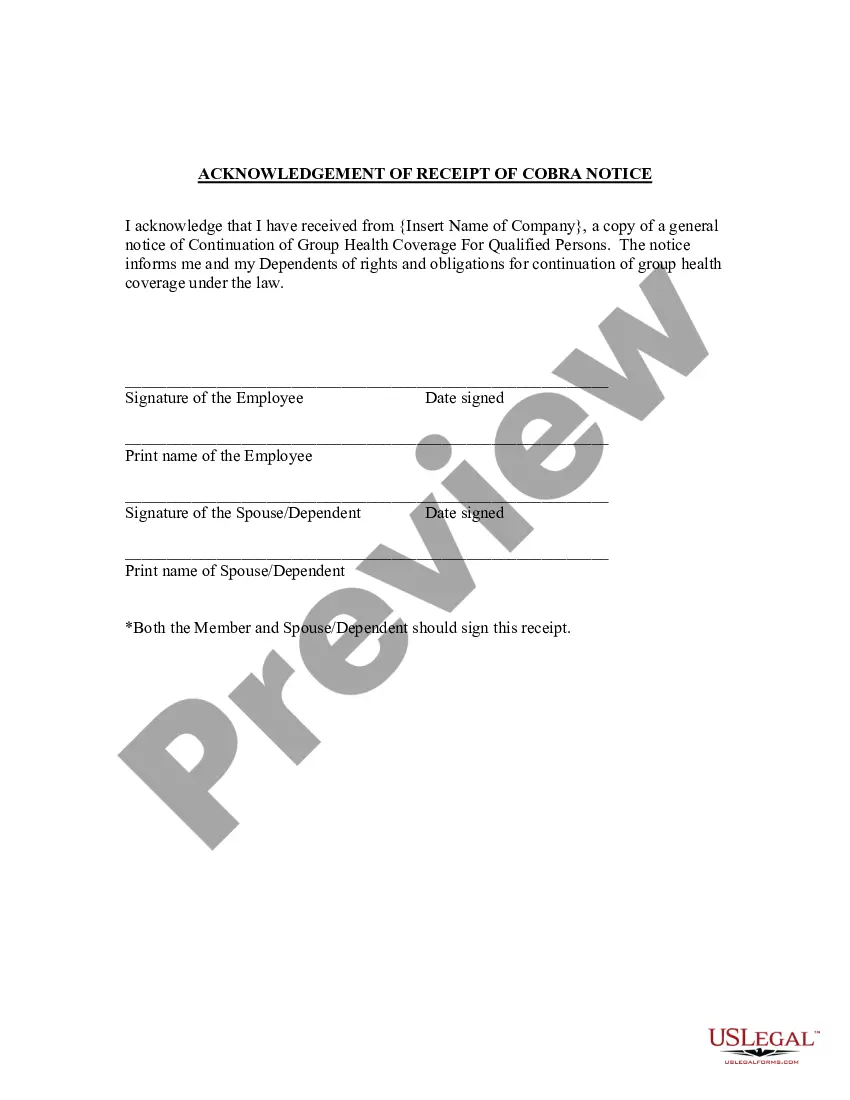

Alabama Acknowledgment of Receipt of COBRA Notice

Description

How to fill out Acknowledgment Of Receipt Of COBRA Notice?

Are you presently in a position that requires you to have documentation for possibly company or specific duties almost every day.

There are numerous legal document templates available online, but locating reliable ones can be challenging.

US Legal Forms offers thousands of template forms, including the Alabama Acknowledgment of Receipt of COBRA Notice, which are designed to meet state and federal regulations.

If you find the appropriate form, click Get now.

Select the pricing plan you desire, fill out the required information to create your account, and pay the transaction with your PayPal or credit card.

- If you are already familiar with the US Legal Forms website and have an account, simply Log In.

- After that, you can acquire the Alabama Acknowledgment of Receipt of COBRA Notice template.

- If you do not have an account and wish to start using US Legal Forms, follow these steps.

- Obtain the form you need and ensure it is for the correct region/area.

- Utilize the Preview option to review the form.

- Check the description to ensure that you have chosen the correct form.

- If the form is not what you are looking for, use the Search field to find the form that suits you and your needs.

Form popularity

FAQ

Initial COBRA notices must generally be provided within 14 days of the employer notifying the third-party administrator (TPA) of a qualifying event.

DOL ERISA Penalties An employer is liable up to an additional $110 per day per participant if they fail to provide initial COBRA notices. ERISA can also hold any fiduciary personally liable for non-compliance.

There are several other scenarios that may explain why you received a COBRA continuation notice even if you've been in your current position for a long time: You may be enrolled in a new plan annually and, therefore, receive a notice each year. Your employer may have just begun offering a health insurance plan.

Although the earlier rules only covered summary plan descriptions (SPDs) and summary annual reports, the final rules provide that all ERISA-required disclosure documents can be sent electronically -- this includes COBRA notices as well as certificates of creditable coverage under the Health Insurance Portability and

There are several other scenarios that may explain why you received a COBRA continuation notice even if you've been in your current position for a long time: You may be enrolled in a new plan annually and, therefore, receive a notice each year. Your employer may have just begun offering a health insurance plan.

Are there penalties for failing to provide a COBRA notice? Yes, and the penalties can be substantial. Under the Employment Retirement Income Security Act of 1974 (ERISA), a penalty of up to $110 per day may be imposed for failing to provide a COBRA notice.

In addition, employers can provide COBRA notices electronically (via email, text message, or through a website) during the Outbreak Period, if they reasonably believe that plan participants and beneficiaries have access to these electronic mediums.

Employers should send notices by first-class mail, obtain a certificate of mailing from the post office, and keep a log of letters sent. Certified mailing should be avoided, as a returned receipt with no delivery acceptance signature proves the participant did not receive the required notice.

If You Do Not Receive Your COBRA PaperworkReach out to the Human Resources Department and ask for the COBRA Administrator. They may use a third-party administrator to handle your enrollment. If the employer still does not comply you can call the Department of Labor at 1-866-487-2365.