Alabama Shareholders' Agreement with Special Allocation of Dividends among Shareholders in a Close Corporation

Description

How to fill out Shareholders' Agreement With Special Allocation Of Dividends Among Shareholders In A Close Corporation?

You can invest hours online searching for the legal document template that meets the state and federal requirements you need.

US Legal Forms offers thousands of legal forms that can be reviewed by experts.

You can easily download or print the Alabama Shareholders' Agreement with Special Allocation of Dividends among Shareholders in a Close Corporation from our services.

If you need to find another version of the form, use the Search field to locate the template that fits your needs and requirements.

- If you possess a US Legal Forms account, you can sign in and click the Download button.

- After that, you can complete, modify, print, or sign the Alabama Shareholders' Agreement with Special Allocation of Dividends among Shareholders in a Close Corporation.

- Every legal document template you purchase is yours indefinitely.

- To obtain an additional copy of a purchased form, navigate to the My documents tab and click the corresponding button.

- If you are using the US Legal Forms website for the first time, follow the simple instructions below.

- First, make sure you have chosen the correct document template for the region/area of your choice. Check the form description to ensure you have selected the correct form.

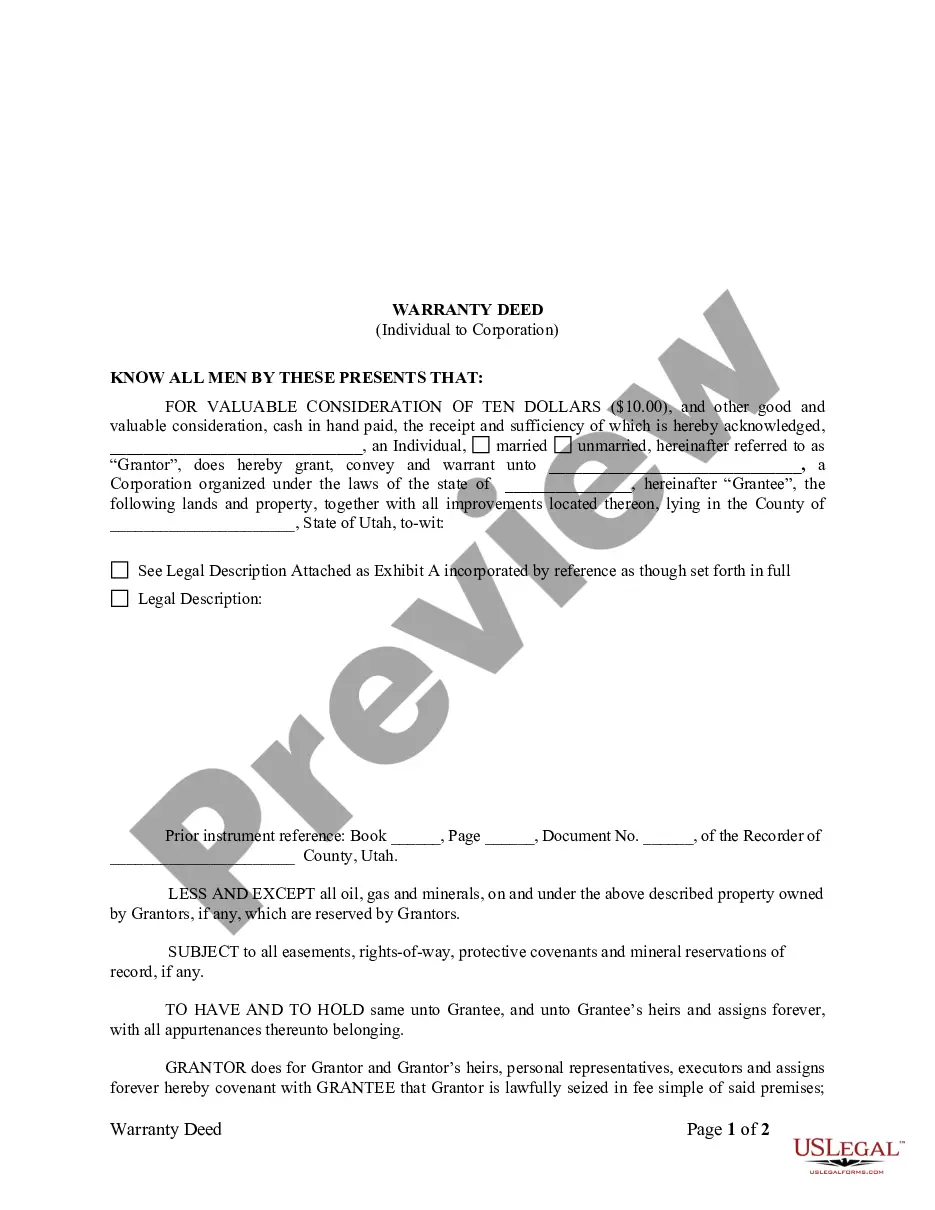

- If available, utilize the Preview button to look through the document template as well.

Form popularity

FAQ

The Share Purchase Agreement needs to be signed by both the purchaser and seller of the shares. Before you put pen on paper, you want to review all the details and provisions for accuracy and your comfort level. It is not necessary to get the agreement notarized.

The shareholder agreement should clearly identify who has stock, at what value, and what rights those stocks carry. Additionally, the shareholders should agree on details about what happens to the stock when one leaves the corporation.

A shareholders' agreement includes a date; often the number of shares issued; a capitalization table that outlines shareholders and their percentage ownership; any restrictions on transferring shares; pre-emptive rights for current shareholders to purchase shares to maintain ownership percentages (for example, in the

A shareholders' agreement is an agreement entered into between all or some of the shareholders in a company. It regulates the relationship between the shareholders, the management of the company, ownership of the shares and the protection of the shareholders. They also govern the way in which the company is run.

A Shareholders Agreement is a contract concluded between shareholders to a company that formalizes the relationship and governs the duties and responsibilities between all stakeholders to the company.

Drafting a Successful Shareholders' AgreementDrafting a successful shareholders' agreement.Understand your client's business.Don't overcomplicate decision making.Decide how to deal with stalemates.You need an exit.Think through all the possible outcomes for your exit mechanism it needs to work.

Key Takeaways Shareholders are subject to capital gains (or losses) and/or dividend payments as residual claimants on a firm's profits. Shareholders also enjoy certain rights such as voting at shareholder meetings to approve the members of the board of directors, dividend distributions, or mergers.

What Should You Include In Your Shareholders' Agreement?Decision Making.Pre-Emptive Right.Right of First Refusal.Tag Along Right.Drag-Along Right.Purchase Option.Shotgun Provision.Confidentiality, Non-Competition and Non-Solicitation.More items...?

A shareholders' agreement includes a date; often the number of shares issued; a capitalization table that outlines shareholders and their percentage ownership; any restrictions on transferring shares; pre-emptive rights for current shareholders to purchase shares to maintain ownership percentages (for example, in the