Alabama Assignment of Principal Obligation and Guaranty

Description

How to fill out Assignment Of Principal Obligation And Guaranty?

Are you in a place the place you require files for sometimes enterprise or specific uses almost every day time? There are a variety of lawful record layouts available on the net, but discovering kinds you can rely is not simple. US Legal Forms delivers a huge number of develop layouts, such as the Alabama Assignment of Principal Obligation and Guaranty, which can be written to satisfy state and federal demands.

When you are presently acquainted with US Legal Forms web site and possess a merchant account, just log in. Next, you can down load the Alabama Assignment of Principal Obligation and Guaranty web template.

Unless you have an accounts and need to begin to use US Legal Forms, follow these steps:

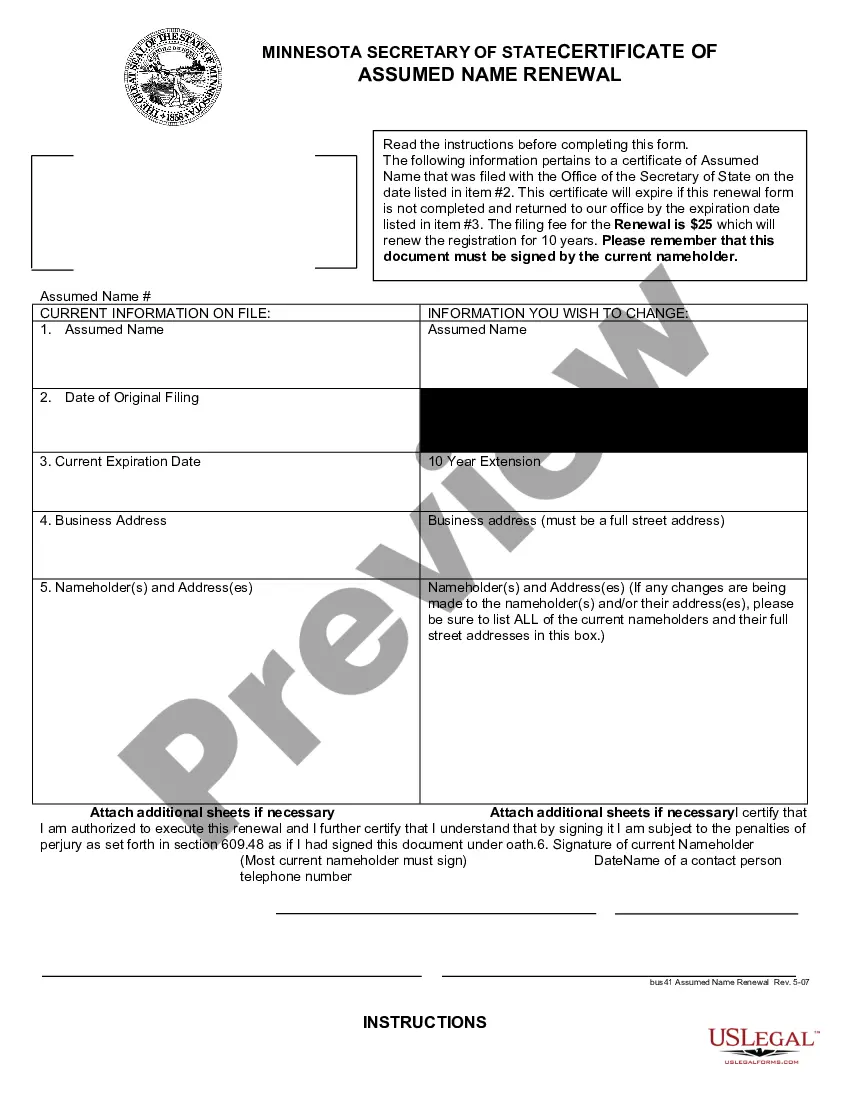

- Obtain the develop you will need and ensure it is for the correct metropolis/state.

- Use the Preview button to review the form.

- Read the outline to actually have chosen the right develop.

- If the develop is not what you`re trying to find, take advantage of the Lookup area to find the develop that meets your requirements and demands.

- When you obtain the correct develop, simply click Acquire now.

- Opt for the rates strategy you desire, complete the required information and facts to make your money, and buy your order utilizing your PayPal or credit card.

- Select a handy file format and down load your copy.

Locate each of the record layouts you might have bought in the My Forms food selection. You can get a more copy of Alabama Assignment of Principal Obligation and Guaranty any time, if needed. Just click the needed develop to down load or print the record web template.

Use US Legal Forms, by far the most considerable variety of lawful types, to conserve time and prevent faults. The assistance delivers skillfully created lawful record layouts that you can use for a range of uses. Make a merchant account on US Legal Forms and commence creating your lifestyle easier.

Form popularity

FAQ

The usual way that a guaranty is enforced is through a written demand (although this is not usually required in most forms) followed by the filing of a law suit.

The benefit of guarantees can be assigned to a third party.

The lender may assign all or part of the guaranteed portion of the loan to one or more holders by using an Assignment Guarantee Agreement.

The Guarantor may not assign, transfer or part with any of its rights or obligations under this Guarantee and Indemnity or any of the Relevant Lease Documents without the prior written consent of the Lessor. Assignment by Guarantor.

CONSIDERATION As noted in the article on Contracts, to be binding either some form of consideration must be paid to a party, or reasonable reliance and detriment must be shown for the relying party.

In a finance or lending context, a guarantor would be forced to answer for the debt or default of the debtor to the creditor, if a debtor does not fulfill an obligation on their part to repay their debt.

In order for a guaranty agreement to be enforceable, it has to be in writing, the writing has to be signed by the guarantor, and the writing has to contain each of the following essential elements: 1. the identity of the lender; 2. the identity of the primary obligor; 3.

The most common form of consideration is the payment (in kind or in cash) for the subject matter of the contract, whether it be rights, goods, services or otherwise. In the case of a guarantee, the consideration is usually the agreement of a bank to lend, or to continue to lend, to a third party (the business).