eligibility Verification Form from U.S. Citizenship and Immigration Services. The I-9 Form is used to confirm citizenship and eligibility to work in the U.S.

Alabama Unemployment Phone NumbersTo file an Unemployment Compensation Claim 1-866-234-5382 ( am pm, Mon. Fri.)To file an Unemployment Compensation Claim (TTY/TDD) (334) 309-9005 ( am pm, Mon.To contact the Inquiry Line regarding an existing claim 1-800-361-4524 ( am pm, Mon.

PROCESSING TIME FOR YOUR CLAIM It usually takes two or three (2-3) weeks following the week you filed your claim to receive your first benefit payment, provided that you have followed all instructions, filed your weekly certifications as instructed, and have met all eligibility requirements.

Please email status@labor.alabama.gov or call (334) 954-4730.

Employees must submit basic information including name, Social Security number and citizenship status. Employees also must supply documentation along with this form to prove they are eligible to work in the United States. Documentation examples include a current passport, state issued I.D. and Social Security card.

Tax rates range from 0.65% to 6.8% and include an employment security assessment of 0.06%. The unemployment tax rate for new employers is 2.7% in 2021, unchanged from 2020. Alabama's unemployment-taxable wage base is $8,000.

You can check your claim status online at Unemployment Benefits Services or call Tele-Serv at 800-558-8321. We use information from you and your last employer to determine if you qualify. TWC sends your last employer a letter with the reason you gave for no longer working there.

Before you can add an employee to your team, you are legally responsible for confirming the employee is eligible to work in the United States.Form I-9.Form W-4.State W-4.Emergency contact form.Employee handbook acknowledgment form.Bank account information form.Benefits forms.

New Hire Paperwork: AlabamaAlabama employers must obtain a completed Form A-4, Employee's Withholding Tax Exemption Certificate, from each employee. Alabama does not accept the federal Form W-4.Employers must provide notice to new hires regarding misrepresentations with respect to workers' compensation benefits.