Assignment is the act of transferring power or rights to another, such as contractual rights. Accounts may be characterized as accounts payable, which is money that is owed to be paid to another, or accounts receivable, which is money owed for products or services to a provider of the same. This generic form is assignment of a particular account receivable.

Alabama Assignment of Particular Account

Description

How to fill out Assignment Of Particular Account?

Discovering the right legitimate record design can be quite a have a problem. Obviously, there are a lot of templates available online, but how will you discover the legitimate develop you require? Take advantage of the US Legal Forms internet site. The services provides a large number of templates, including the Alabama Assignment of Particular Account, that you can use for company and private requirements. Every one of the varieties are checked out by experts and fulfill federal and state specifications.

Should you be already listed, log in to your accounts and then click the Download switch to find the Alabama Assignment of Particular Account. Use your accounts to search with the legitimate varieties you might have purchased earlier. Proceed to the My Forms tab of your accounts and acquire an additional duplicate in the record you require.

Should you be a new consumer of US Legal Forms, listed here are easy directions so that you can adhere to:

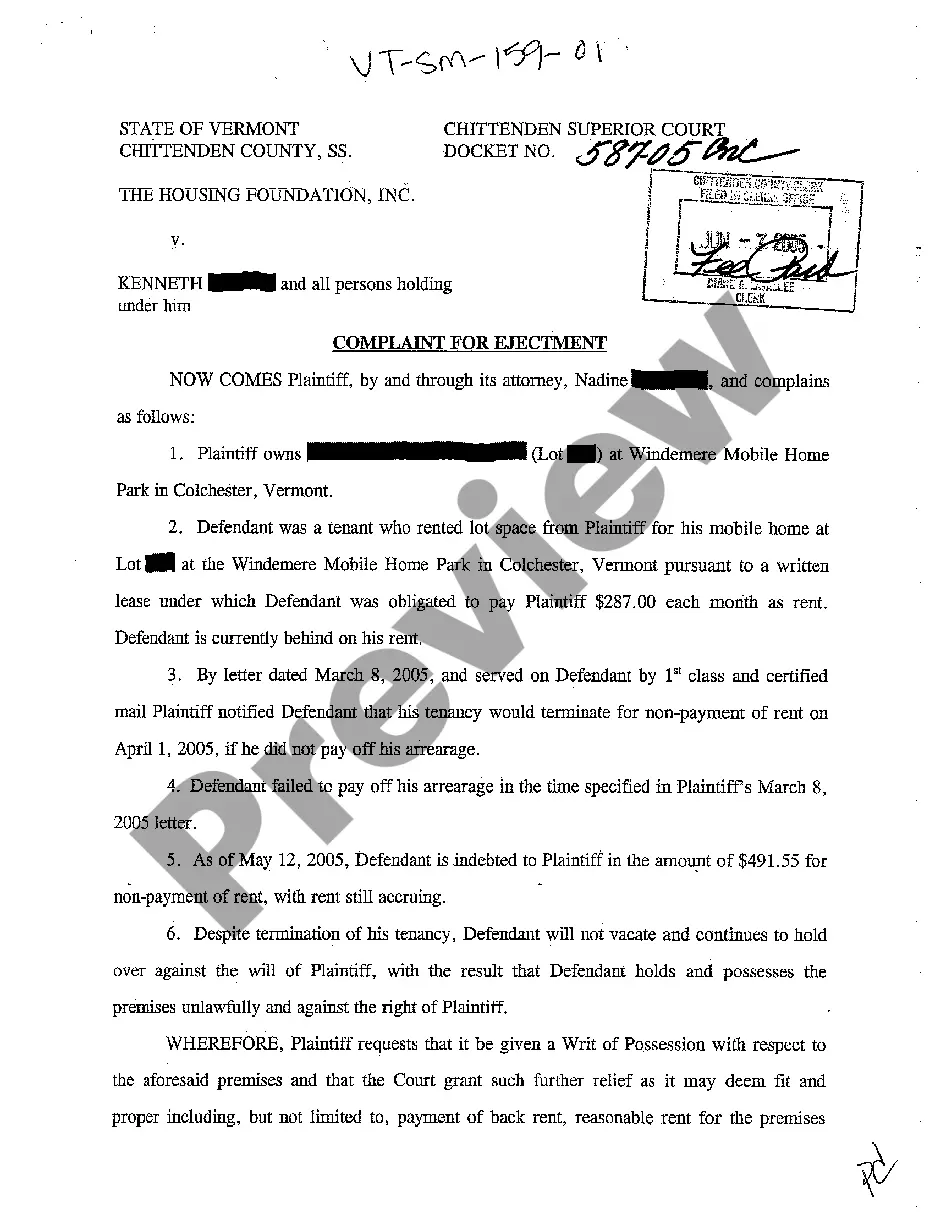

- Initial, be sure you have chosen the appropriate develop for your personal town/area. You can look over the shape utilizing the Review switch and study the shape explanation to make sure it will be the best for you.

- When the develop is not going to fulfill your expectations, utilize the Seach industry to find the correct develop.

- Once you are certain the shape is acceptable, go through the Acquire now switch to find the develop.

- Opt for the pricing program you desire and type in the necessary details. Design your accounts and buy the transaction with your PayPal accounts or credit card.

- Opt for the submit structure and obtain the legitimate record design to your system.

- Complete, revise and print out and indication the attained Alabama Assignment of Particular Account.

US Legal Forms will be the most significant local library of legitimate varieties in which you can discover different record templates. Take advantage of the company to obtain appropriately-made paperwork that adhere to express specifications.

Form popularity

FAQ

Any party may appeal from a judgment entered against him or her by a district court to the circuit court at any time within seven days after the entry thereof, and appeal and the proceedings thereon shall in all respects, except as provided in this article, be governed by this code relating to appeal from district ...

Section 6-5-380 makes the parent or guardian liable for the "injury to, or destruction of" someone else's property?real or personal property?caused by the intentional, willful, or malicious act or acts of the minor.

When any person is in peaceable possession of lands, whether actual or constructive, claiming to own the same, in his own right or as personal representative or guardian, and his title thereto, or any part thereof, is denied or disputed or any other person claims or is reputed to own the same, any part thereof, or any ...

Tile 6-6-332, Code of Alabama. Complaint for money must be served in ance with Rule 4, Alabama Rules of Civil Procedure which requires service by certified mail or personal service by either the Sheriff's office or a private process server.

Section 6-6-1 Duty of courts to encourage settlement of pending controversies.