Colorado Self-Employed Business Development Executive Agreement

Description

How to fill out Self-Employed Business Development Executive Agreement?

Are you in a situation where you frequently require documentation for various organizational or individual activities each day.

There are numerous legitimate document templates accessible online, but locating ones you can trust is not easy.

US Legal Forms provides thousands of template options, such as the Colorado Self-Employed Business Development Executive Agreement, which are crafted to meet state and federal regulations.

Choose a convenient file format and download your document.

Access all the document templates you have purchased in the My documents section. You can obtain another copy of the Colorado Self-Employed Business Development Executive Agreement anytime, if needed. Just click the relevant template to download or print the document.

Utilize US Legal Forms, the most extensive collection of lawful templates, to save time and avoid errors. The service offers professionally designed legal document templates that can be utilized for various purposes. Create an account on US Legal Forms and start simplifying your life.

- If you are already familiar with the US Legal Forms website and possess an account, just Log In.

- Then, you can download the Colorado Self-Employed Business Development Executive Agreement template.

- If you do not have an account and wish to start using US Legal Forms, follow these steps.

- Find the document you need and ensure it is for the correct state.

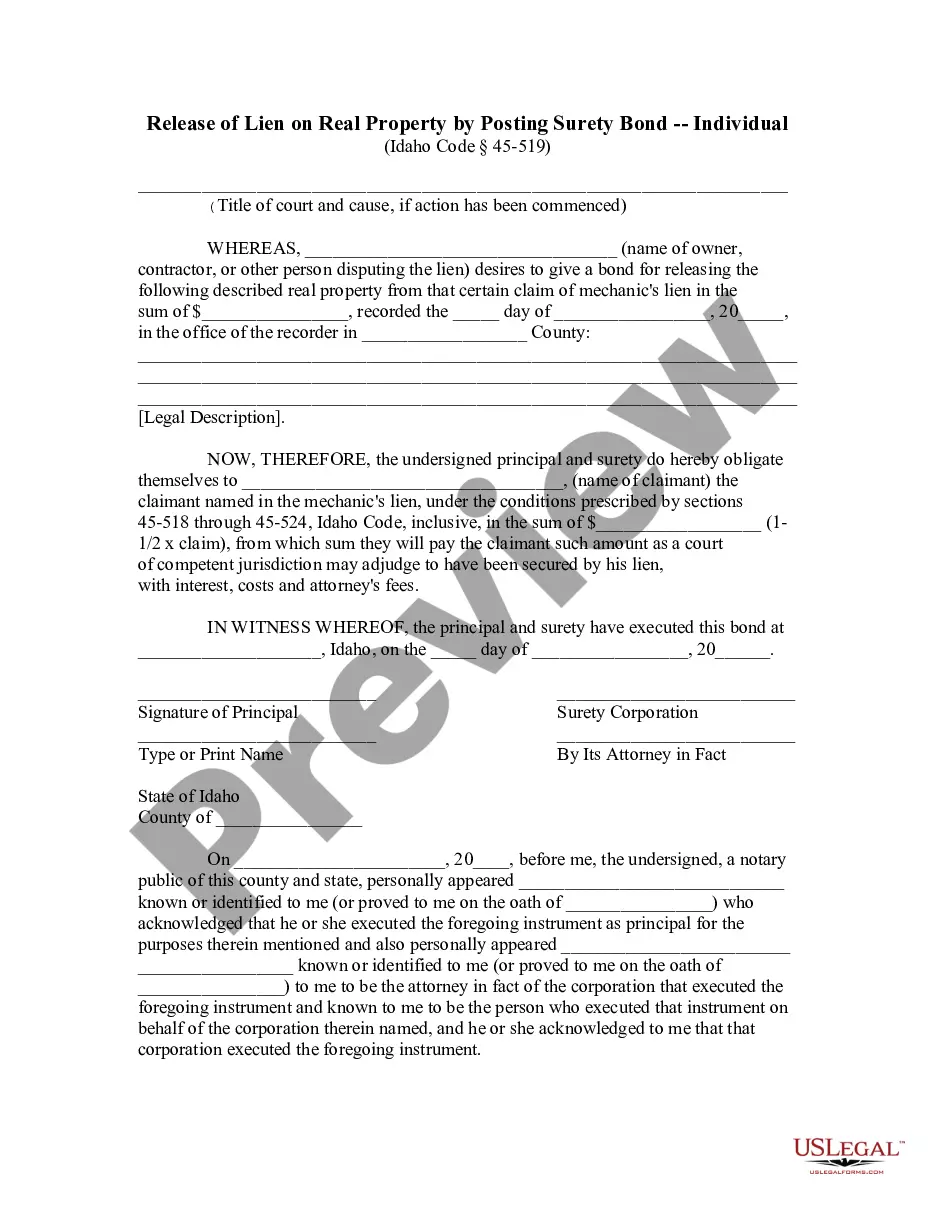

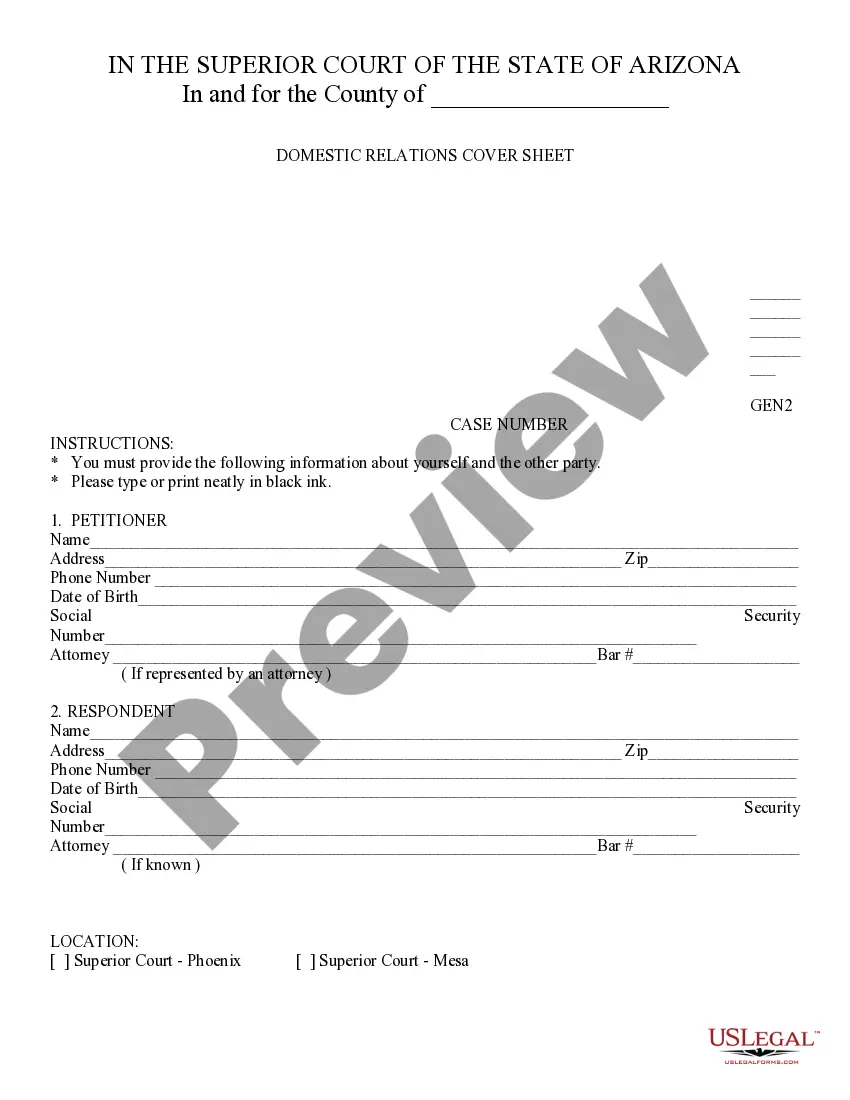

- Use the Preview feature to examine the form.

- Review the summary to confirm you have selected the right template.

- If the document isn’t what you’re looking for, use the Search field to find the form that fits your needs.

- Once you find the appropriate form, simply click Acquire now.

- Select your preferred pricing plan, complete the required information to create your account, and pay for your order using PayPal or credit card.

Form popularity

FAQ

In Colorado, an operating agreement is not legally required for an LLC; however, it is highly recommended. This document outlines the management structure and operating procedures of the LLC. Having a clear operating agreement can prevent misunderstandings among members and provides a solid framework for your business operations. Consider incorporating these details into your Colorado self-employed business development executive agreement.

To fill out an independent contractor agreement for your Colorado self-employed business development executive agreement, start by clearly stating the parties involved. Next, outline the scope of work, deadlines, and payment terms. Make sure to include confidentiality and non-compete clauses if necessary. Finally, both parties should sign and date the agreement to make it legally binding.

A business development agreement outlines the terms and conditions between businesses regarding collaborative efforts to attain growth and revenue objectives. It specifies roles, responsibilities, and expectations of the parties involved. This document is crucial for independent contractors and businesses working under a Colorado Self-Employed Business Development Executive Agreement, as it establishes a solid foundation for successful partnerships.

Yes, an LLC can exist without an operating agreement; however, it may face challenges. Operating without one could lead to misunderstandings among members about management roles and profit distribution. An operating agreement ensures that everyone is on the same page and strengthens the LLC's credibility. If you're drafting a Colorado Self-Employed Business Development Executive Agreement, including such an agreement for your LLC can enhance organizational clarity.

Protecting yourself as an independent contractor involves several critical steps. Start by putting your agreements in writing, specifying the terms of your work and payment. Consider using a Colorado Self-Employed Business Development Executive Agreement to clarify the relationship and minimize risks. Additionally, ensure proper insurance coverage and keep thorough records to safeguard your business.

No, Colorado does not mandate an operating agreement for LLCs; yet, it is a prudent choice. An operating agreement helps articulate member responsibilities and decision-making processes. Without it, the LLC might fall under default state regulations, which may not suit your specific needs. For those working under a Colorado Self-Employed Business Development Executive Agreement, an operating agreement supports better business practices.

Yes, a 1099 worker can negotiate their rate. As an independent contractor, you have the freedom to discuss and agree on payment terms with your clients. This flexibility allows you to align your compensation with the value you provide and market rates. When drafting a Colorado Self-Employed Business Development Executive Agreement, ensure that your rate reflects your expertise and contributions.

In Colorado, an LLC does not legally require an operating agreement; however, it is highly recommended. Having an operating agreement helps clarify the management structure and operational procedures of the LLC. This document can significantly benefit all members by reducing disputes and outlining expectations. If you're creating a Colorado Self-Employed Business Development Executive Agreement, an operating agreement can add an extra layer of professionalism.