Alabama Deed Conveying Property held by Spouses as Tenants in Common to Husband and Wife as Community Property

Description

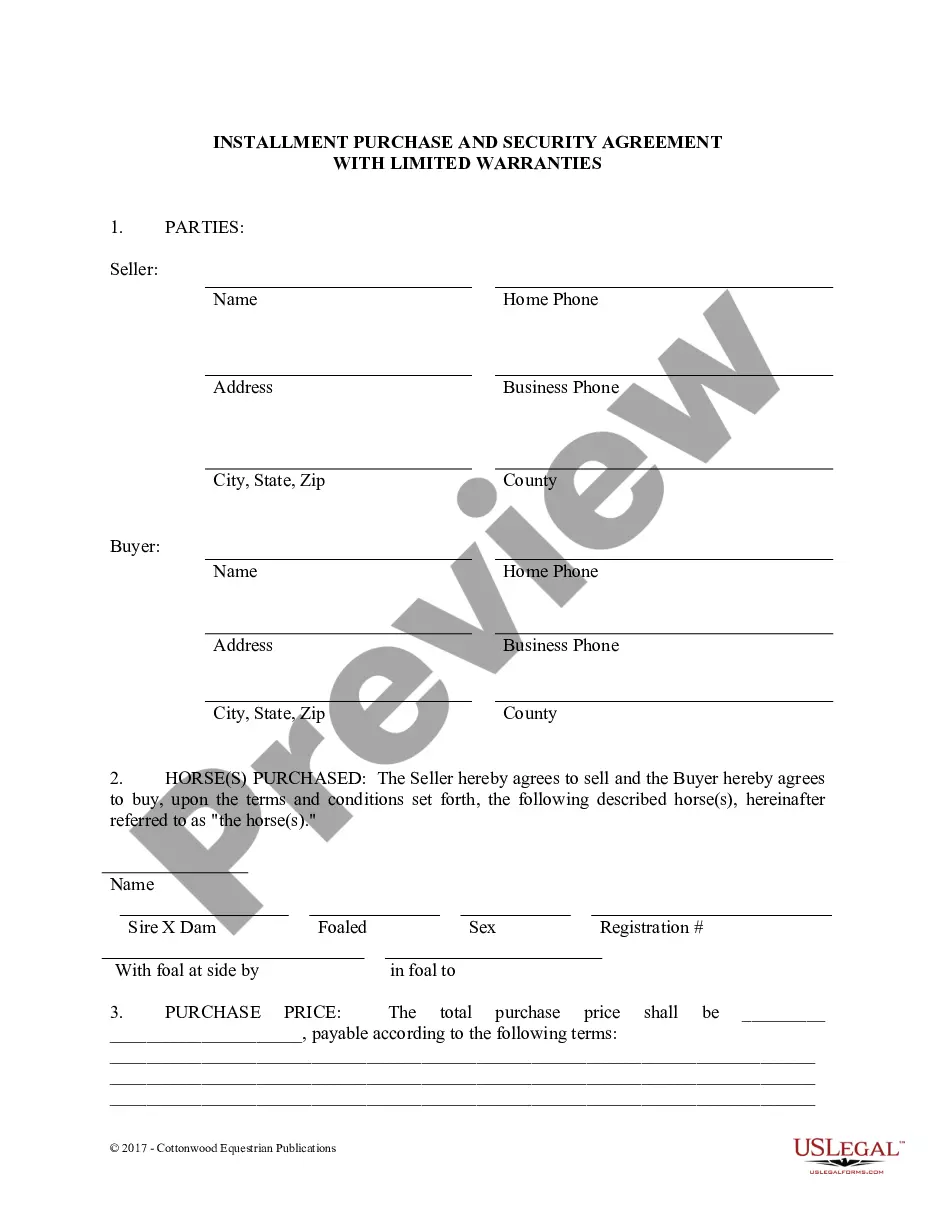

How to fill out Deed Conveying Property Held By Spouses As Tenants In Common To Husband And Wife As Community Property?

You can invest several hours on the Internet attempting to find the lawful record template that suits the federal and state specifications you want. US Legal Forms supplies thousands of lawful forms which are analyzed by specialists. You can easily obtain or printing the Alabama Deed Conveying Property held by Spouses as Tenants in Common to Husband and Wife as Community Property from your services.

If you already possess a US Legal Forms profile, it is possible to log in and then click the Acquire switch. Next, it is possible to full, modify, printing, or signal the Alabama Deed Conveying Property held by Spouses as Tenants in Common to Husband and Wife as Community Property. Every lawful record template you buy is your own property for a long time. To get an additional backup of any acquired form, go to the My Forms tab and then click the corresponding switch.

If you work with the US Legal Forms site the very first time, adhere to the easy recommendations under:

- Initial, make sure that you have chosen the right record template to the region/metropolis of your liking. Read the form explanation to make sure you have picked out the right form. If readily available, make use of the Review switch to look from the record template too.

- In order to get an additional variation of the form, make use of the Research discipline to obtain the template that meets your requirements and specifications.

- When you have found the template you need, simply click Buy now to proceed.

- Select the pricing prepare you need, type your accreditations, and register for your account on US Legal Forms.

- Full the deal. You can use your bank card or PayPal profile to pay for the lawful form.

- Select the file format of the record and obtain it for your gadget.

- Make adjustments for your record if possible. You can full, modify and signal and printing Alabama Deed Conveying Property held by Spouses as Tenants in Common to Husband and Wife as Community Property.

Acquire and printing thousands of record layouts while using US Legal Forms Internet site, that offers the most important selection of lawful forms. Use skilled and status-certain layouts to deal with your organization or individual demands.

Form popularity

FAQ

In conclusion, if you are buying a house in Alabama that you intend to be the primary residence of you and your spouse, then that property will be subject to the homestead exemption and you will need your spouse's assent and signature on the conveyance.

Titles are transferred by deeds. A deed is the actual legal document that would transfer the ownership (title) of a property from one person to another. A deed is signed by the person selling or transferring the property rights, called the grantor.

As with any conveyance of realty, a gift deed requires a complete legal description of the parcel. In Alabama, if the legal description references a plat, the plat should be attached to the deed, or the deed should describe the plat book and office in which it can be found (Ala. Code 1975, 35-4-74).

Recording ? A quit claim deed should be filed in the office of the County Probate Judge along with any required fees. Signing Requirements ? If a notary acknowledgment is not included in the conveyance of the property, a witness must attest to the conveyance.

The deed should be signed by the current owner or owners, with each signature notarized using Alabama's statutorily approved acknowledgments. There is no need for the new owners (grantees) to sign the deed.

Attorney Involvement All legal documents must be drafted by an attorney licensed to practice in the State of Alabama. Parties to a transaction can draft their own documents if they are doing so on behalf of themselves.

50 per $500 or $1.00 per $1000 on value of property conveyed - charged in increments of $500. The amount of value conveyed is always rounded to the nearest $500. A $1.00 ?no-tax? fee is charged on deeds that are tax exempt.

Without survivorship, the default ownership among multiple owners is ownership as ?tenants in common.? Each owner's interest in the property will pass as part of their probate estate on their death. Ownership with right of survivorship is common with married couples.