Alabama Personnel Payroll Associate Checklist

Description

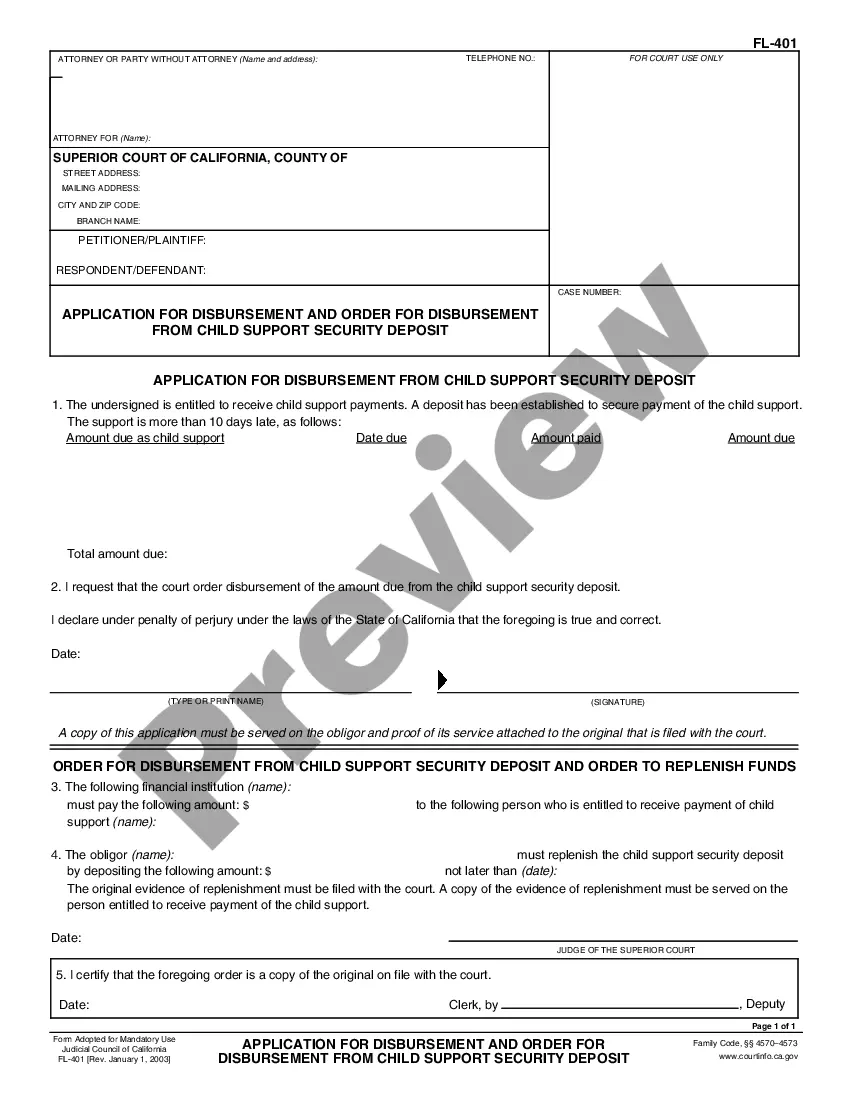

How to fill out Personnel Payroll Associate Checklist?

If you need to finalize, acquire, or produce sanctioned document formats, utilize US Legal Forms, the most extensive selection of legal templates available online.

Employ the site’s straightforward and user-friendly search feature to locate the documents you require.

Various templates for corporate and personal purposes are organized by categories and states, or keywords.

Step 4. Once you have found the form you need, click the Get now button. Choose the payment plan you prefer and enter your information to register for an account.

Step 5. Process the payment. You can use your Visa or MasterCard or PayPal account to complete the transaction.

- Use US Legal Forms to obtain the Alabama Personnel Payroll Associate Checklist in just a few clicks.

- If you are already a US Legal Forms customer, Log In to your account and click the Download button to get the Alabama Personnel Payroll Associate Checklist.

- You can also access forms that you previously downloaded from the My documents tab in your account.

- If you are using US Legal Forms for the first time, follow these steps.

- Step 1. Ensure that you have selected the form for the correct city/state.

- Step 2. Utilize the Review option to examine the form’s content. Be sure to read the details carefully.

- Step 3. If you are not satisfied with the form, use the Search field at the top of the screen to find alternative templates in the legal document format.

Form popularity

FAQ

First, you must open a general employer tax account with the state this is a mandatory prerequisite before any employer can get a withholding-specific tax account number. Register online with the Alabama Department of Revenue. Scroll to the Businesses tile. Click Register a business/Obtain a New Tax Account Number.

From a best practice perspective, the following documents should be included: employment documents including a job description, letter of offer, employment contract, copy of the business' employee handbook and Fair Work Information Statement; Tax File Declaration form; superannuation nomination form; and.

Before you can add an employee to your team, you are legally responsible for confirming the employee is eligible to work in the United States.Form I-9.Form W-4.State W-4.Emergency contact form.Employee handbook acknowledgment form.Bank account information form.Benefits forms.

Setting Up Your New Employee: Have your new employee fill out Form W-4, Employee's Withholding Certificate, for federal income taxes.

First time applicants may register online at or contact the Alabama Department of Revenue, Business Registration Unit at (334) 242-1584 and request Form COM: 101 (Combined Registration Form) to register for a state sales and/or seller's use tax license, and state administered local

The Alabama Secretary of State charges a $200 fee to file the Certificate of Formation. You must also pay a separate Probate Court filing fee, which is at least $50. You must reserve your business name by filing an LLC name reservation. It costs $28 to file online and $10 if filed by mail.

Alabama Withholding Tax Account NumberIf you are a new business, register online with the AL Department of Revenue.If you already have an AL Withholding Tax Account Number, you can find this on correspondence from the AL Department of Revenue or by contacting the agency at 334-242-1584.

Corporations, LLCs, LLPs, and partnerships must register with ADOR to conduct business in Alabama. Standard forms and taxes include sales and use tax, income tax withholding, and unemployment tax. In addition, depending on your startup, you may have to register for and pay additional state taxes.

Banded scoring is a statistical procedure for grouping test scores that statistically are not meaningfully different from one another. In banded scoring, bands are set objectively and mathematically. The people in a band are similar to each other in that statistically there is no meaningful difference in their scores.

How long does it take to get hired at State of Alabama? The hiring process at State of Alabama takes an average of 59 days when considering 15 user submitted interviews across all job titles.