Alabama LLC Operating Agreement - Taxed as a Partnership

Description

How to fill out LLC Operating Agreement - Taxed As A Partnership?

Have you ever found yourself in a situation where you require documents for either business or personal purposes almost every workday.

There are numerous reliable document templates accessible online, but finding forms you can depend on is challenging.

US Legal Forms offers a wide array of template options, such as the Alabama LLC Operating Agreement for S Corp, which are designed to comply with federal and state regulations.

When you locate the correct form, click Get now.

Choose the pricing plan you prefer, enter the necessary information to create your account, and complete your purchase using PayPal or a credit card.

- If you are already acquainted with the US Legal Forms website and possess an account, just Log In.

- Then, you can download the Alabama LLC Operating Agreement for S Corp template.

- If you do not have an account and wish to start using US Legal Forms, follow these steps.

- Find the form you need and confirm it is for the right area/state.

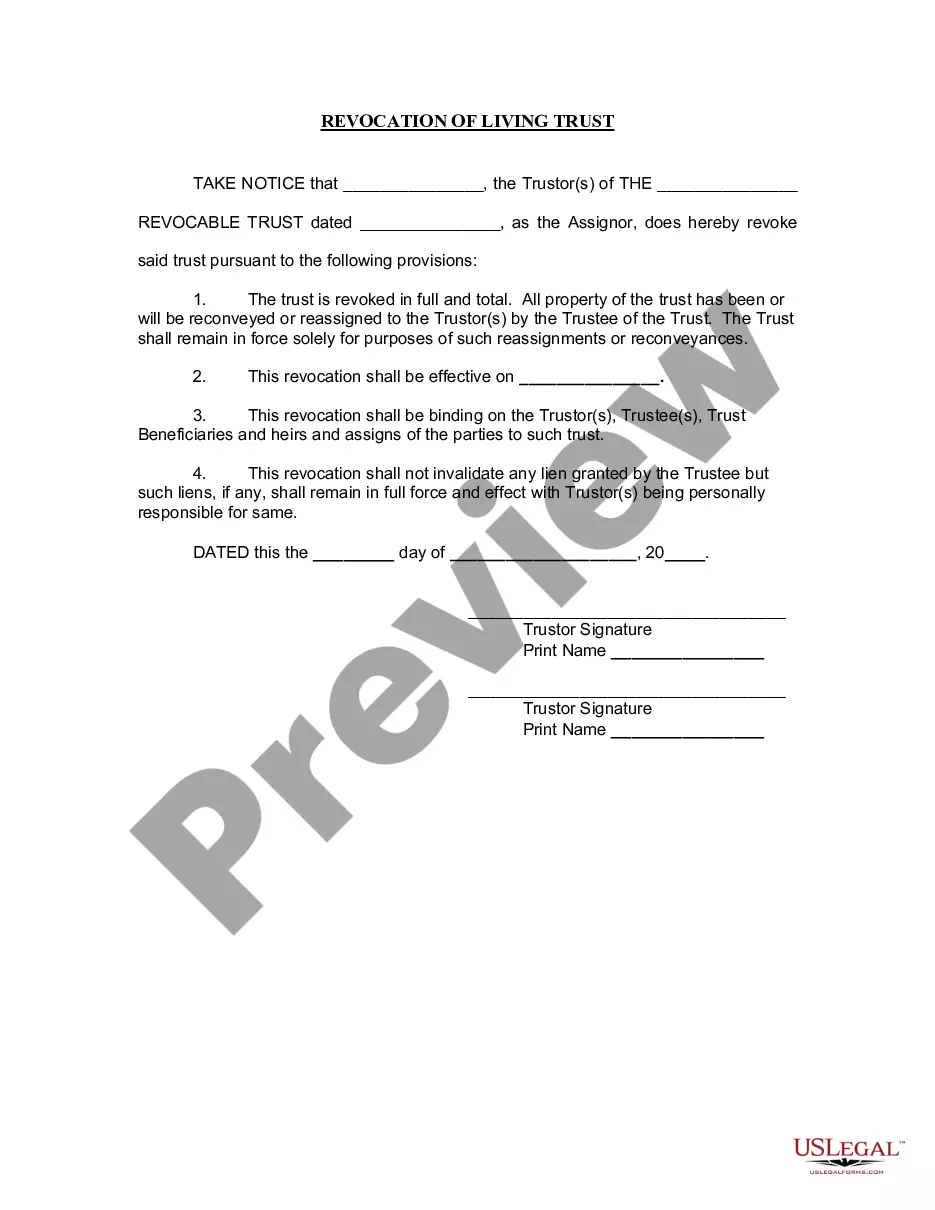

- Utilize the Preview button to examine the form.

- Review the description to ensure you have selected the correct form.

- If the form does not match what you are looking for, use the Search field to find a form that suits your needs.

Form popularity

FAQ

An operating agreement is a key document used by LLCs because it outlines the business' financial and functional decisions including rules, regulations and provisions. The purpose of the document is to govern the internal operations of the business in a way that suits the specific needs of the business owners.

To form an Alabama LLC, you'll need to file a Certificate of Formation with the Alabama Secretary of State. You can apply online or by mail for $200. The Certificate of Formation is the legal document that officially creates your Alabama limited liability company.

An S corp operating agreement is a business entity managing document. Typically, an operating agreement is a document that defines how a limited liability company will be managed. An S corp actually uses corporate bylaws and articles of incorporation for the purpose of organizing the business operation.

Every Alabama LLC owner should have an operating agreement in place to protect the operations of their business. While not legally required by the state, having an operating agreement will set clear rules and expectations for your LLC while establishing your credibility as a legal entity.

All LLC's should have an operating agreement, a document that describes the operations of the LLC and sets forth the agreements between the members (owners) of the business. An operating agreement is similar to the bylaws that guide a corporation's board of directors and a partnership agreement.

There is no State requirement in Alabama to have an operating agreement, however, it is still highly recommended to have one in order to state the purpose of the business as well as the ownership interest of the members (if a multi-member LLC).

Every Alabama LLC owner should have an operating agreement in place to protect the operations of their business. While not legally required by the state, having an operating agreement will set clear rules and expectations for your LLC while establishing your credibility as a legal entity.

An LLC Operating Agreement in Alabama is an agreement between all members of the LLC; the agreement specifically identifies how the LLC will be managed, voting rights, how profits/losses will be distributed, and other important decision-making processes.