Alabama Social Worker Agreement - Self-Employed Independent Contractor

Description

How to fill out Social Worker Agreement - Self-Employed Independent Contractor?

If you require thorough, download, or print legal document templates, utilize US Legal Forms, the largest selection of legal forms available on the web.

Take advantage of the site's straightforward and user-friendly search to obtain the documents you need. A variety of templates for business and personal purposes are categorized by types and jurisdictions, or keywords.

Use US Legal Forms to acquire the Alabama Social Worker Agreement - Self-Employed Independent Contractor in just a few clicks.

Each legal document template you purchase is yours forever. You will have access to every form you saved in your account. Navigate to the My documents section and select a form to print or download again.

Complete and download, and print the Alabama Social Worker Agreement - Self-Employed Independent Contractor with US Legal Forms. There are numerous professional and state-specific forms you can utilize for your business or personal needs.

- If you are currently a US Legal Forms user, Log In to your account and click the Acquire button to locate the Alabama Social Worker Agreement - Self-Employed Independent Contractor.

- You can also access forms you previously saved in the My documents tab of your account.

- If you are using US Legal Forms for the first time, follow the instructions below.

- Step 1. Ensure that you have selected the form for your specific city/state.

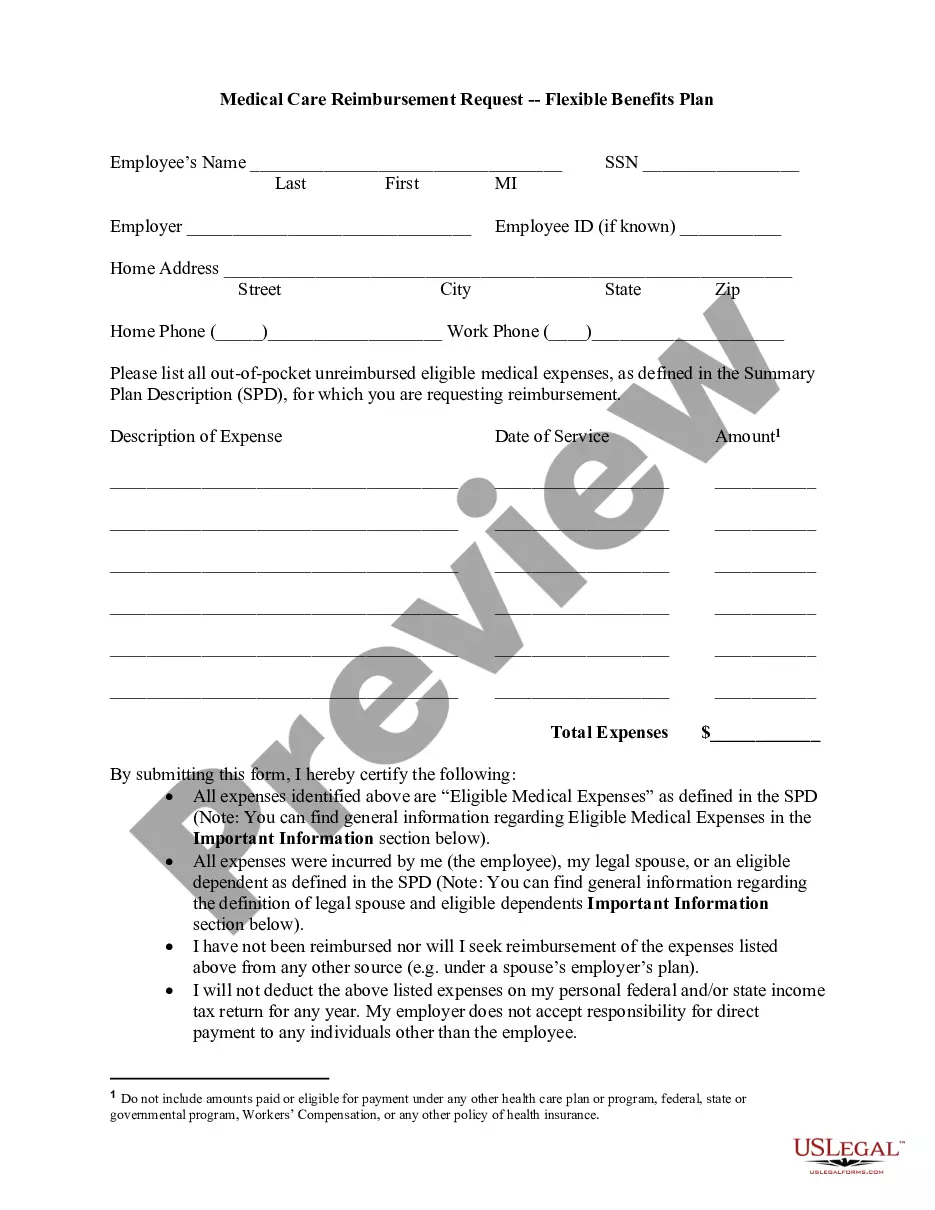

- Step 2. Use the Preview feature to view the form's content. Don't forget to read the description.

- Step 3. If you are not satisfied with the form, use the Search area at the top of the screen to find other versions of the legal form template.

- Step 4. Once you have found the form you want, click the Buy now button. Choose the payment plan you prefer and enter your details to register for an account.

- Step 5. Complete the transaction. You can use your Visa or MasterCard or PayPal account to process the payment.

- Step 6. Select the format of the legal form and download it to your device.

- Step 7. Complete, edit, and print or sign the Alabama Social Worker Agreement - Self-Employed Independent Contractor.

Form popularity

FAQ

Filling out an independent contractor agreement for the Alabama Social Worker Agreement - Self-Employed Independent Contractor is straightforward. Start by clearly defining the services you will provide and the terms of compensation. Be sure to include crucial details like deadlines, payment schedules, and confidentiality agreements where necessary. Resources like the US Legal Forms platform can guide you through the process, ensuring you cover all important aspects in your agreement.

As an independent contractor working under an Alabama Social Worker Agreement - Self-Employed Independent Contractor, you will need to complete several essential documents. Typically, this includes a contractor agreement that outlines the scope of work, payment terms, and responsibilities. Additionally, you may need to submit tax forms, like the W-9, to report your income. Ensuring that all paperwork is properly filled out protects both you and your clients, providing clarity and legal security.

Yes, you can absolutely have a contract if you're self-employed. In fact, having a written agreement is beneficial as it clarifies the terms of your working relationship with clients. It ensures that both parties understand their obligations and helps prevent misunderstandings. Using an Alabama Social Worker Agreement - Self-Employed Independent Contractor from US Legal Forms provides a solid foundation for your business arrangements.

To create an independent contractor agreement, start by defining the scope of work and the expectations for both parties. Clearly outline payment terms, deadlines, and responsibilities. You can include clauses that specify confidentiality and termination conditions. Using a reliable platform like US Legal Forms can simplify the process of drafting an Alabama Social Worker Agreement - Self-Employed Independent Contractor.

Absolutely, an independent contractor is classified as self-employed. This designation means you run your business and offer services based on the agreement you have with clients. When you formalize your work through an Alabama Social Worker Agreement - Self-Employed Independent Contractor, you acknowledge this status and the accompanying obligations and freedoms that come with it.

Receiving a 1099 form typically indicates that you are an independent contractor, which means you are also considered self-employed. This form shows income earned from clients who do not withhold taxes on your behalf. If you sign an Alabama Social Worker Agreement - Self-Employed Independent Contractor and receive a 1099, you should understand your tax responsibilities and the benefits of managing your earnings.

Writing an independent contractor agreement involves outlining the terms of the working relationship clearly. Start by defining the services provided, payment structure, and project timelines. It’s crucial to include clauses that refer to the Alabama Social Worker Agreement - Self-Employed Independent Contractor. Using templates from trusted platforms like uslegalforms can simplify this process and ensure you cover all necessary elements.

The choice between saying self-employed or independent contractor often depends on the context. While both terms indicate a similar status of working independently, 'self-employed' covers a broader range of business activities. In an Alabama Social Worker Agreement - Self-Employed Independent Contractor, it may be more precise to use 'independent contractor' when referring specifically to service agreements and contracts in the field of social work.

Yes, an independent contractor is indeed considered self-employed. They hire themselves out to provide services while managing their own business operations. When you enter into an Alabama Social Worker Agreement - Self-Employed Independent Contractor, you take on the responsibilities that come with this status. This includes tax obligations and the freedom to set your rates and working conditions.

A person qualifies as self-employed when they manage their own business, rather than working for someone else. This includes individuals who operate as independent contractors, freelancers, or sole proprietors. In the context of the Alabama Social Worker Agreement - Self-Employed Independent Contractor, you must control your work hours and the method in which you complete tasks. This autonomy is central to self-employment.