Alabama Guaranty of Payment of Dividends on Stocks

Description

How to fill out Guaranty Of Payment Of Dividends On Stocks?

Are you presently in a position where you need to have paperwork for possibly business or individual purposes nearly every working day? There are plenty of legitimate record layouts accessible on the Internet, but locating ones you can rely is not easy. US Legal Forms gives a large number of form layouts, such as the Alabama Guaranty of Payment of Dividends on Stocks, that happen to be created to meet state and federal requirements.

When you are previously knowledgeable about US Legal Forms website and possess an account, just log in. Following that, you are able to down load the Alabama Guaranty of Payment of Dividends on Stocks design.

Should you not come with an profile and would like to start using US Legal Forms, abide by these steps:

- Get the form you want and make sure it is for the right town/region.

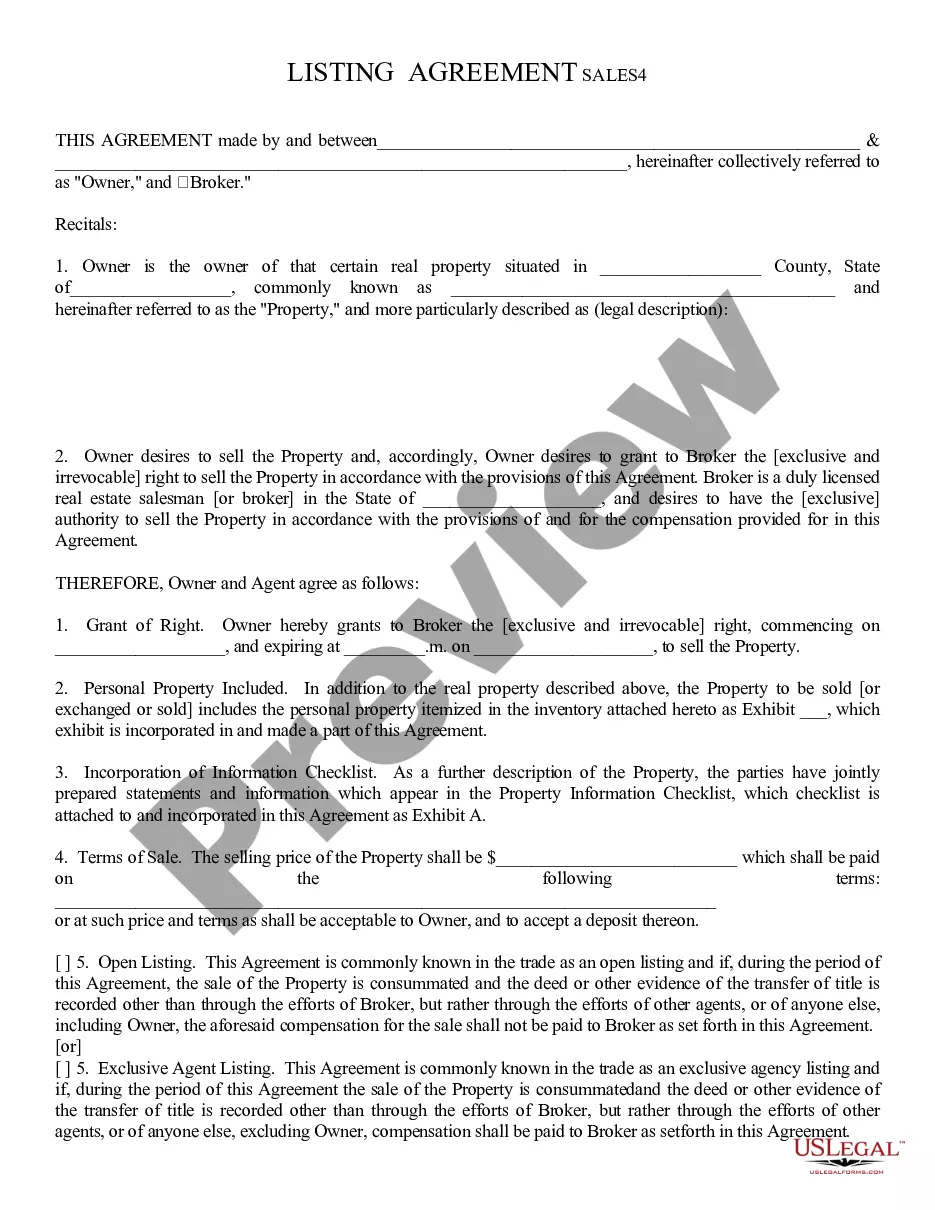

- Make use of the Review switch to analyze the shape.

- Look at the explanation to ensure that you have chosen the correct form.

- When the form is not what you`re seeking, use the Research discipline to find the form that fits your needs and requirements.

- If you discover the right form, click Acquire now.

- Opt for the prices strategy you desire, fill in the necessary info to produce your money, and pay money for an order making use of your PayPal or credit card.

- Decide on a practical paper formatting and down load your duplicate.

Find all the record layouts you may have bought in the My Forms menus. You may get a more duplicate of Alabama Guaranty of Payment of Dividends on Stocks at any time, if possible. Just click the essential form to down load or produce the record design.

Use US Legal Forms, the most extensive variety of legitimate forms, to save lots of efforts and avoid faults. The services gives appropriately created legitimate record layouts that you can use for an array of purposes. Create an account on US Legal Forms and begin creating your daily life easier.

Form popularity

FAQ

Covered securities are exempted from state restrictions and regulations in order to standardize and simplify regulatory compliance. Covered securities must be acquired after a certain date to qualify. The National Securities Market Improvement Act clarifies the rules governing covered securities.

Generally, if an investment of money is made in a business with the expectation of a profit to come through the efforts of someone other than the investor, it is considered a security.

1975, § 8-6-11(a)(9), any offer or sale of securities which is made in compliance with the following requirements of this rule will be deemed to be an exempt transaction and Code of Ala.

A security is "[a]n instrument that evidences the holder's ownership rights in a firm (e.g., a stock), the holder's creditor relationship with a firm or government (e.g., a bond), or the holder's other rights (e.g., an option)." Black's Law Dictionary, 10th ed.

A security is a financial asset that can be sold or traded in a financial market. The term securities refers to investments that can be exchanged and used to raise capital. The most common types of securities are stocks, bonds, ETFs (exchange traded funds), options, and mutual funds.

?When used in this title, unless the context otherwise requires? (1) The term ''security'' means any note, stock, treasury stock, security future, security-based swap, bond, debenture, evidence of indebtedness, certificate of interest or participation in any profit-sharing agreement, collateral-trust certificate, ...