Alabama Purchase Order for Software Development

Description

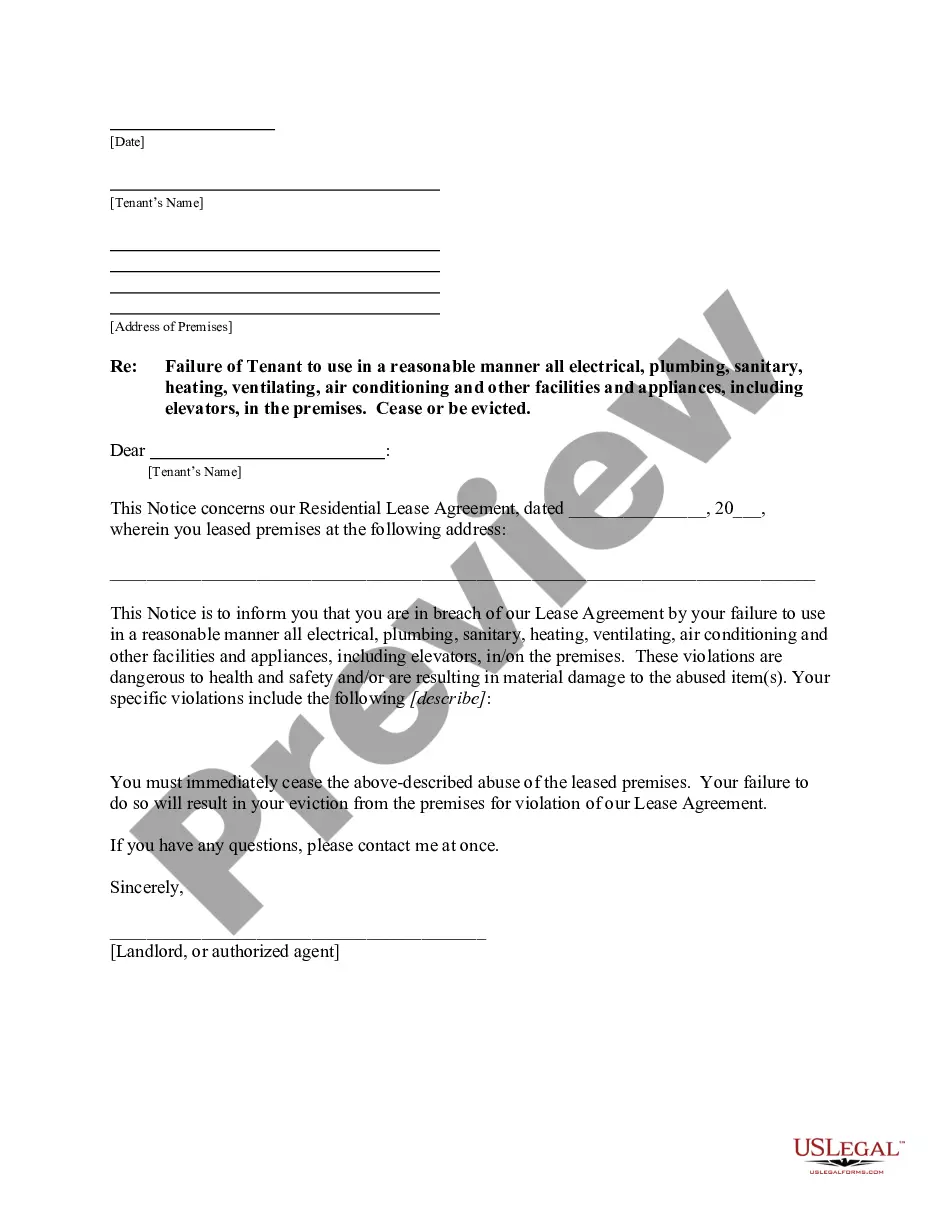

How to fill out Purchase Order For Software Development?

You might spend hours online attempting to locate the valid document template that satisfies the state and federal obligations you require.

US Legal Forms provides thousands of valid forms that have been assessed by experts.

You can download or print the Alabama Purchase Order for Software Development from the service.

Consult the form description to confirm you have selected the right form. If available, utilize the Preview button to view the document template as well.

- If you already have a US Legal Forms account, you can Log In and click on the Download button.

- Then, you can complete, edit, print, or sign the Alabama Purchase Order for Software Development.

- Every valid document template you purchase is yours permanently.

- To obtain another copy of a purchased form, visit the My documents section and click the appropriate button.

- If you are using the US Legal Forms website for the first time, follow the straightforward instructions listed below.

- First, ensure you have chosen the correct document template for the state/city of your choice.

Form popularity

FAQ

Becoming a vendor for the state of Georgia requires you to register with the Georgia Procurement Registry. You will need to provide pertinent business information, including your Dun and Bradstreet number. Once registered, you can start participating in various contracting opportunities, including those involving an Alabama Purchase Order for Software Development. US Legal Forms offers resources that can help guide you through the registration requirements, ensuring you meet all necessary criteria.

To become a New Jersey state-approved vendor, you must complete a registration process with the New Jersey Division of Revenue. You will need to provide information regarding your business entity, tax information, and more. Once approved, you can compete for contracts, including projects needing an Alabama Purchase Order for Software Development. Utilizing the services of US Legal Forms can simplify the registration and compliance tasks, making the process more efficient.

Getting a vendor license in Alabama involves applying through your local city or county government. Gather all necessary documentation, such as your Federal Employer Identification Number and proof of compliance with any state regulations. After your application is approved, you’ll be eligible to submit bids, including those for an Alabama Purchase Order for Software Development. Consider using US Legal Forms to access the necessary forms and instructions for a smoother application process.

To become a vendor for the state of Alabama, you need to register with the Alabama Department of Finance. Ensure you have the relevant documents, which may include your business license and tax identification number. After registration, you can start bidding on opportunities, including projects that require an Alabama Purchase Order for Software Development. Using platforms like US Legal Forms can help streamline your registration process.

Yes, in Alabama, software is generally subject to sales tax unless otherwise specified. This includes custom software developed under an Alabama Purchase Order for Software Development. Businesses should factor this tax into their project budgets to avoid unexpected costs.

Alabama Form 40 must be filed with the Alabama Department of Revenue, either online or by mail, depending on your preference. When preparing your Alabama Purchase Order for Software Development, ensure that you also have your tax documents organized to facilitate this process. Filing timely can help avoid penalties and ensure compliance.

Alabama employs both a state sales tax and local sales taxes to fund various levels of government services and infrastructure. This often confuses residents and business owners alike. When dealing with an Alabama Purchase Order for Software Development, keeping this in mind can help clarify your financial obligations.

Many consider Alabama to be relatively tax friendly for businesses, thanks to lower overall tax rates compared to other states. This can benefit companies looking to optimize their budgets, especially for needs like an Alabama Purchase Order for Software Development. As you evaluate your investment, it's prudent to look at the state’s incentives for software-related businesses.

No, Alabama does not have a flat 10% sales tax. The state has a base sales tax rate of 4%, but local governments can impose additional sales taxes. When making an Alabama Purchase Order for Software Development, it's essential to account for these extra local taxes, as they might vary by city or county.

In Alabama, certain items are not subject to sales tax, including groceries, prescription medications, and certain services. This includes the Alabama Purchase Order for Software Development when it falls under professional service agreements. Understanding what is taxable can help businesses streamline their expenses.