Alabama Flex Time Request Form

Description

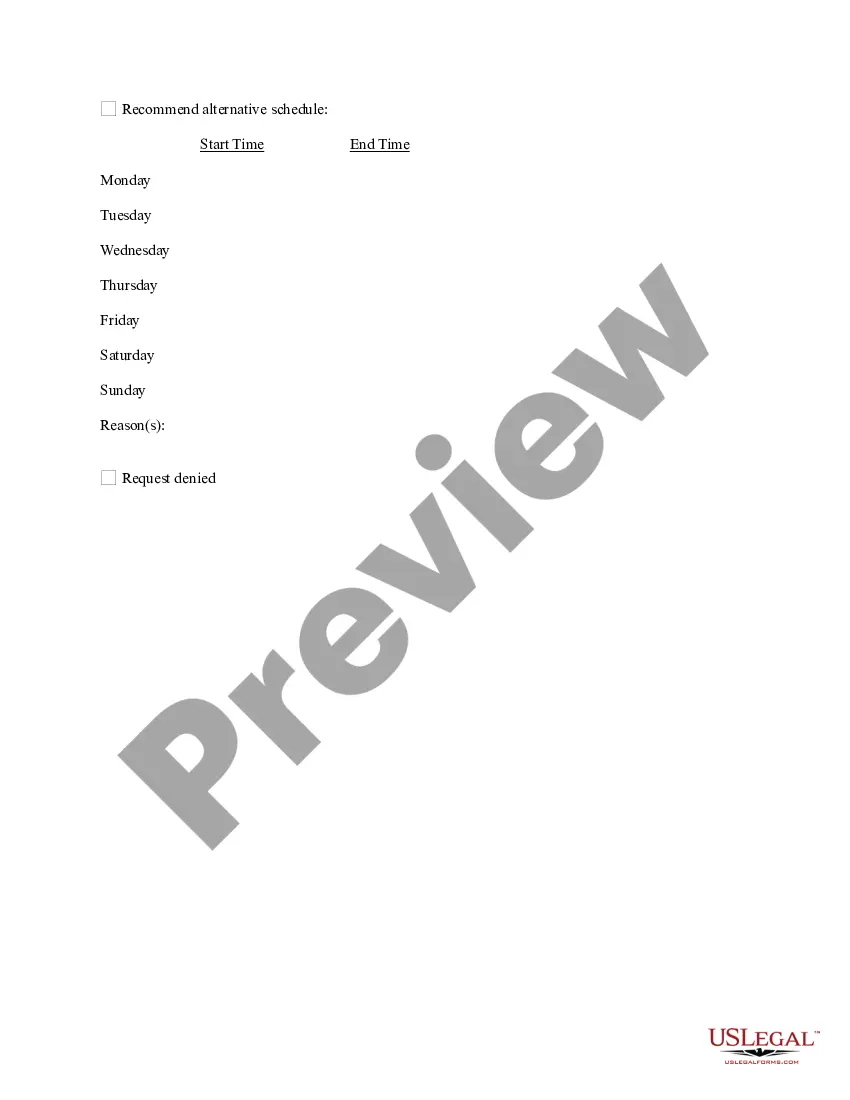

How to fill out Flex Time Request Form?

Finding the correct official document format can be a challenge.

Of course, there are numerous templates available online, but how can you obtain the official form you require.

Visit the US Legal Forms website. The service offers a vast selection of templates, including the Alabama Flex Time Request Form, which you can utilize for both business and personal purposes.

You can review the form using the Review button and examine the form outline to confirm it is suitable for you.

- All of the forms are reviewed by experts and meet state and federal requirements.

- If you are already registered, Log In to your account and click on the Download button to access the Alabama Flex Time Request Form.

- Use your account to browse the legal forms you may have purchased previously.

- Navigate to the My documents tab in your account to obtain another copy of the document you require.

- If you are a new user of US Legal Forms, here are straightforward instructions for you to follow.

- First, ensure you have selected the appropriate form for your city/region.

Form popularity

FAQ

The University of Alabama’s hybrid work policy supports a blend of in-office and remote work, aiming to improve work-life balance for its employees. Under this policy, employees can work from home several days a week while still fulfilling their responsibilities on campus. Familiarizing yourself with this policy could be beneficial when considering how to implement a flexible working schedule.

When a company ends an employee's job, they typically provide a termination letter, also called a letter of separation, stating the reason for termination and next steps. A termination letter is an official and professional way to document and describe the separation between the employee and employer.

Notice of Separation means the completion of a written election by an Eligible Team Member, on a form that has been approved by the Plan Administrator, that he or she wishes to terminate his or her employment in accordance with the Officer Separation Program, as described in Article III of this document.

Each new employee will need to fill out the I-9 Employment Eligibility Verification Form from U.S. Citizenship and Immigration Services. The I-9 Form is used to confirm citizenship and eligibility to work in the U.S.

Unemployment compensation benefits are taxable income. Each year all of your unemployment benefit payments are reported to the Internal Revenue Service and to the Alabama Department of Revenue. You can request to have federal income taxes withheld from your unemployment benefit payments.

Tax rates range from 0.65% to 6.8% and include an employment security assessment of 0.06%. The unemployment tax rate for new employers is 2.7% in 2021, unchanged from 2020. Alabama's unemployment-taxable wage base is $8,000.

As an employer, you have legal obligations when you terminate an employee. For example, if you are an employer terminating an employee, you must complete an employment separation certificate upon request. Indeed, it is important that as an employer you take such obligations seriously to avoid issues in the future.

Unemployment compensation benefits are taxable income. Each year all of your unemployment benefit payments are reported to the Internal Revenue Service and to the Alabama Department of Revenue. You can request to have federal income taxes withheld from your unemployment benefit payments.

By emergency rule adopted July 10, 2020, the Alabama Department of Labor (ADOL) now requires all Alabama employers to provide notice of the potential availability of unemployment benefits to employees at the time of their separation.

The following states require that employers provide written notice of separation (discharge, layoff, voluntary resignation) to a departing employee: Arizona, California, Connecticut, Georgia, Illinois, Louisiana, Massachusetts, Michigan, New Jersey, New York, and Tennessee.