Alabama Standard Conditions of Acceptance of Escrow

Description

How to fill out Standard Conditions Of Acceptance Of Escrow?

US Legal Forms - one of the largest collections of legal documents in the United States - offers a vast selection of legal document templates that you can download or print.

By using the site, you can access thousands of forms for business and personal use, categorized by types, states, or keywords. You can find the most recent forms, such as the Alabama Standard Conditions of Acceptance of Escrow, in just minutes.

If you have a subscription, Log In to download the Alabama Standard Conditions of Acceptance of Escrow from the US Legal Forms library. The Download button will be available on every form you view. You can access all previously downloaded forms in the My documents section of your account.

Make modifications. Fill, edit, print, and sign the downloaded Alabama Standard Conditions of Acceptance of Escrow.

All templates you add to your account do not expire and are your property indefinitely. So, if you wish to download or print another copy, just navigate to the My documents section and click on the form you need. Access the Alabama Standard Conditions of Acceptance of Escrow with US Legal Forms, one of the most extensive collections of legal document templates. Utilize a multitude of professional and state-specific templates that meet your business or personal requirements.

- If you are using US Legal Forms for the first time, here are simple instructions to get you started.

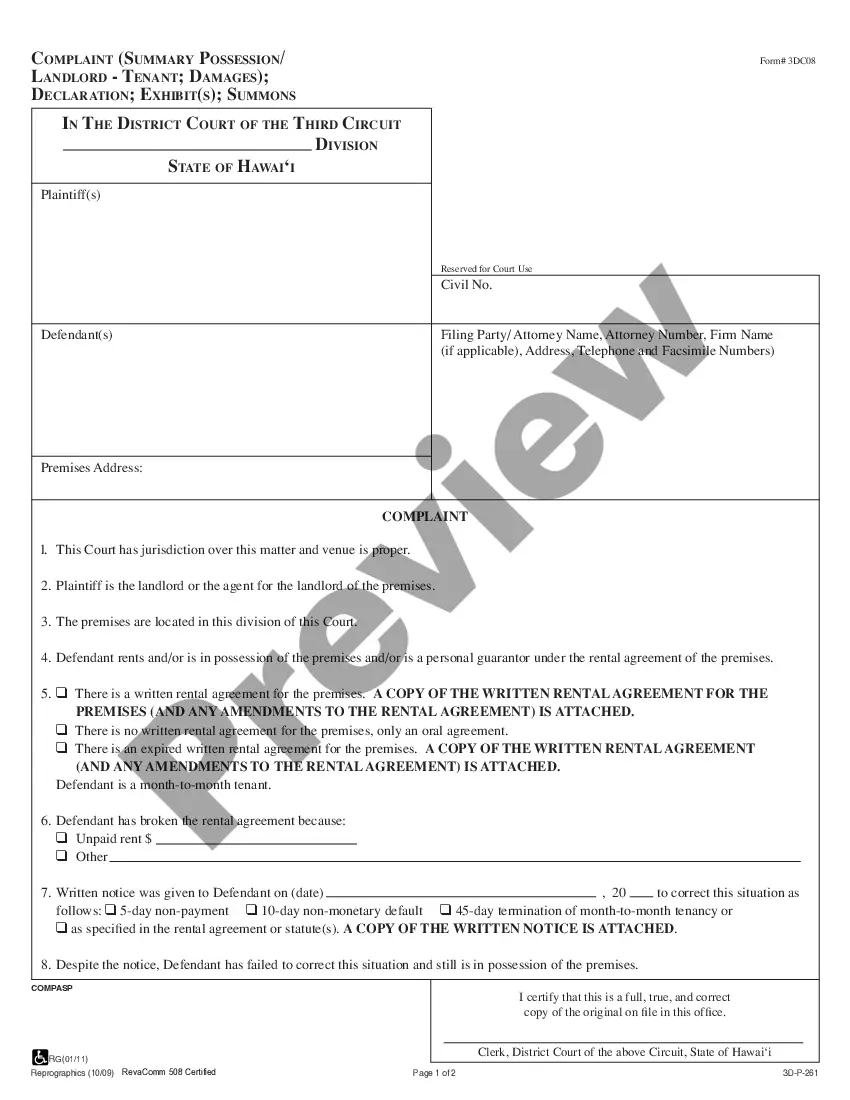

- Ensure you have selected the correct form for your city/state. Click the Review button to examine the content of the form. Check the form summary to confirm you have selected the appropriate form.

- If the form does not meet your needs, use the Search field at the top of the screen to find one that does.

- If you are satisfied with the form, confirm your selection by clicking the Purchase now button. Then, choose your preferred pricing plan and provide your information to register for an account.

- Process the payment. Use your credit card or PayPal account to complete the payment.

- Select the format and download the form to your device.

Form popularity

FAQ

Unlike in many other U.S. states, Alabama law employs a rule known as caveat emptor for the sale of used residential property. Caveat emptor is Latin for "let the buyer beware," which means that the seller has no actual duty to advise the buyer of issues with the property's physical condition during the sale.

A contingency period typically lasts anywhere between 30 and 60 days. If the buyer isn't able to get a mortgage within the agreed time, then the seller can choose to cancel the contract and find another buyer. This timeframe may be important if you encounter a delay in getting financed.

Earnest money and deposits are held in an escrow account. Once you back out, those funds are released to the seller if you haven't performed them. However, if you get your inspections, appraisals, and financing within the agreed-upon date range and choose to back out, there are no penalties.

The seller might have a clause hidden deep in the contract that allows him to cancel the escrow without penalties for any reason he wishes to do so. Look for that carefully when going over the contract or you could get caught up in a mess down the road.

Cancelling escrow after all the contingencies have been met is possible but will put the buyer's deposit at risk of forfeiture. Once the decision has been made to cancel the escrow, the seller should be notified immediately.

Generally, once you are in the escrow process, you may back out only if the other party fails to meet contingencies. Check the terms of your sales contract. The other party may wish to negotiate rather than cancel the sale.

Closing conditions can include: Provisions that each party's warranties and representations are valid as of the closing date. Provisions stating warranties and representations have been met by all parties involved. If applicable, approval given by government authority for the transaction to occur.

In real estate, one phrase you'll run into is caveat emptor....The short list of states that lean toward caveat emptor is:Alabama.Arkansas.Georgia.North Dakota.Virginia.Wyoming.

The contingency period refers to a time period that starts the date an offer is accepted and ends on the contingency removal date, which is a date named in the accepted offer.

In short: Yes, buyers can typically back out of buying a house before closing. However, once both parties have signed the purchase agreement, backing out becomes more complex, particularly if your goal is to avoid losing your earnest money deposit.