Alabama Flood Insurance Authorization

Description

How to fill out Flood Insurance Authorization?

Are you presently inside a placement that you need to have files for either enterprise or person functions just about every day time? There are a lot of authorized document themes available on the net, but locating versions you can depend on is not straightforward. US Legal Forms delivers thousands of kind themes, like the Alabama Flood Insurance Authorization, which are published to meet state and federal requirements.

In case you are already familiar with US Legal Forms internet site and possess a free account, just log in. After that, you can download the Alabama Flood Insurance Authorization web template.

Should you not have an bank account and wish to start using US Legal Forms, adopt these measures:

- Discover the kind you will need and make sure it is to the correct area/state.

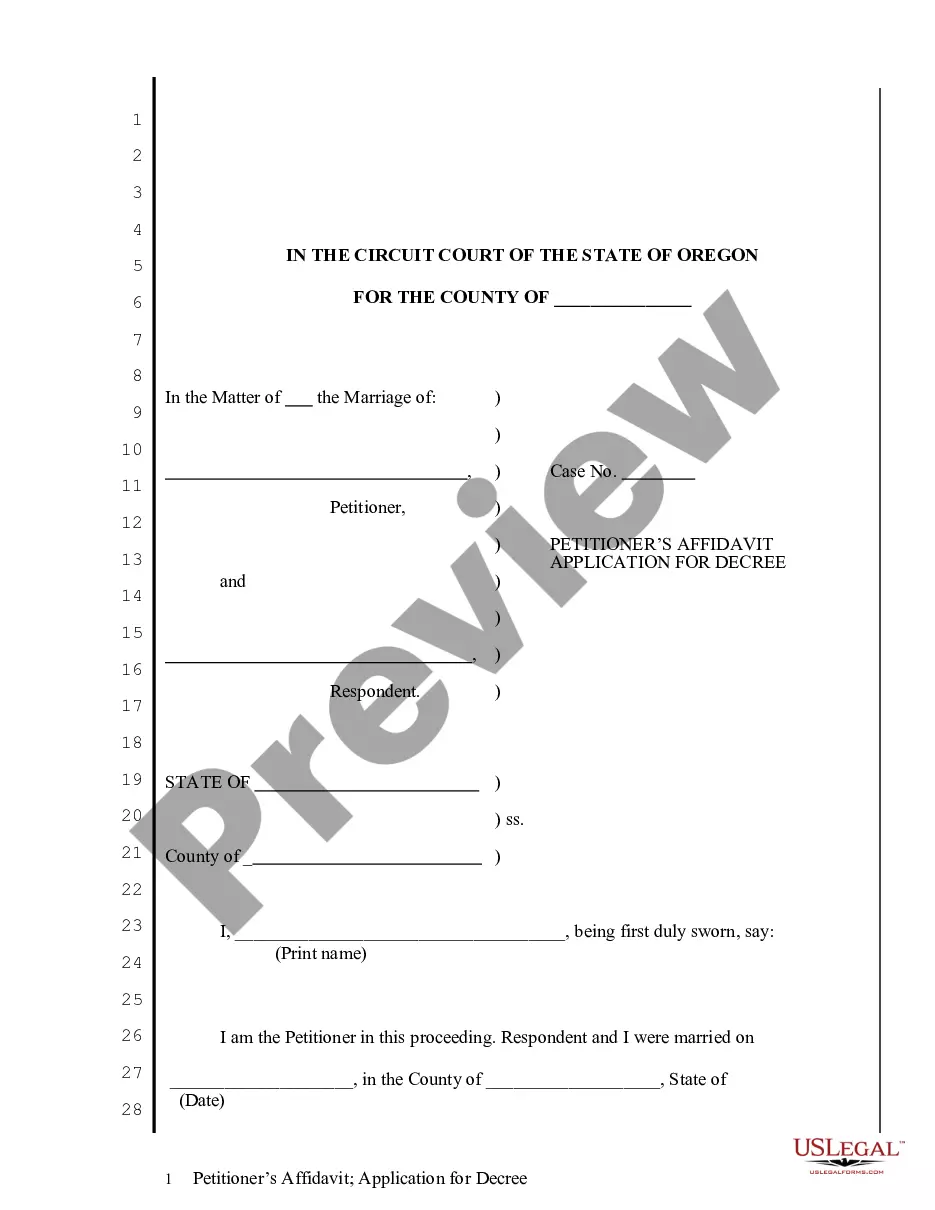

- Make use of the Review key to analyze the form.

- Look at the information to actually have chosen the proper kind.

- When the kind is not what you are seeking, utilize the Look for industry to discover the kind that meets your needs and requirements.

- If you discover the correct kind, simply click Get now.

- Pick the prices prepare you would like, fill in the desired information to create your bank account, and pay money for the order utilizing your PayPal or credit card.

- Pick a practical document format and download your version.

Get each of the document themes you have purchased in the My Forms food list. You can obtain a further version of Alabama Flood Insurance Authorization anytime, if possible. Just select the needed kind to download or produce the document web template.

Use US Legal Forms, one of the most comprehensive collection of authorized forms, to save lots of some time and steer clear of blunders. The support delivers appropriately made authorized document themes that can be used for a range of functions. Create a free account on US Legal Forms and begin producing your lifestyle easier.

Form popularity

FAQ

Contact any licensed surveyor for information on obtaining an Elevation Certificate. Or contact the Floodplain Management and Disaster Mitigation Services staff at 205-254-2479. Flood maps and flood protection references are available at the downtown Birmingham Public Library.

Document your flood damage Before removing flood-damaged items from your home, policyholders should be sure to take the following steps: Take photos and videos. Take photos and videos of the damage, including structural and personal property damage on the inside and outside of your home, before discarding items.

The Write-Your-Own (WYO) Program The WYO Program began in 1983 and it is a cooperative undertaking between the private insurance industry and FEMA. The approximately 50 companies currently participating in the program sell and service the Standard Flood Insurance Policy in their own names.

What to do During a Flood Warning or Flash Flood Warning Move immediately to higher ground or stay on high ground. Continue to check the media for emergency information. Follow instructions from public safety officials. ... If you must evacuate your home, take only essential items and bring your pets if safe to do so.

Items not covered by building or contents coverage: Temporary housing and additional living expenses incurred while the building is being repaired or is unable to be occupied.

The National Flood Insurance Program (NFIP) is managed by the FEMA and is delivered to the public by a network of more than 50 insurance companies and the NFIP Direct.

The Standard Flood Hazard Determination Form is required for all federally backed loans and is used by lenders to determine the flood risk for their building loans. The form is authorized by the National Flood Insurance Reform Act of 1994 and is imposed on lenders by their regulatory entities, not by FEMA.

Keep in mind you can only purchase flood insurance through an insurance agent; you cannot buy it directly from the National Flood Insurance Program (NFIP). Since Alabama Flood Insurance is a general agent, we can easily process all flood insurance policies through the NFIP or through one of our many private carriers.

After a Flood Avoid moving water. Stay away from damaged areas unless your assistance has been specifically requested by police, fire, or relief organization. Emergency workers will be assisting people in flooded areas. ... Play it safe. ... Return home only when authorities indicate it is safe.

Steps to follow Contact your insurer. You should call your insurer as soon as possible to have a claims adjuster handle your claim. Check the insurance contract and the coverage included. ... Undertake emergency repairs. ... Inquire about additional living expenses. ... Assess and document the damage. ... Repair or replace damaged items.