Alabama Returned Items Report

Description

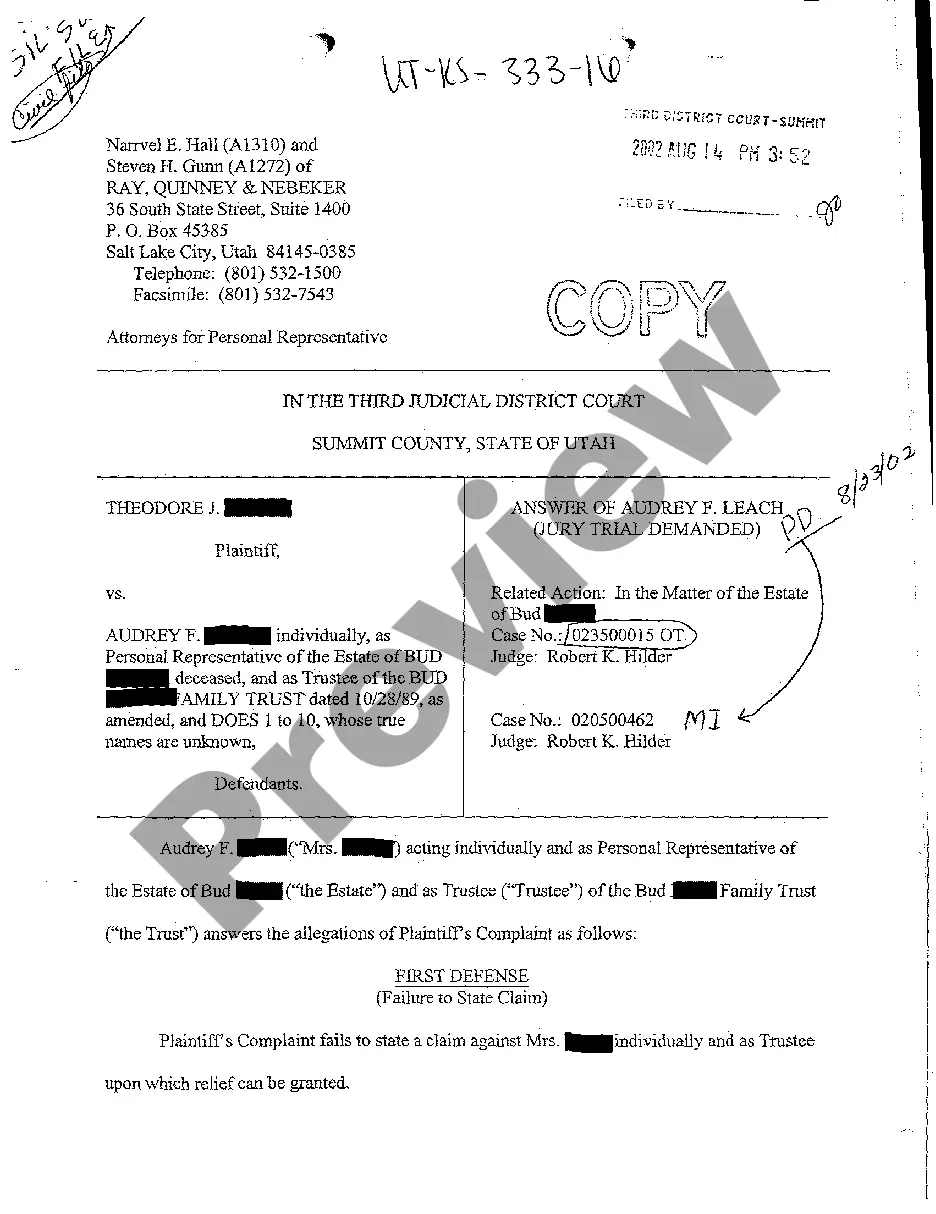

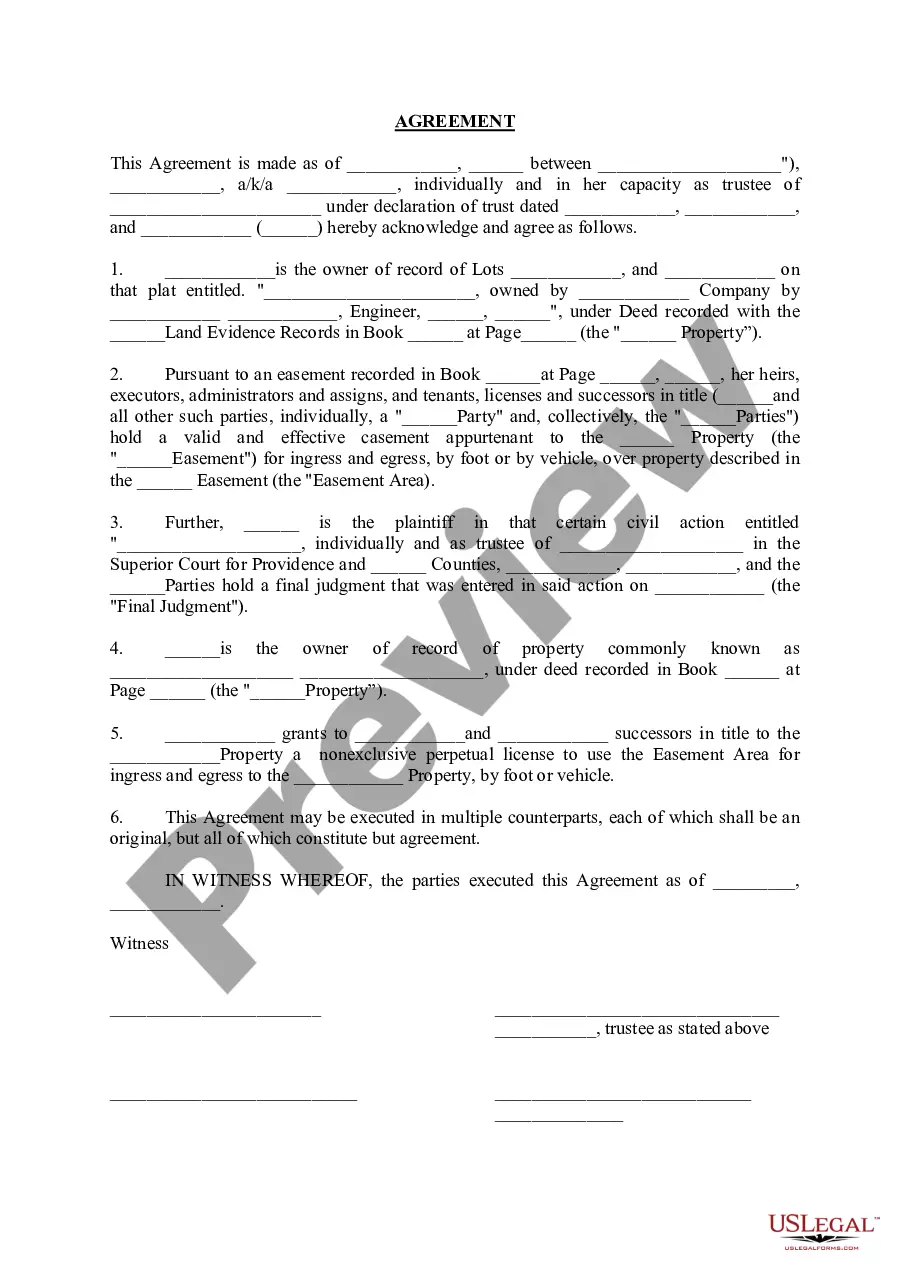

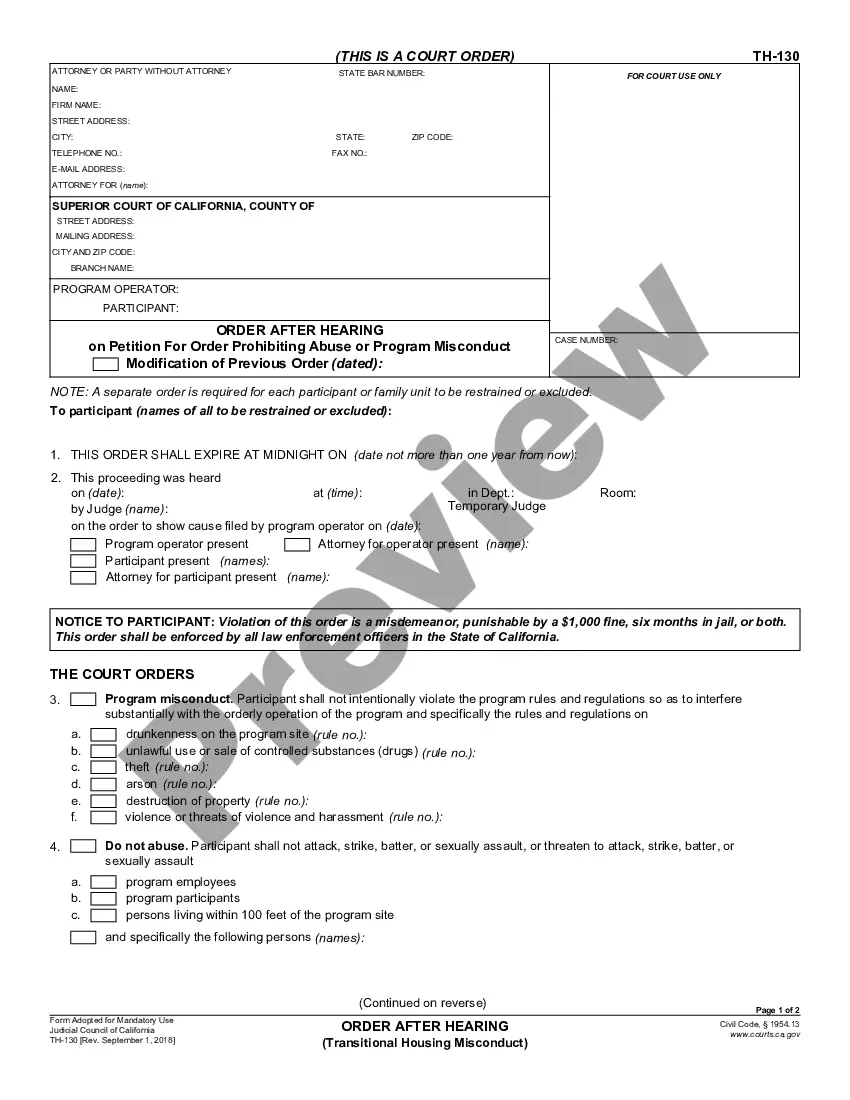

How to fill out Returned Items Report?

If you need to finalize, acquire, or create authentic document templates, turn to US Legal Forms, the largest collection of legal forms available online.

Utilize the site's straightforward and efficient search feature to find the documents you require.

Various templates for business and personal purposes are organized by categories and states, or by keywords.

Every legal document template you purchase is yours indefinitely.

You will have access to every form you have downloaded in your account. Visit the My documents section and select a form to print or download again.

- Use US Legal Forms to locate the Alabama Returned Items Report in just a few clicks.

- If you are already a US Legal Forms member, Log In to your account and then click on the Download button to get the Alabama Returned Items Report.

- You can also access forms you have previously downloaded in the My documents section of your account.

- If this is your first time using US Legal Forms, follow the steps below.

- Step 1. Ensure you have selected the form for the correct city/state.

- Step 2. Use the Preview option to review the content of the form. Remember to read the description.

- Step 3. If you are not satisfied with the form, use the Search field at the top of the screen to find other types in the legal form format.

- Step 4. Once you have found the form you need, click the Buy now button. Choose your preferred pricing plan and enter your details to register for an account.

- Step 5. Complete the transaction. You can use your credit card or PayPal account to finalize the purchase.

- Step 6. Select the format of the legal form and download it to your device.

- Step 7. Fill out, edit, and print or sign the Alabama Returned Items Report.

Form popularity

FAQ

Form PPT is to be filed by Pass-through Entities only. BUSINESS PRIVILEGE TAX PAYMENT. Payment of the total tax due must be received on or before the original due date of the return. Form BPT-V must accompany all business privilege tax pay- ments, unless payments are made electronically.

Form 40A is Alabama's Individual Resident Income Tax Return (short version) and it applies to full year residents only. Please keep in mind that if you file Form 40A close to the deadline, there might be a delay of 90 days until you receive the refund.

Where Do I Find Alabama State Tax Forms? If you are trying to locate, download, print, or fill state of Alabama tax forms, you can do so on the Alabama Department of Revenue website.

Alabama Form 40 is used by full-year and part-year residents to file their state income tax return.

Alabama Consolidated Corporate Income Tax ReturnsAct 98-502 allows the Alabama Department of Revenue to accept consolidated corporate income tax returns for tax years beginning after December 31, 1998.

Form 40 is the Alabama income tax return form for all full-time and part-time state residents (non-residents must file a Form 40NR). This tax return package includes Form 4952A, Schedules A, B, CR, D, E and OC. Form 40 requires you to list multiple forms of income, such as wages, interest, or alimony .

Also called the Registration and Annual Report for Canadian Securities Form, Form 40-F is a filing with the US Securities and Exchange Commission (SEC) used by Canadian companies that want to offer their securities to United States investors.

Form 1040 is used by U.S. taxpayers to file an annual income tax return.

The tax rate for business privilege tax is graduated, based on the entity's federal taxable income apportioned to Alabama. The rates range from $0.25 to $1.75 for each $1,000 of net worth in Alabama. The minimum business privilege tax is $100.

(1) A licence in Form 20C or Form 20D 1to sell, stock exhibit or offer for sale or distribute Homoeopathic medicines shall not be granted to any person unless the authority empowered to grant the licence is satisfied that the premises in respect of which the licence is to be granted are clean and in the case of a